- How to use our e-service filing Income Tax Return 1 via e-service

How to use our e-service filing Income Tax Return 1 via e-service

This is a guide on how to use the e-service filing Income Tax Return 1 via e-service.

1. How to log in to the e-service

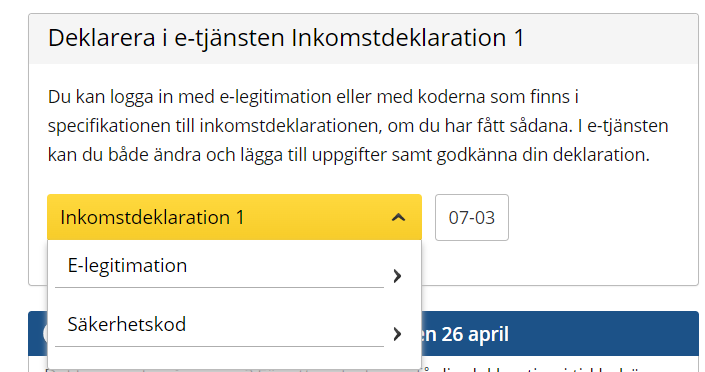

Select the login mode for eID (“E-legitimation”) or security code (“Säkerhetskod”).

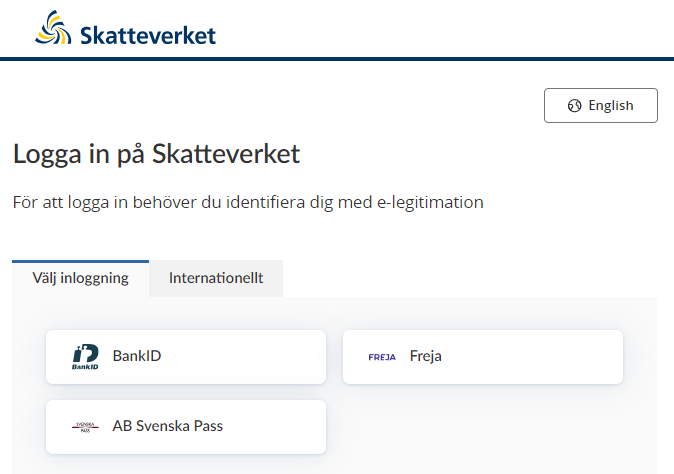

1.1 Log in with eID

When you have selected the e-service you want to log in to, a login page will open. In the upper part of the view you can change the language to English by clicking the button ”English”. By choosing ”International” you get more alternatives for eIDs you can use to log in to the e-service. Select the login mode that suits you best by clicking it, and then proceed to identify yourself.

1.2 Log in with a security code

- If you choose to log in with a security code, type your personal identity number and the security code for identification. Your security codes are shown on the specification that came with your Income Tax Return 1 form.

- Click on “Jag legitimerar mig” to identify yourself.

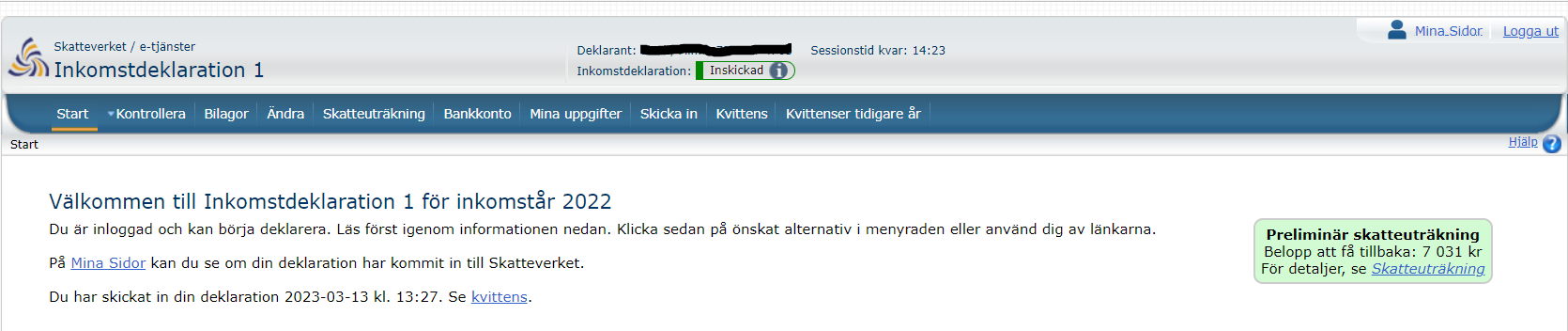

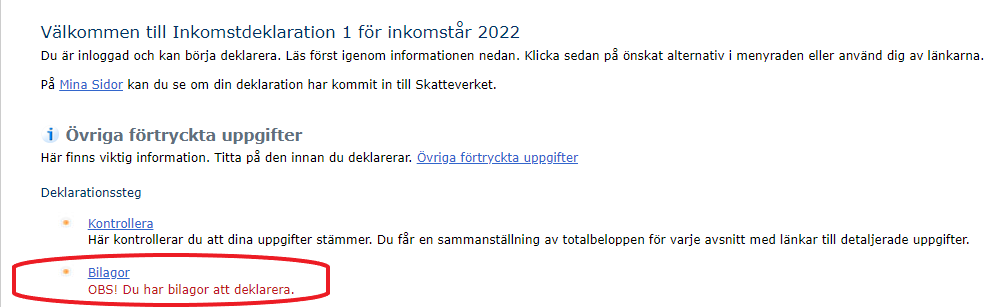

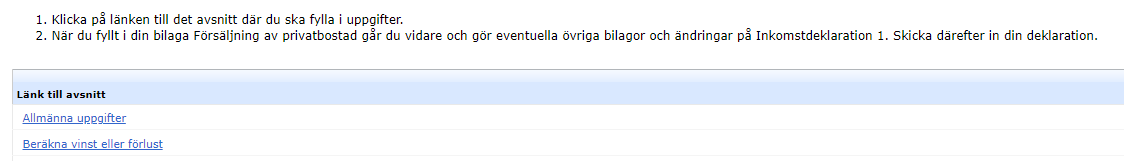

2. Start page

At the top of the start page you will find the following information:

- name and personal identity number

- whether your tax return has been filed

- whether required annexes are ready to be attached

There is also a link to the “My pages” section (“Mina sidor) and an option to log out of the service.

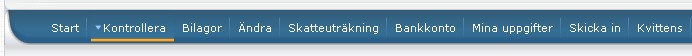

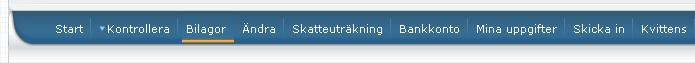

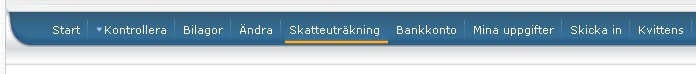

The top menu bar shows the various sections of the service: “Start”, “Check”, “Annexes”, “Make changes”, “Tax calculation”, “Bank account”, “My contact details”, “Submit”, and “Receipts for previous years”. You access the various sections by clicking on each heading, which is also a link to the section in question.

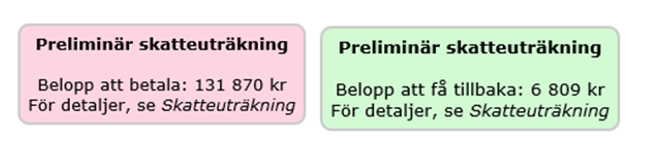

On the start page, you can also find the result of your preliminary tax calculation.

This shows either the refund you are due to receive (“Belopp att få tillbaka”) or the amount you have to pay (“Belopp att betala”). The preliminary tax calculation is updated when you make changes to your tax return, for example if you add or remove amounts or fill in annexes. The box is green if you are due a refund and pink if you have tax to pay.

3. Help ("Hjälp")

For further instructions in Swedish, click on the help icon.

4. Check ("Kontrollera")

This is where you check that the information is correct. A summary is shown including the total amounts from statements of earnings and deductions for each tax return section (1. “Income from employment”, 3. “General allowances”, etc.).

