Other languages

- ...

- » English (Engelska)

- » Individuals and employees

- » New in Sweden and will be employed here

- » Notification of preliminary income tax

Notification of preliminary income tax

(A-skatt)

In this e-service you can send in a notification for preliminary income tax.

Longer waiting times than usual

New rules for foreign employers have caused longer waiting times to apply for preliminary A-tax. Many people are notified of their case within six weeks, but the waiting time can currently be up to 16 weeks if your case requires more investigation or if we need more information. We apologize for the long wait.

Use our e-service

You need an email address to be able to log in with a temporary login. Log in to the e-service by clicking the yellow button Log in.

You should use this e-service if you are not registered in the Swedish Population Register, but are in Sweden for 6 months or longer, and are working the whole or parts of that period. If you are working in Sweden for a shorter period than six months, you should apply for special income tax for non-residents (Swedish: SINK) instead.

Make sure to fill out the questions in the e-service with the correct information and attach a document that confirm your income, such as an employment contract to reduce the administration time of your errand.

In this e-service, you can send in a notification for preliminary income tax.

You must enclose a copy of your passport to your notification of preliminary income tax. If you do not have a passport, you should attach a copy of your national identity card instead.

Keep in mind that all information must be visible when photographing or scanning your passport or national identity card. It is preferred if the copy is in color.

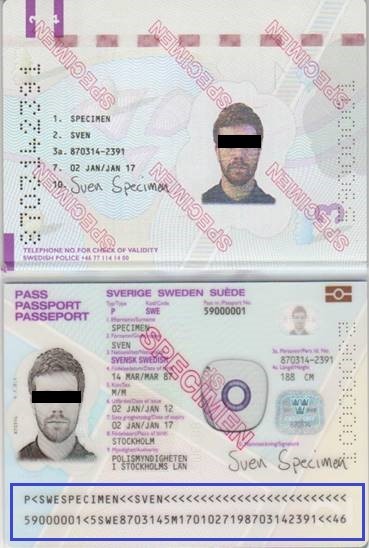

Passport: Attach a copy of the entire page showing;

- Personal information

- Period of validity

- Country of issue

- Signature

It is especially important that the entire machine-readable code on the identity page is clearly visible, see the marked area in the image.

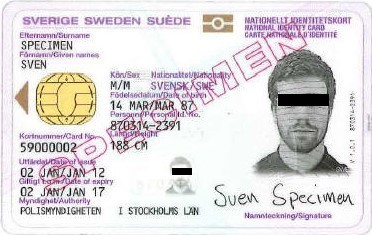

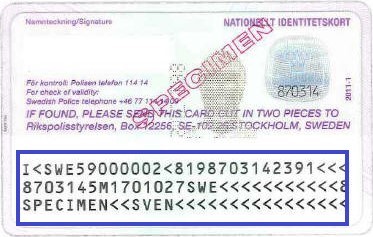

National identity card: Attach a copy of the entire front and the entire back.

It is especially important that the entire machine-readable code on the identity page is clearly visible, see the marked area in the image.

Leave a review (Your Europe)

Leave a review (Your Europe)