Other languages

- Other languages

- » In English (Engelska)

- » More on Skatteverket

- » Test service and technical specification

Test service and technical specification

This page contains information about the test service and technical specification for the e-filing of income statements.

Test service

XML files can be tested in the test service, in order to ascertain that they follow the requirements in the technical specification.

Technical description

The technical description describes how to design and submit data files containing income statements (KU). It is intended primarily for software companies and information providers with their own systems for generating income statement files.

Income year 2024

From the 17th of April it is possible to submit income statements via our e-service Lämna kontrolluppgifter for income year 2024.

The schema version 10.0 does not contain any changes in field codes or income statements from the last schema version. However, it will no longer be possible to submit a Swedish personal identity number in the field for information provider number (field code 201) for the income statement types where the information provider can only be a legal person.

This will affect you who submit one of the following income statements: KU20, KU21, KU25, KU26, KU28, KU30, KU31, KU32, KU34, KU35, KU40, KU41, KU55, KU65, KU66, KU68, KU71, KU72, KU73, KU80, KU81, KU90, KU91, KU92 eller KU93.

1. Submission dates

1.1 Submission dates for income statements/corrections

The dates for submitting income statements as well as corrections are important to keep in mind, as is the date for reporting Swedish withholding tax on dividends.

- 31 January – Income statements must be submitted to the Swedish Tax Agency no later than 31 January of the year following the income year. Corrections to income statements must be submitted promptly.

- 30 June – Income statement, KU72, must be submitted to the Swedish Tax Agency no later than 30 June of the year following the income year.

1.2 Submission dates for Swedish withholding tax on dividends

- Swedish tax on dividends must be reported no later than four (4) months after the dividend.

2. Submission methods

2.1 The e-service Lämna kontrolluppgifter (submit income statements)

The e-service Lämna kontrolluppgifter External link. contains two separate ways to submit income statement files. You can upload XML files or you can manually register the income statements.

External link. contains two separate ways to submit income statement files. You can upload XML files or you can manually register the income statements.

The e-service requires an e-ID.

2.1.1 Upload XML files in the e-service (filöverföring)

The e-service allows you to upload XML files containing income statements.

The Swedish Tax Agency does not accept files lacking mandatory identification data, or that contain formatting errors, field type errors, or errors related to the connection between fields. The requirements are stated in appendix 1 and 2.

It is possible to upload multiple files.

The maximum size for files in the file transfer service is 200 MB. If your file exceeds 200 MB it you can split it into smaller parts and submit the files separately. The total size of your submitted files can exceed 200 MB.

2.1.2 Manually register income statements (manuell registrering)

The e-Service allows you to register income statements manually. The purpose of this procedure is to eliminate the need to submit income statements on paper, although that possibility remains. The forms can be downloaded from the Swedish Tax Agency's website.

2.2 Upload XML files via SHS/e-transport

Submitting income statements files via e-transport requires an agreement with the Swedish Tax Agency. Please note that we currently do not accept any new agreements. You will however still be able to submit income statements via e-transport if you already have an agreement with us.

When you log into the e-transport interface, you use an authentication certificate authorised by the Swedish Tax Agency. Certificates are issued by an approved external party for e-transport. At present, valid certificates are only available from Steria AB.

Note: If the file has been sent via e-Transport, the error message will not contain detailed error information. Also, the acknowledgement is not made immediately; it is sent by e-mail to the e-mail address stated in the file’s XML-group Avsandare (information of sender) with delay.

The file size should not exceed 1 GB.

3. File testing

3.1 Test service

With the e-Service “Test file with income statements” you can test your XML file to make sure it is readable by the Swedish Tax Agency’s systems. The test run generates a report on the test results.

Note: The test file cannot be larger than 3 MB.

Errors found are described in the report generated by the test run. If you need help interpreting the error messages, use the website http://www.w3.org/TR/xmlschema-1/#outcomes External link. as a reference.

External link. as a reference.

3.2 Validation against XML schema

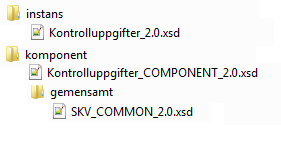

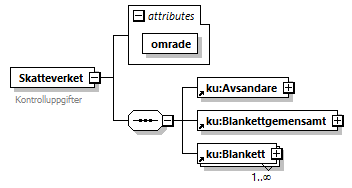

An XML schema is a collection of rules that describes the structure of an XML document. It has the file extension .xsd.

XML files are validated against an XML schema that is published by the Swedish Tax Agency.