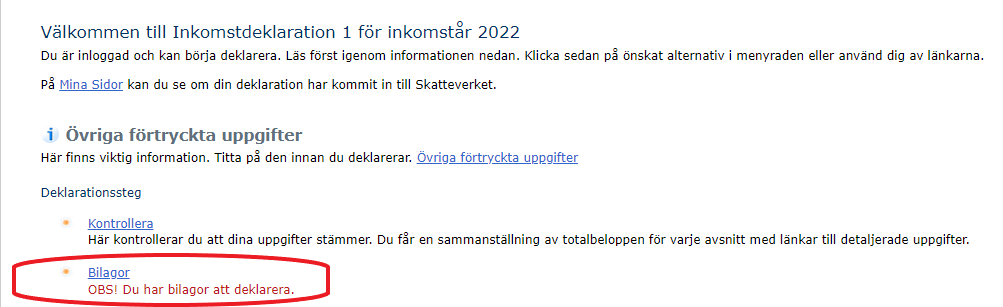

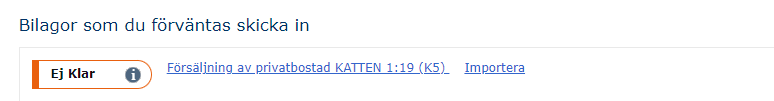

5. Annexes ("Bilagor)

The menu item for annexes (“Bilagor”) can only be selected if you logged in using eID.

This menu selection allows you to fill in the following annexes:

- Income from employment in certain cases (T1)

- Income from a hobby (T2) - Sale of securities (K4)

- Sale of a private residence (K5/K6) - Sale of commercial property (K7)

- Final tax relief or reversal (K2)

- Sale/housing benefit for tenant-owner property (in an association with at least 60% of total income from commercial activities) (K9)

- Investment allowance (K11)

- Business activities (NE/NEA/N8)

- Qualified shares in a close company (K10)

- Shares in a partnership (N3A)

- Unqualified shares in an unlisted company (K12)

- Other capital information.

You can manage your annexes in one of three ways: you can fill in an annexe that the Swedish Tax Agency has already generated for you; create and fill in an annexe yourself; or import information from an annexe already transferred as a file.

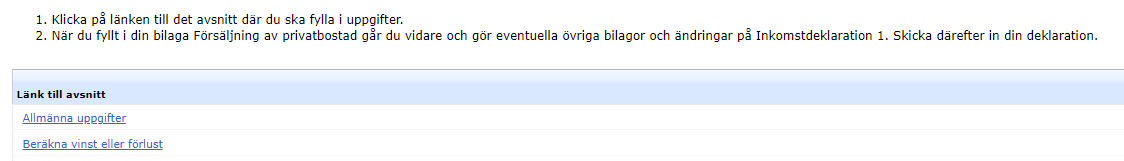

5.1 Filling in annexes K4, K5, K6 generated for you by the e-service

Annexe K4

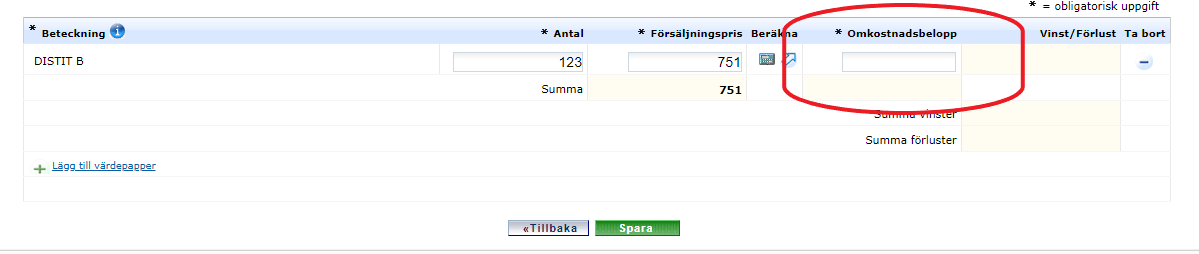

If you have sold securities such as shares, investment fund units or bonds, you have to report the sale in annexe K4. This annexe has been created for you with most of the information already filled in. The only thing you have to add is your cost amount for the securities sold.

- Click on “Bilagor” (“Annexes”)

- Select K4:

- Fill in the cost amount in each section. If other information is missing, fill in this information too. This might be the designation of the securities, the number sold, or the sale price.

- Add any sales you carried out in 2022 which are not already filled in.

- Click “Spara” to save the information and calculate the gain or loss, and then “Tillbaka” to exit.

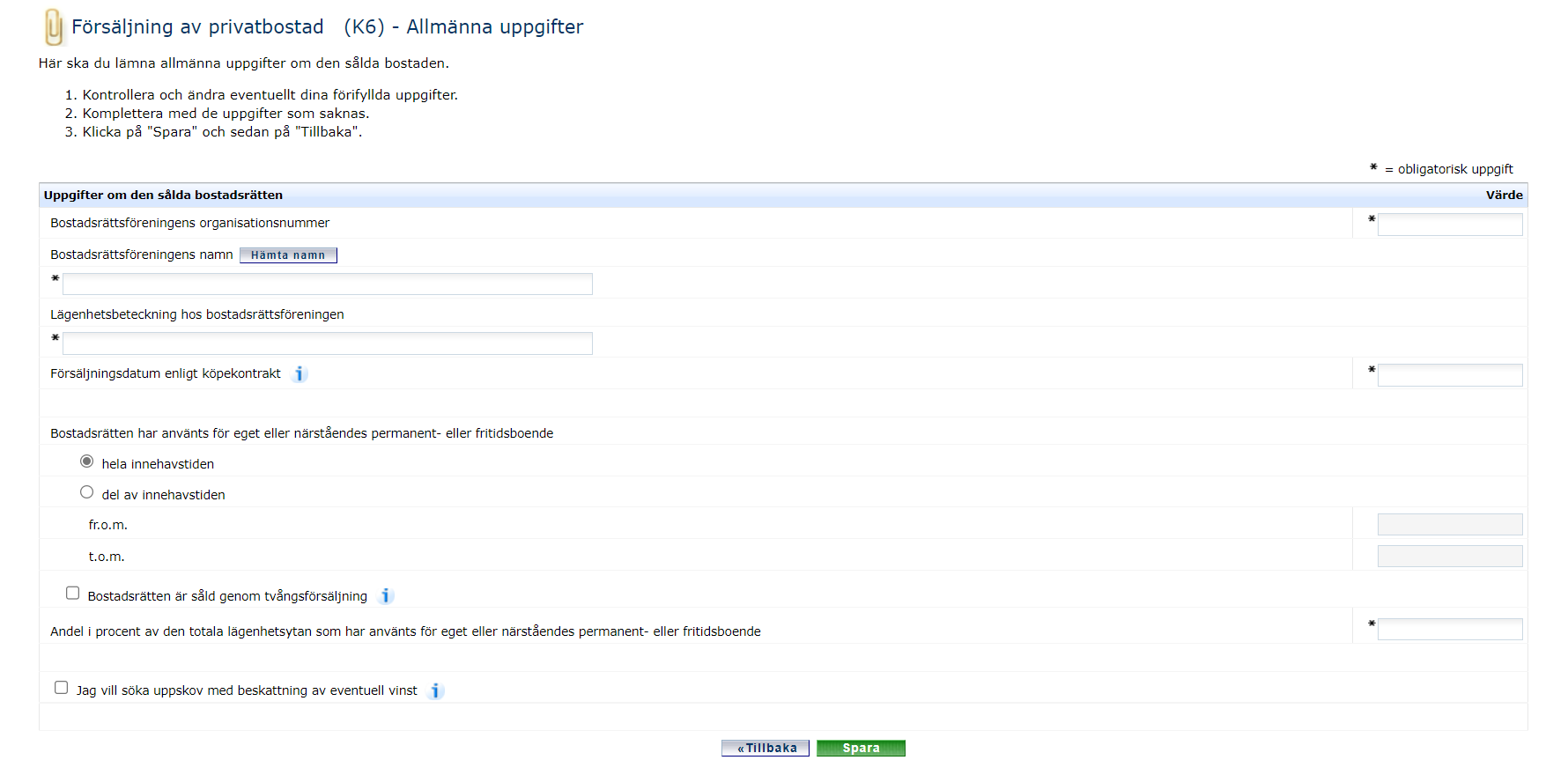

Sale of a private residence, Annexe K5 or K6

If you have sold your private residence, you have to report the sale in your tax return. If you have sold a detached house, a terraced house, a semi-detached house, a holiday home or an owner-occupied apartment, you have to report the sale in Annexe K5.

