Lördag 14 februari kl. 07.00-18.00 sker underhåll som kan medföra störningar och avbrott på Skatteverkets e-tjänster.

- How to use our e-service Calculate income after tax and consult tax table

How to use our e-service Calculate income after tax and consult tax table

This is a user guide on how to use our e-service Calculate income after tax and consult tax table.

If you receive a salary, pension or other compensation from a single payer, who deducts tax according to the tax table, you can use this service to work out what your monthly income after tax will be in 2026. You can also consult your tax table.

Log in to the e-service

Use our e-service Calculate income after tax and consult tax table (in Swedish: Räkna ut inkomst efter skatt och se skattetabell).

How to log in to the e-service

The e-service does not require you to log in – just click the yellow field with its name (Räkna ut inkomst efter skatt och se skattetabell).

Information about your year of birth, municipality, registered religious organisation and income

The questions are adapted to what you want to use the e-service for, and to the information you provide. The result is calculated based on the information you provide. None of the information you fill in will be saved.

Step 1

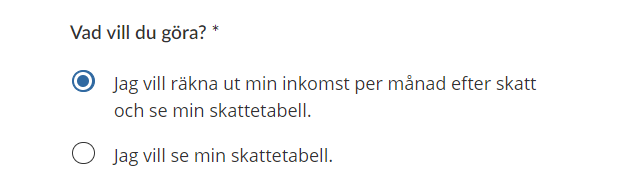

Select what you want to do. There are two options in the service:

- Calculate your monthly income after tax and consult your tax table.

- Only consult your tax table.

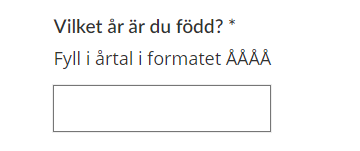

If you selected “I want to calculate my monthly income after tax and consult my tax table”, you need to fill in your year of birth. Use the format YYYY for the year.

Step 2

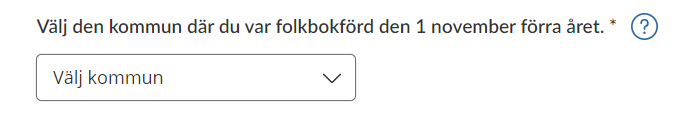

Select the municipality where you were listed as resident in the Population Register on 1 November last year.

Step 3

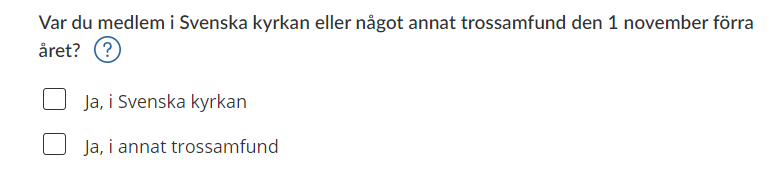

If you were a member of the Church of Sweden and/or another registered religious organisation on 1 November last year, select the parish/religious organisation in question.

Step 4

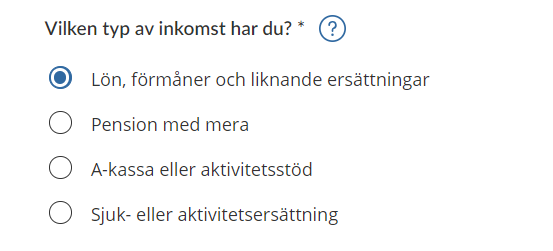

Select the type of income you receive.

Step 5

Enter your monthly income before tax. State the amount in SEK.

Step 6a

Click “Räkna ut” (”Calculate”) if you selected “Jag vill räkna ut min inkomst per månad efter skatt och se min skattetabell” (“I want to calculate my monthly income after tax and consult my tax table”).

Your monthly income after tax is shown, as well as the tax table that applies to you.

Your tax rate is the sum of municipal/regional taxes and funeral fee. This fee is already included for members of the Church of Sweden. If you are a member of another registered religious organisation or parish, you should add this fee.

Round the tax rate up to a whole number. The rounded up number indicates the tax table. 32:50 = table 32. 32:51 = table 33.

The tax table is divided into six columns according to the type of income/compensation in question – for example salary, pension or sickness benefit.

Based on the year of birth you filled in and what type of income you selected, the column from which your tax deduction was taken is also shown.

Step 6b

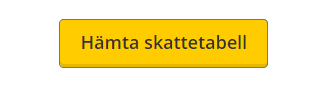

Click “Hämta skattetabell” (“Get tax table”) if you selected “Jag vill se min skattetabell” (“I want to consult my tax table”).

Your tax table will be shown, as well as an explanation of how your tax rate is calculated.

Your tax rate is the sum of municipal/regional taxes and funeral fee. This fee is already included for members of the Church of Sweden. If you are a member of another registered religious organisation or parish, you should add this fee.

Round the tax rate up to a whole number. The rounded up number indicates the tax table. 32:50 = table 32. 32:51 = table 33.