The XML schema has the following structure:

4. Preparing to submit the income statement file

4.1 Checklist before you submit the file

It is important that the information submitted are of high quality. Therefore you are recommended to use the checklist below before submitting your report. The checklist can save both time and trouble for you, the Swedish Tax Agency, and for the person to whom the information relates.

When reporting income statements, you need to consider the following:

- Make sure the same information provider number (FK201) has been used to report the employer’s contributions and deducted tax, PAYE.

- Make sure the file contains relevant and updated contact information.

- Make sure the specification number (FK570) is specified for all income statements.

- If the person to whom the information relates has no Swedish personal identity number or coordination number, the following must be stated:

- FK222 Date of Birth (FK224 Other ID number for legal entities)

- FK216, 217 First Name, Last Name

- FK218 Street address

- FK220 Postal location

Note: FK230, FriAdress, together with FK221, LandskodPostort, may be used instead of Fk218 and Fk220.

- Check that all remuneration or costs are included and that they have been given the accurate element names.

- Check that you have entered the ISIN for all securities that have ISIN.

Note: If ISIN has a country code other than “SE”, make sure always to add a name in plain text. Also make sure that your “own” internal ISINs are converted to actual ISINs (FK572).

4.2 The right information for the right person

The summary and pre-printing of income tax returns are based on the submitted income statement. Therefore it is important that the income statements are provided

- on time,

- with the correct Swedish personal identity number or coordination number (correct identity), and

- with correct figures.

Income earners are also credited with preliminary tax based on the submitted income statements. Employers and others who report information in the PAYE return, must make sure that the information is consistent with the submitted income statements.

4.3 Informing the person to whom the information relates

When the income statement has been submitted to the Swedish Tax Agency, the equivalent information must be submitted to the person to whom the information relates. The information can be submitted in any of the following ways:

- On the last pay slip for the year

- On annual statements

- On personal forms adapted to suit personal printing routines and needs

- By e-mail

It is important that it is easy to compare the income statement information with the information on the income tax return.

If income statement KU13 or KU14 has been submitted, the information sent to the employee must include a statement to the following effect:

KU13: “This information refers to income which, as part of the decision on special income tax for non-residents, should not be declared in Sweden.”

KU14: “This information refers to a special income statement, that is, pensionable income and replacement of income statements, for income that should not be declared in Sweden.”

4.4 Personal Identification

The Swedish Tax Agency has improved the security of the e-service for filing income statements. This means that you have to identify yourself whenever you wish to submit income statements electronically.

- If you submit an income statement file via file transfer, you have to identify yourself with e-ID. It does not mean that you are personally responsible for the file contents, but it enables the Swedish Tax Agency to identify the source of information.

- Submitting income statements files via e-transport requires an agreement with the Swedish Tax Agency. When you log into the e-transport interface, you use an authentication certificate authorised by the Swedish Tax Agency. Certificates are issued by an approved external party for e-transport. At present, valid certificates are only available from Steria AB.

Note: You do not have to log in with your e-ID in order to test your file in the Swedish Tax Agency's test service.

5. Acknowledgements

5.1 Acknowledgements

When the Swedish Tax Agency receives an accurate income statements file, an electronic acknowledgement is generated and sent to the person who submitted the file. The acknowledgement is a confirmation that the Tax Agency has received and can read the reported income statements.

If the income statements file submitted contains errors, you will receive an error message detailing the errors detected.

Note: If the file has been sent via e-Transport, the error message will not contain detailed error information. Also, the acknowledgement is not made immediately; it is sent by e-mail to the e-mail address stated in the file’s XML-group Avsandare (information of sender) with delay.

6. Contents of the income statements file

6.1 Contact details for information providers

Having access to accurate contact details makes it easier for both information providers and the Swedish Tax Agency.

The section Blankettgemensamt of the income statement file should contain details about those who are contact persons for the providers of income statement information.

Note: At least one contact person must be specified for the information providers.

Large organisations may have different contact persons for different departments or divisions. For this reason, it is possible to provide contact details for several persons in the section Blankettgemensamt. For example, one company may have one contact person for income statements dealing with the company's employees, and another contact person for the income statements dealing with securities. In the field Sakomrade (area of expertise) you can specify which part of the business a certain contact person is responsible for.

6.2 Identifiers

An income statement is identified as unique through a combination of five fields. These five fields are called identifiers. If only one of the identifiers are different from this identifier on another income statement, then the two income statements are distinguished from each other. The following income statement fields are identifiers:

- KU type: The form that should be used for the income statements in question

- FK201: The information provider's personal ID or corporate ID number

- FK203: Income year

- FK215, FK222 or FK224: Whoever the income statement relates to. Personal ID, coordination number, or corporate ID number (FK215). Should none of these numbers exist, specify date of birth for an individual (F222) or another ID number for a legal entity (FK224).