If you have sold a tenant-owner apartment or a tenant-owner terraced house, you have to report the sale in annexe K6.

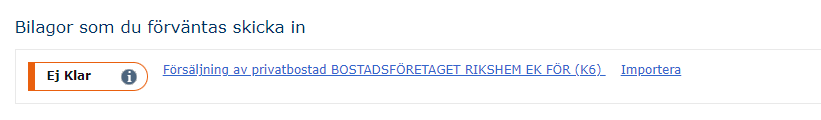

- Click on “Bilagor” (“Annexes”):

- Select Annexe K6.

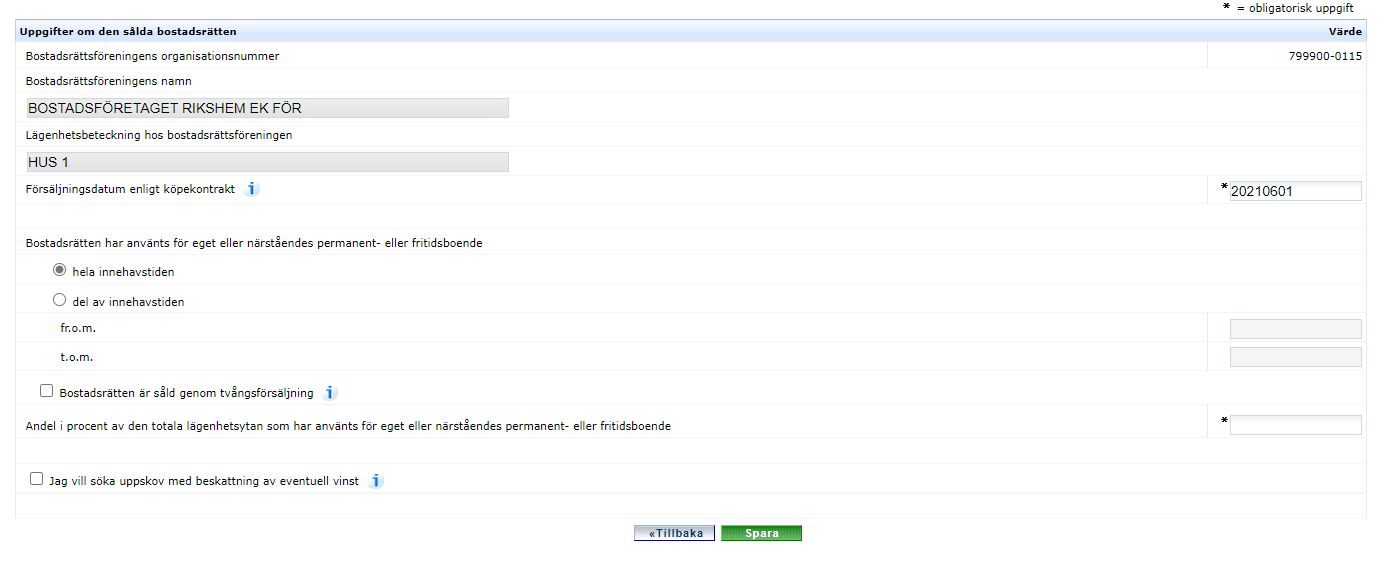

- Click on the link for general information (“Allmänna uppgifter”):

- Check and if necessary change the information already filled in.

- Add any information that is missing.

- Click “Spara” and then “Tillbaka” to save and exit.

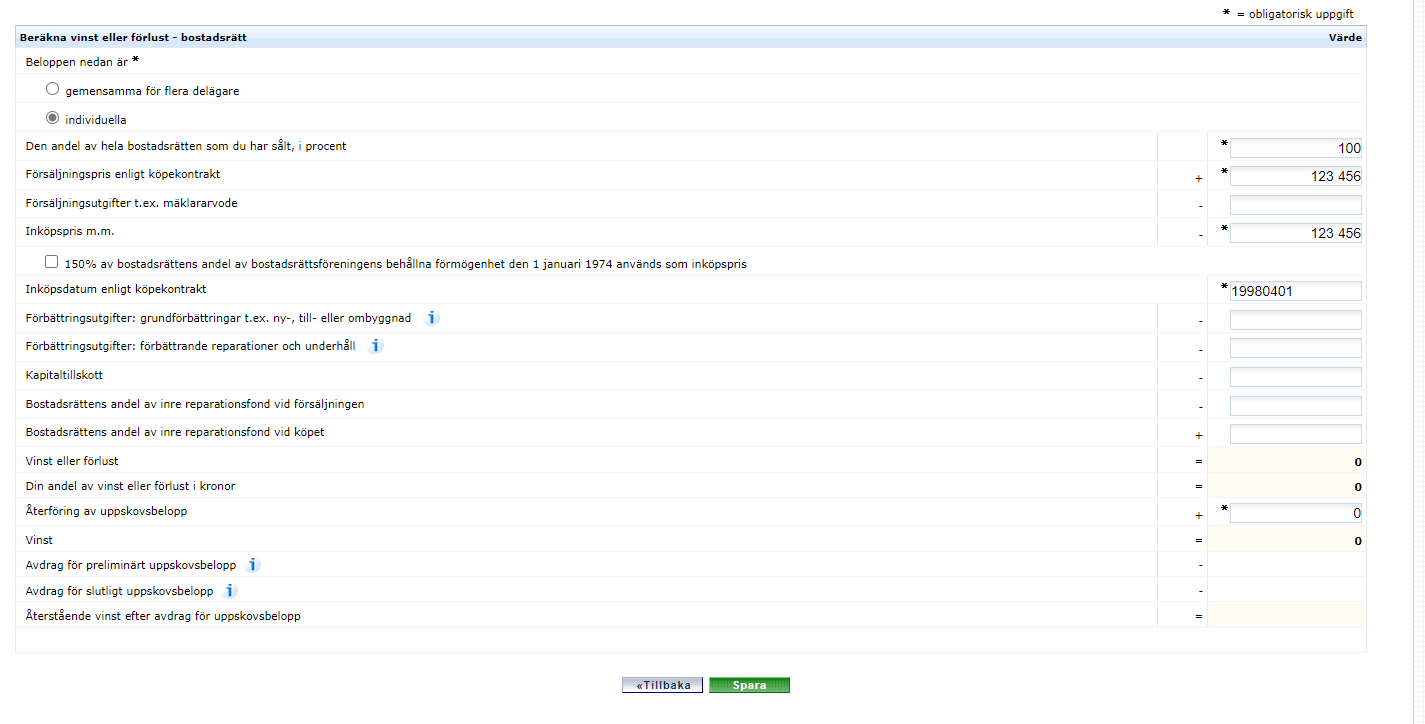

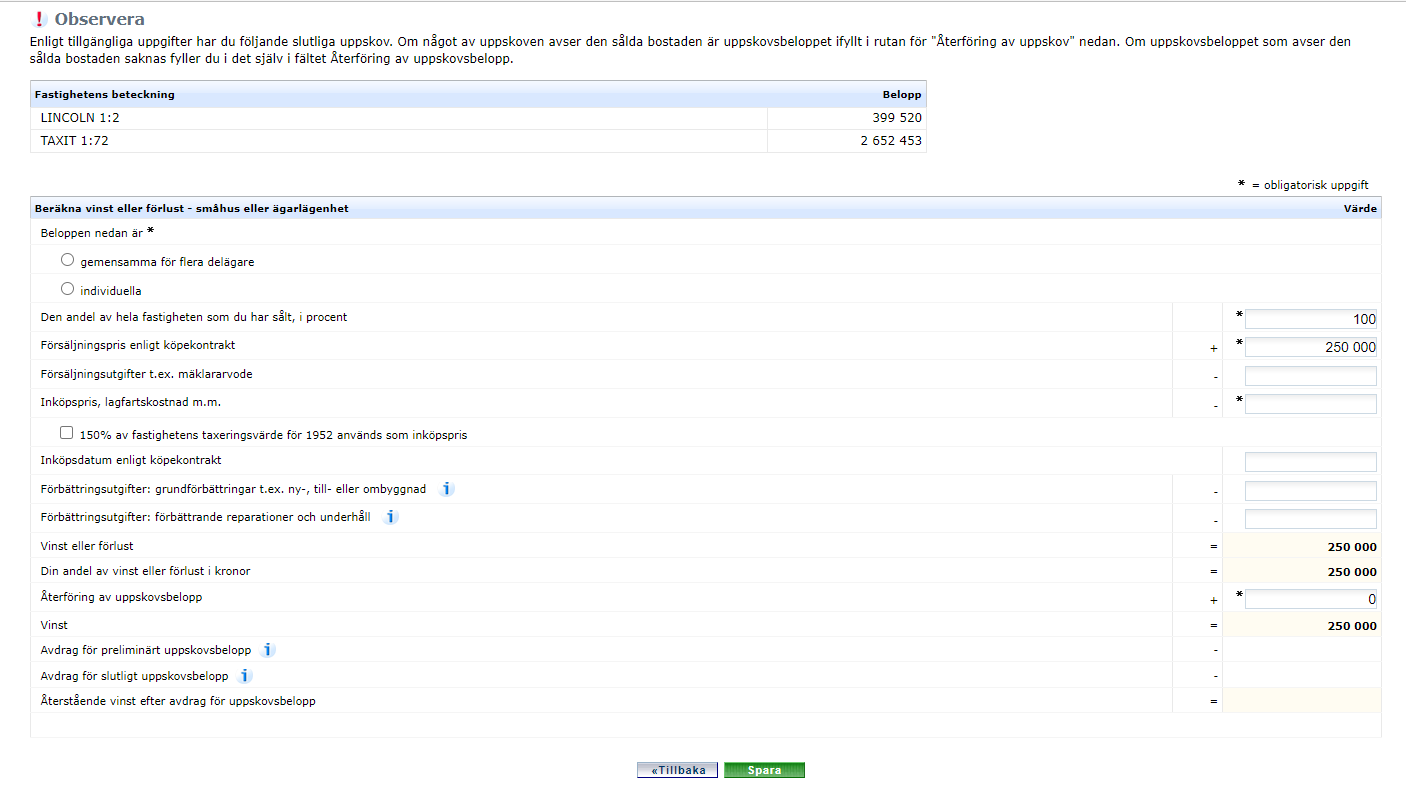

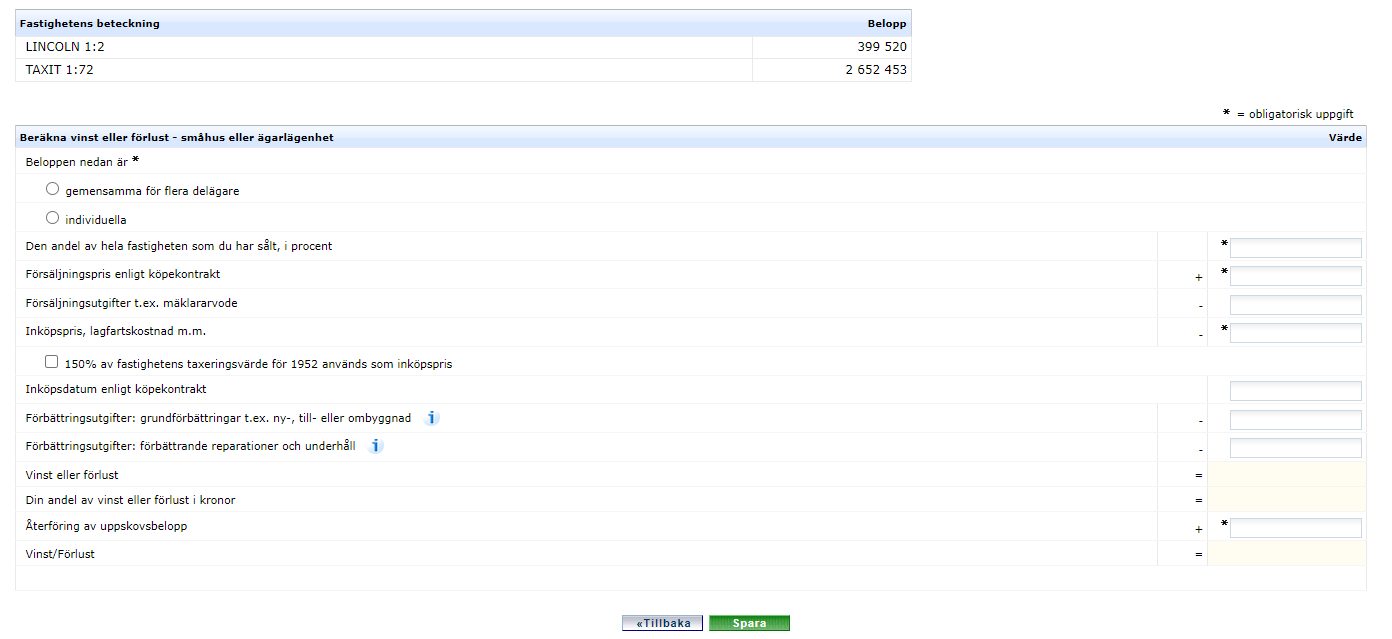

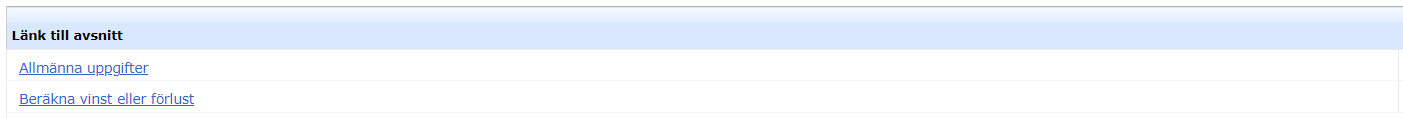

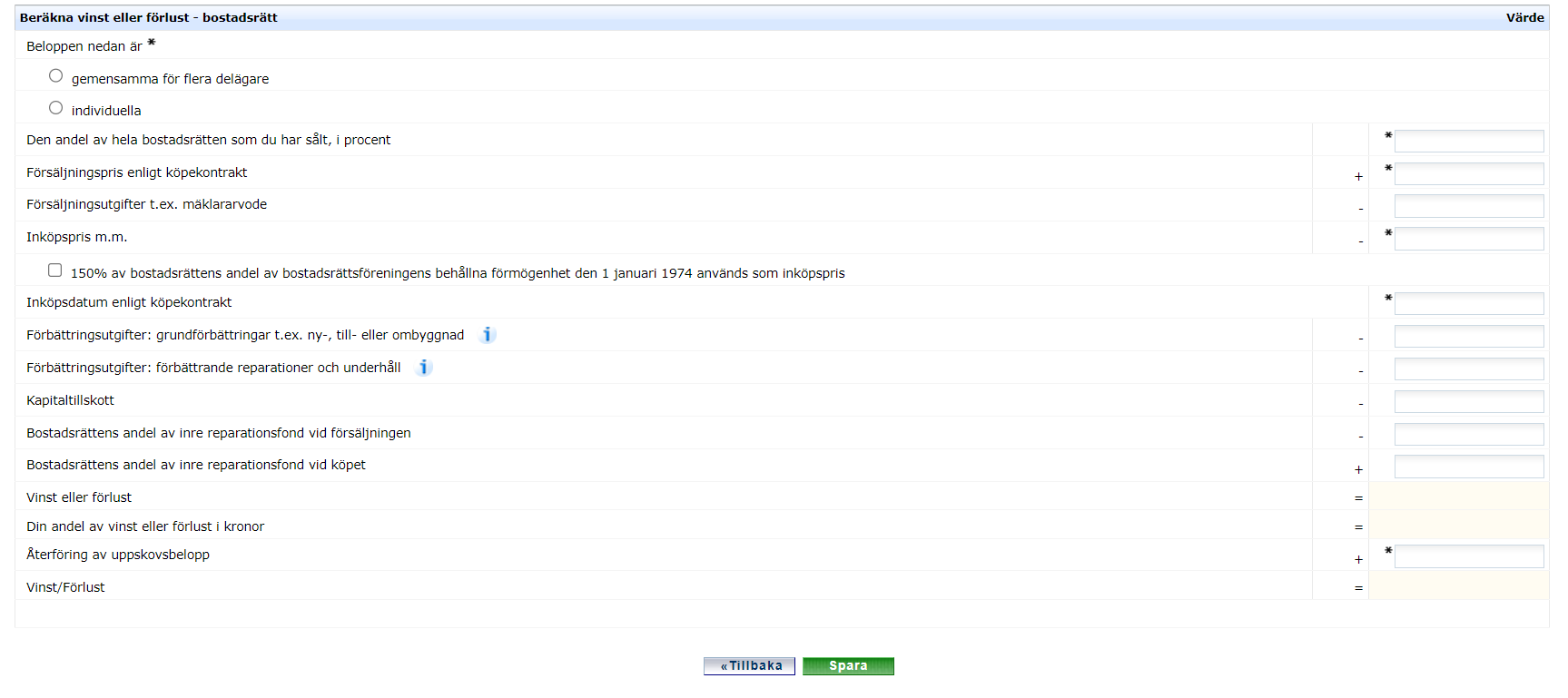

- Select the section for calculation of of profit or loss (“Beräkna vinst eller förlust”).

This is where you submit information for calculating your profit or loss from the sale of the property. First indicate whether the amounts stated in the section are shared between several part-owners or individual (your own).

Select shared amounts if:

- there are several of you selling together, and you have the same purchase price and improvement costs.

Select individual amounts if:

- you are the sole owner of the property

- you have only sold a share of the property

- there are several of you selling together, but you have different purchase prices and/or improvement costs.

Note that if there are several of you selling together, but with different purchase prices and improvement costs, the relevant amounts for sale price, selling costs, purchase price, improvment costs, etc. need to be specified for each seller.

- Check and make any necessary changes to the prefilled information.

- Add any information that is missing.

- When you have filled in all the information, click “Spara” to save, and your profit or loss will be calculated. Then click “Tillbaka” to exit.

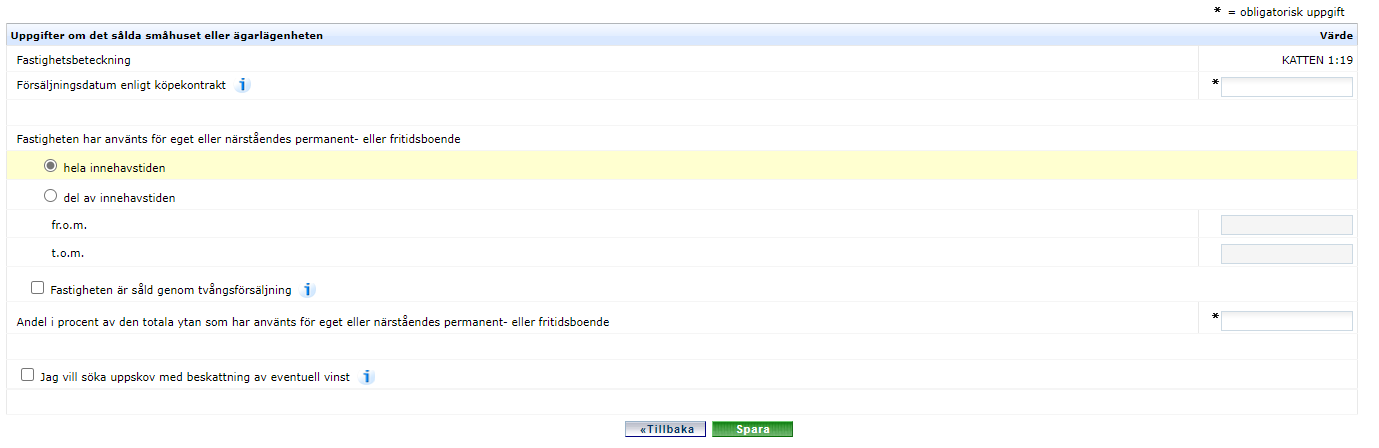

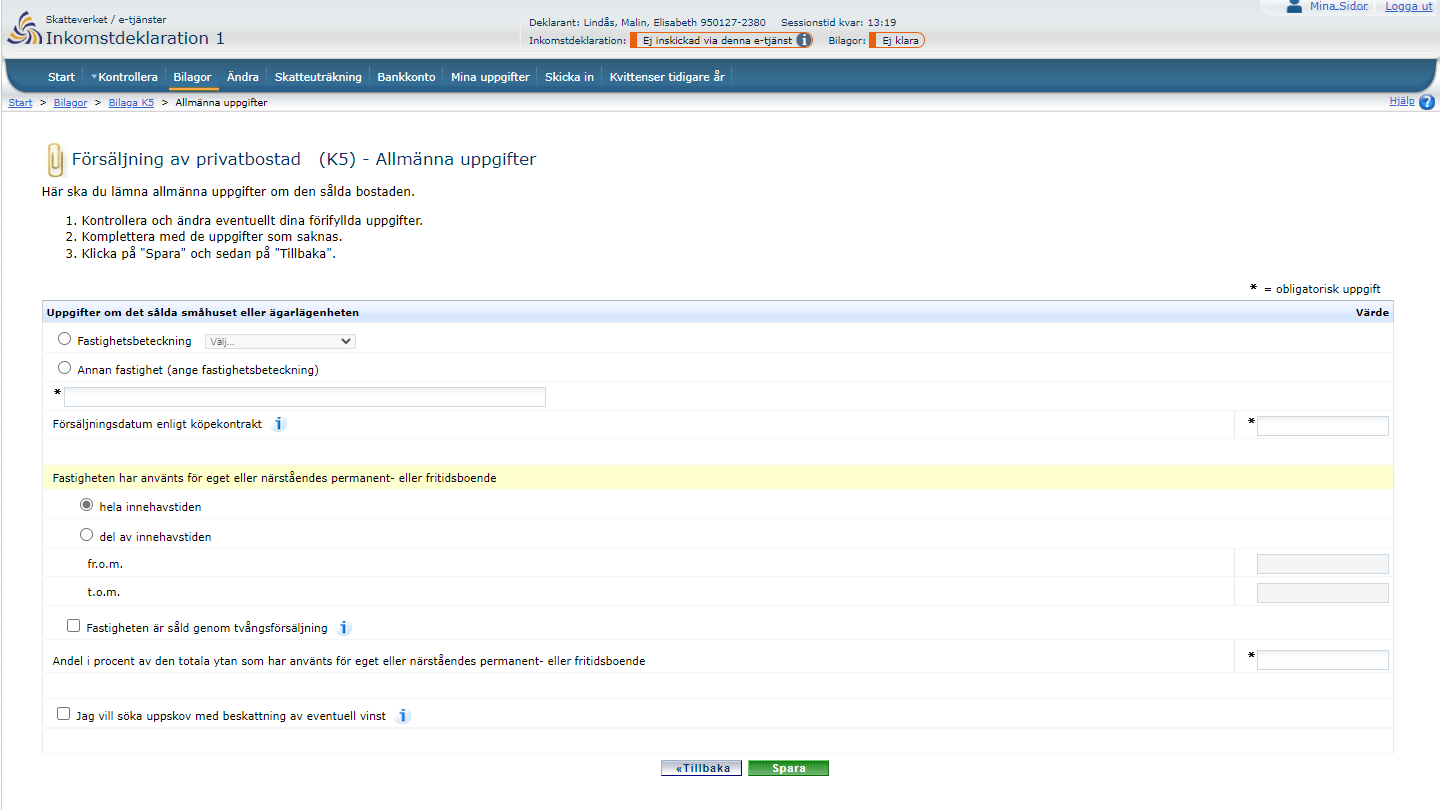

- Select annexe K5.

- Clicka on the link to the general information section (“Allmänna uppgifter”).

- Check and make any necessary changes to the prefilled information.

- Add any information that is missing.

- When you have filled in all the information, click “Spara” to save, and your profit or loss will be calculated. Then click “Tillbaka” to exit.

- Select the section for calculation of of profit or loss (“Beräkna vinst eller förlust”)

- Check and make any necessary changes to the prefilled information.

- Add any information that is missing.

- When you have filled in all the information, click “Spara” to save, and your profit or loss will be calculated. Then click “Tillbaka” to exit.

5.2 Create Annexes K4, K5 and K6 yourself

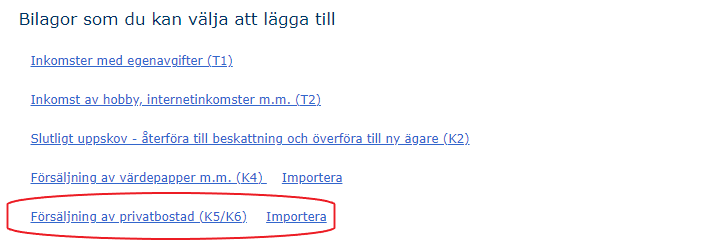

Select the annexe you want to create under the heading “Bilagor som du kan välja att lägga till” (“Annexes you can choose to add”).

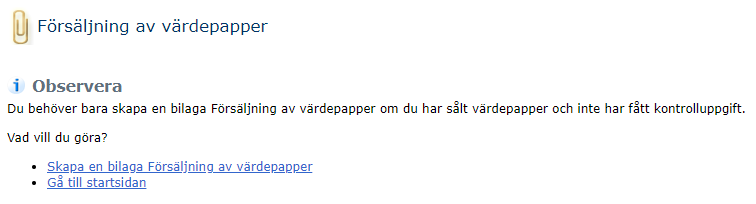

If you want to create a K4 annexe, “Sale of securities, etc.”

- Click the link “Försäljning av värdepapper m.m”

- Click the option “Skapa en bilaga Försäljning av värdepapper” to create the annexe.

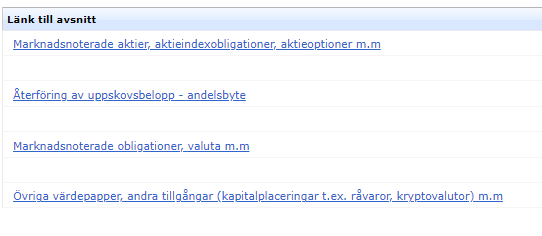

- Click the link to the section where you want to add information.

- Listed shares, share-index bonds, share options, etc.

- Reversal of tax relief – share swap

- Listed bonds, currency, etc.

- Other securities, other assets (capital investments in e.g. commodities, cryptocurrencies), etc.

- Note that the number of sales of securities you can report in the digital tax return is limited to 300.

- Click the link to the section where you want to add sales that were not already filled in.

- Fill in the required information in the selected section and then click “Spara” and “Tillbaka” to save and exit.

If you want to create a K5 or K6

- Click the link for sale of a private residence (K5/K6)

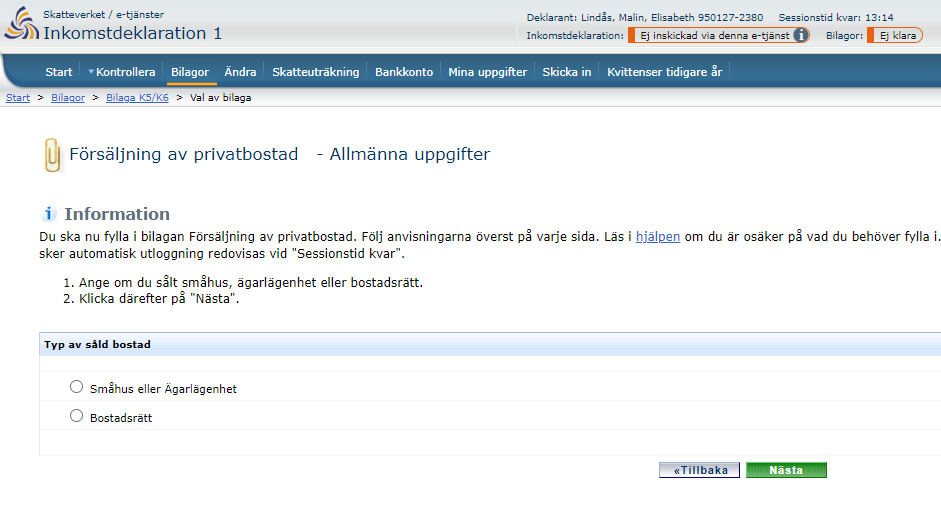

Select the option for the type of property sold (“Typ av såld bostad”).

- Residential house or owner-occupied apartment (“Småhus eller Ägarlägenhet”)

- Tenant-owner property (“Bostadsrätt)

Then click “Nästa” to got o the next step.

If you selected residential house or owner-occupied flat, a K5 annexe will be created.

- Check and if necessary change the information already filled in.

- Add any information that is missing.

- Click “Spara” and then “Tillbaka” to save and exit.

- Select the section for calculation of of profit or loss (“Beräkna vinst eller förlust”).

- Check and make any necessary changes to the prefilled information.

- Add any information that is missing.

- When you have filled in all the information, click “Spara” to save, and your profit or loss will be calculated. Then click “Tillbaka” to exit.

If you selected the option for a tenant-owner property, a K6 annexe will be created.

- Check and if necessary change the information already filled in.

- Add any information that is missing.

- Click “Spara” and then “Tillbaka” to save and exit.

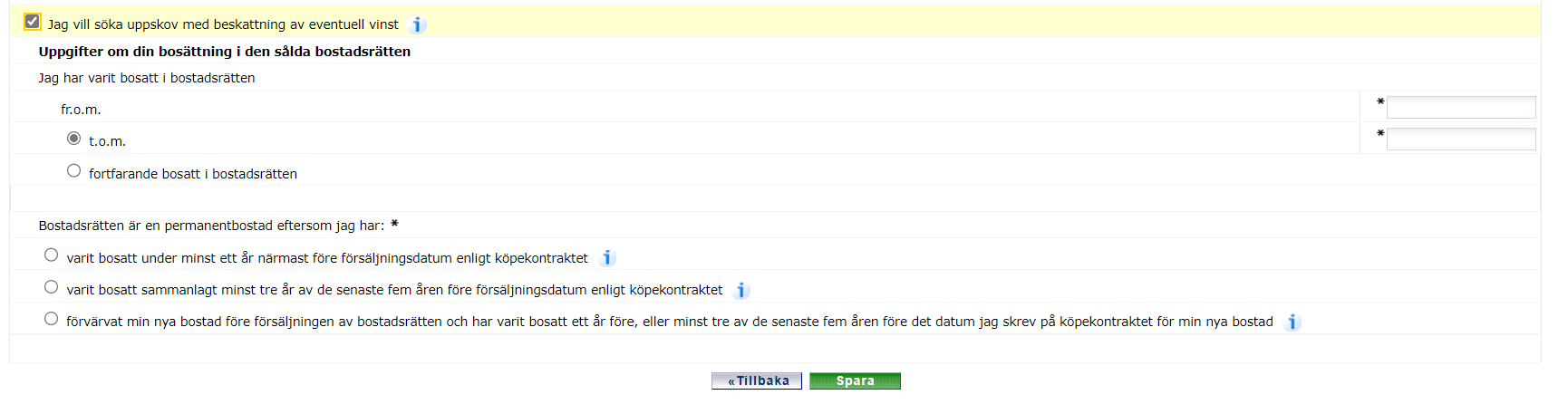

- If you stated that you want to apply for a deferral of tax on the profit, you have to fill in information about your residence in the sold property.

- Then click “Spara” and “Tillbaka” to save and exit.

- Select the section for profit or loss calculation (“Beräkna vinst eller förlust”).

- Check and if necessary change the information already filled in.

- Add any information that is missing.

- Click “Spara” and then “Tillbaka” to save and exit.

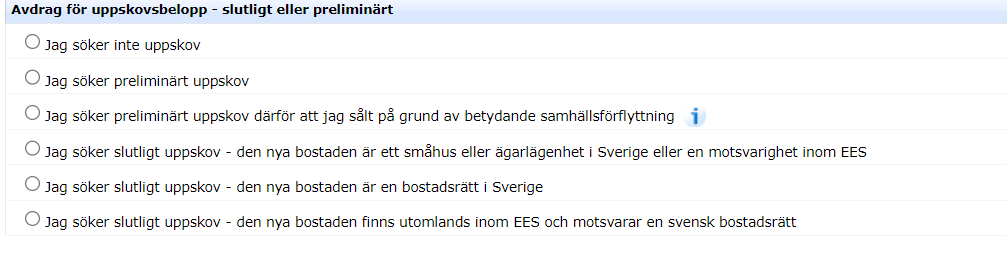

If you stated that you want to apply for a deferral of tax on the profit, continue by selecting the deferral (“Uppskov”) section.

- State whether you are not applying for relief, or whether you want a preliminary or final deferral. For a final deferral, you have to specify what type of new residence you have purchased (a residential house/owner-occupied flat, or a tenant-owner property).

- If you are not applying for a deferral, you don’t need to fill in any further information. Just click “Spara” and then “Tillbaka” to save and exit.

- If you are applying for a final deferral, you have to fill in information about your new residence.

- Click “Spara” to save your information. Then click “Tillbaka” to exit and you will be shown what your maximum allowable deferral amount is. If you want to reduce this amount, open the section for profit or loss calculation (“Beräkna vinst eller förlust”) and specify a lower allowance for final relief amount (“Avdrag för slutligt uppskovsbelopp”).

If you have any questions about other annexes, contact our tax information service (“Skatteupplysningen”).

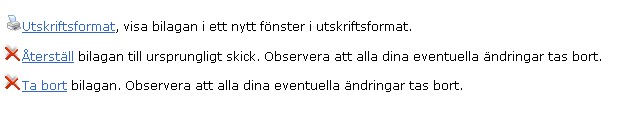

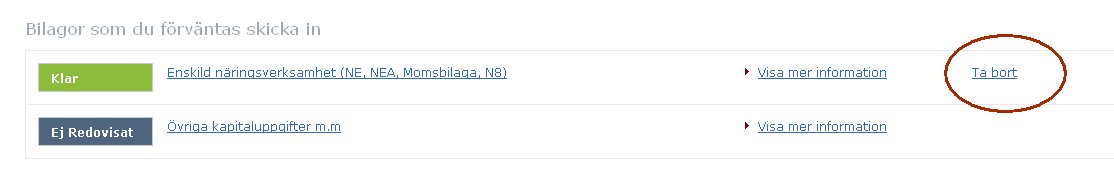

5.3 Removing an annexe

If the Swedish Tax Agency has created an annexe for you, there is the option to delete the prefilled information. You clear the information by clicking “Återställ” at the bottom of the page. If you have already begun filling in information yourself, we recommend that you instead delete, change or add information manually, in order to avoid filling in the entire annexe again.

If you have created an annexe yourself that you do not want to submit, or that you want to submit by different means, you can remove that annexe by clicking on the link at the bottom of the page.

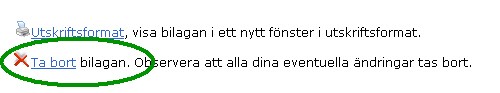

You can also remove completed annexes after selecting annexes (“Bilagor”) from the menu.

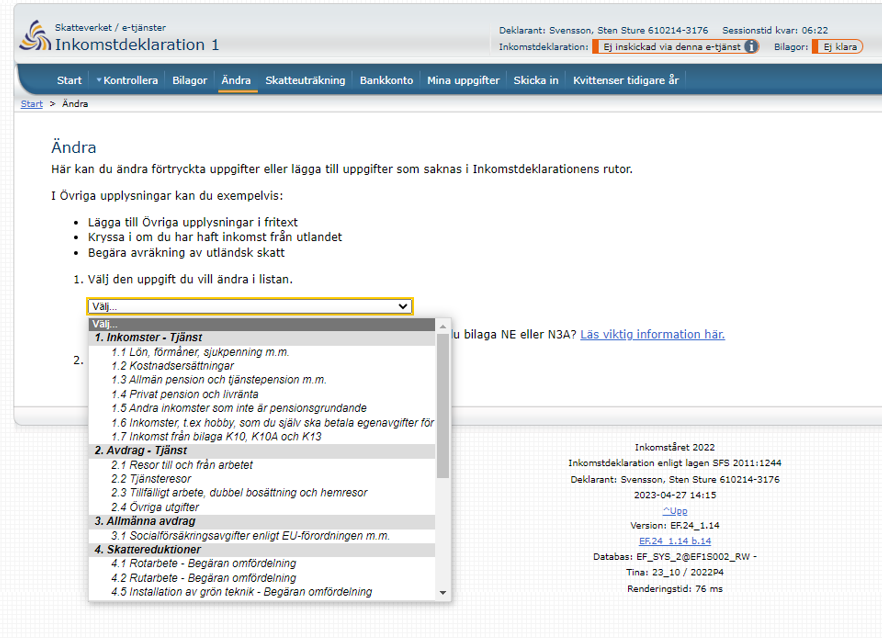

6. Making changes ("Ändra")

Click on Change ("Ändra").

If you logged in with a security code, you can only request deductions for travel to and from work, provide contact details, and specify or change your bank account details.

If you logged in with eID, you have access to all functions in the e-service.

You can change prefilled information, add information that is missing from the boxes in the income tax return, or provide other information.

- Select which item of information you want to change.

- Income – Employment

- 1.1 Salary, benefits, sickness benefit, etc.

- 1.2 Reimbursement of expenses

- 1.3 General pension and occupational pension, etc.

- 1.4 Private pension and annuity

- 1.5 Other income that is not pensionable

- 1.6 Income, e.g. from a hobby, on which you have to pay self-employed contributions

- 1.7 Income from annexes K10, K10A and K13

- Deductions – Employment

- 2.1 Travel to and from work

- 2.2 Business trips

- 2.3 Temporary work, dual residence and travel home

- 2.4 Other expenses

- General deductions

- 3.1 Social insurance charges under EU regulation, etc.

- 4. Tax relief

- 4.1 ROT work – Redistribution request

- 4.2 RUT work – Redistribution request

- 4.3 Installation of green technology – Redistribution request

- Select the item you want to change and click “Ändra” to change.

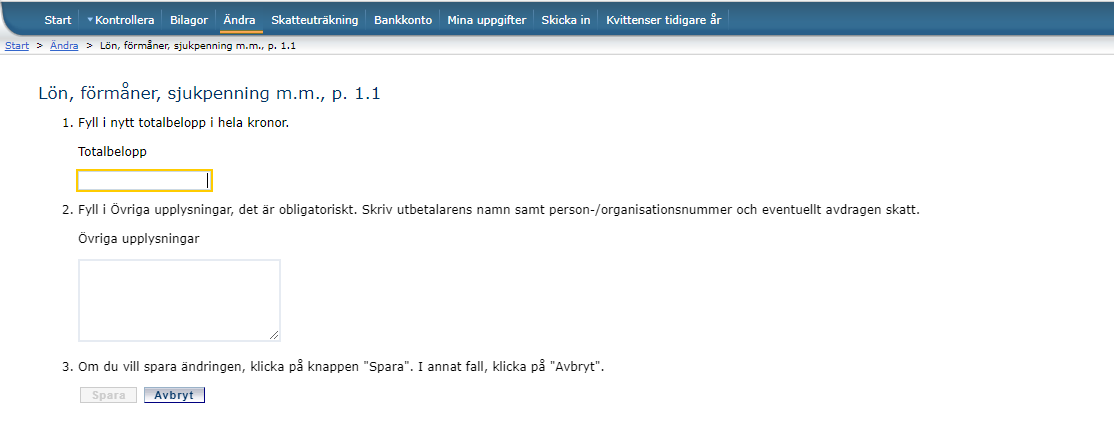

- For all items under “1. Income – Employment”: Fill in a new total amount, and other information where required, and then click “Spara” to save.

The image below shows what it looks like when you change “Salary, benefits including sickness benefit, etc.”

- For changes to ”Deductions – Employment”

To request deductions in the section “2. Deductions – Employment” you must have stated an income in items 1.1, 1.2, 1.5, 1.6 or 1.7 of the section “1. Income – Employment”.

Fill in a new total amount and click “Spara” to save.

- For changes to “3. General deductions”

Fill in a new total amount and click “Spara” to save.

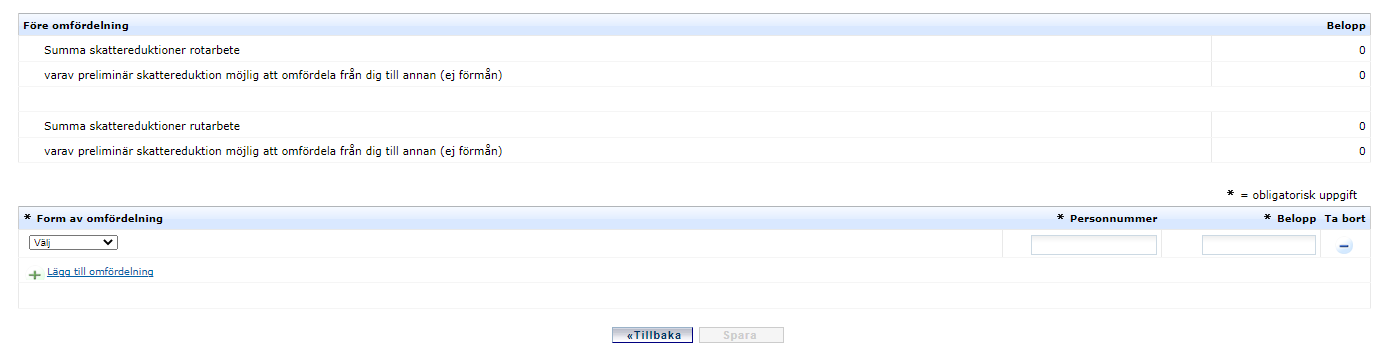

- For changes to “4. Tax relief”

- 4.1 ROT work, 4.2 RUT work, 4.5 Installation of green technology – Redistribution request

- Fill in the form of distribution, your personal identity number and the amount

- Click “Lägg till fördelning” if you need to distribute from/to several people.

- Click “Spara” to save and calculate, and then “Tillbaka” to exit.

The image below shows what it looks like when you request a redistribution for ROT work.

7. Tax calculation ("Skatteuträkning")

Click om Tax calculation ("Skatteuträkning").

Here you have the possibility of making a tax calculation to estimate your final tax. The tax calculation automatically considers any changes you have made to your tax return.

8. Bank account ("Bankkonto")

Click on Bank account ("Bankkonto").

Here you specify a bank account for tax refunds to be paid to. This has to be a Swedish bank account with you as the account holder. If a bank account has already been registered for this purpose, you will see it here.

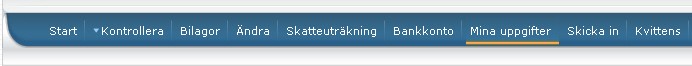

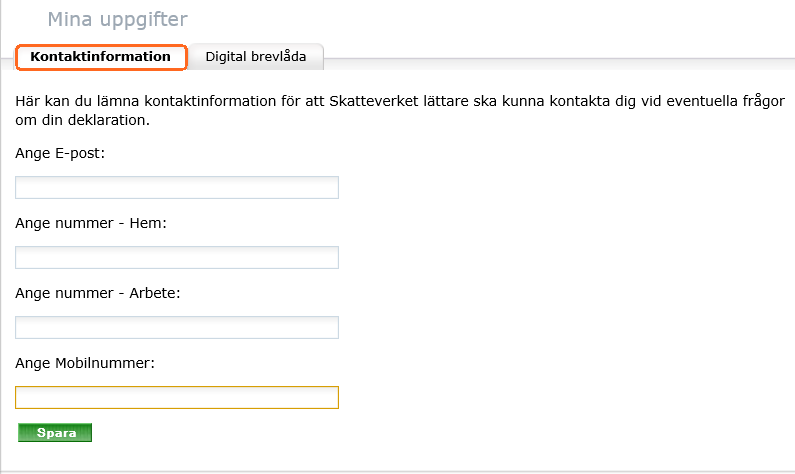

9. My contact details ("Mina uppgifter")

Click on My contact details ("Mina uppgifter").

This is where you provide your contact details so that the Swedish Tax Agency can easily reach you in the event of any questions about your tax return.

Fill in an email address and a telephone number to a fixed-line or mobile phone. This is also where a tax return representative can provide or change contact details for the person whose tax return they are filing.

10. Submit ("Skicka in")

Click on Submit ("Skicka in").

This is where you sign and submit your tax return. When you have confirmed that the details in it are correct, put a tick in the box “Jag har granskat och vill skriva under” (“I have reviewed the details in my tax return, and want to sign it”).

Click on “Nästa” (“Next”). You will then come to the next step: “Kvittens” (“Receipt”).

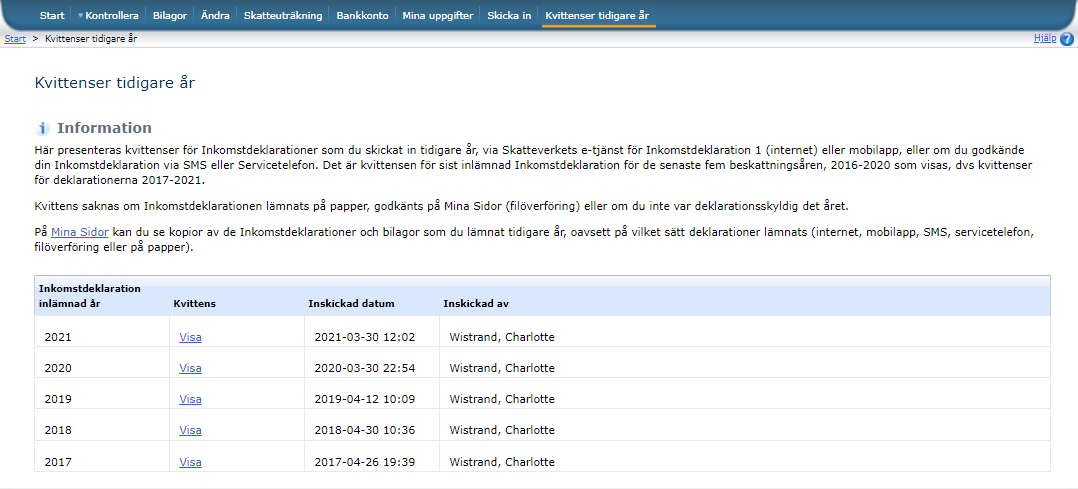

11. Receipt ("Kvittens")

Click on Receipt ("Kvittens").

The receipt will only be available via the menu after the first time you have approved and submitted your tax return via the e-service, the app, your telephone or SMS.

The receipt states when you submitted your tax return and what information you submitted. It also specifies whether the tax return was submitted via the internet, telephone or SMS.

This section shows receipts for income tax returns filed in previous years, either via this e-service for Income Tax Return 1 or the mobile app, or if Income Tax Return 1 was approved via SMS or service telephone.

The receipts for previous years menu item (“Kvittenser tidigare år”) only shows receipts for the preceding five years.

12. Tax to pay

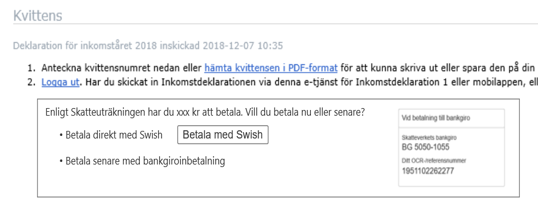

When your tax return has been filed and you have tax to pay on the basis of the information in the return, you can pay via Swish if you logged in using eID. Alternatively, you can choose to pay later via Bankgiro.

13. Logging out

You log out of the Income Tax Return 1 e-service by clicking “Logga ut”. If you made changes to your tax return without submitting it, you will see a warning message when you clickto log out. You will also get a warning message if you submitted a tax return with additional or changed information that you have not approved.