- FK570: Specification number

These five identifiers are mandatory and must be specified in all income statements. They are also important for correction or removal, see the section Correction and removal.

Note: These identifiers are also valid when reporting withholding tax on dividends on KU31. This means that reports for a physical or legal person, who receives dividend from different companies in the same income year, must contain different specification numbers.

6.3 Identifying the person to whom the income statement relates

The person to whom the income statement information relates must be identified. This can be done by specifying one of the following fields:Date of Birth field (FK222). Use this field if the person lacks both personal ID number and coordination number. The three n digits at the end are used to distinguish between individuals who were born on the same day and are all lacking a personal ID number. The details entered in the Date of Birth field should be reused for any additional income statement provided for the same individual. The formal requirement for the Other ID Number is that you have to state at least one digit. Blank, or “space” is not a valid digit. It is recommended that the legal person's foreign organisation number is specified.

Other ID Number (FK 224). For income statements relating to foreign legal persons who have neither a Swedish corporate number nor a registration number, the Other ID Number (FK 224) should be specified, not the Date of Birth field. The Other ID Number field can also be used in cases where a physical person lacks personal ID number or coordination and the date of birth is unknown.Example: A person who was born on June 4 in 1989 and who lacks a personal ID number, the number 19890604001 should be entered in the date of birth field.Enter the date of birth in the format YYYYMMDDnnnPersonal ID number field (FK215). Use this field if the person has a personal ID number, or if the person has a coordination number but no personal ID number.

6.4 Name and address information

Swedish residents. For income statements relating to individuals with a Swedish personal ID number and a registered residence in Sweden, name and address information does not have to be specified.

Non-residents. For income statements relating to non-residents, both persons with a Swedish personal ID number and those with a coordination number, the following fields should be specified: First name (FK216) and Last name (FK217), Street address (FK218), Postal code (FK219), Postal location (FK220), and Country code for postal location (FK221).

If the address does not fit in the regular address fields, Free address (FK230) can be used instead of FK218, FK219 and FK220. It could be a foreign address that are structured differently than a Swedish address. Country code (FK221) is compulsory if you use Free address.

Foreign legal entities. For income statements relating to foreign legal entities, the following fields should be specified: Orgname (FK226), Street address (FK218), Postal code (FK219), Postal location (FK220), and Country code for postal location (FK221).

If the address information does not fit in the field Street address (FK218), the field Street adress2 (FK228) can be used. Can the address information not be distinguished to street, postal code and postal location, the “free address” field Free Address (FK230) can be used. With Free Address a Country Code (FK221) must always be specified. For persons with a coordination number, the address of their native country should be entered, if possible.

Note: If a Swedish personal ID number, coordination number or corporate ID number is missing, the Date of Birth field (for physical persons) or the OtherIDNo field (for legal entities) should be specified.

6.5 Required fields

An income statement must meet certain minimum requirements in order to be approved for electronic submission. The information in question is so essential for the income statement type submitted that the Swedish Tax Agency has no use for the income statement should the information be missing.

Example: An income statement for interest expense must include amounts in at least one of the fields for interest expense. The only exception is when you want to remove an income statement. Then no fields except for identifiers, may exist. Therefore, the associated controls that check this are designed to indicate if the removal marking (FK205) as well as the essential fields are left empty.

6.6 Specification number

The specification number (FK570) must always be specified each income statement. This applies even if you only submit one income statement for the same person.

Note: If the person submitting an income statement for another information provider adds a specification number, it is important that the information provider is aware of the specification number. If the information provider is to submit corrections or removals, the corrected income statement must have the same specification number as the income statement previously submitted.

6.7 Income statements without personal ID number

Income statements without a personal ID number are not included in the income tax return 1, and the person to whom the information relates, is not credited for the preliminary tax. In contrast, the income statement is included when reconciling reported preliminary tax and employer contributions with the PAYE returns.

6.8 Reporting Swedish withholding tax

From income year 2015, the form KU31 should be used to report Swedish withholding tax paid on dividends from companies that are VPC registered or VPC affiliated. The same rules that apply to income statements, also apply to Swedish withholding tax registered via KU31, except that they are submitted four (4) months after the dividend. When you report Swedish withholding tax via KU31, you should not report the same dividend on another KU31.

When Swedish withholding tax is registered in the KU31, you do not have to submit another KU31 for the same dividend. However, you need to submit a common income statement. The common income statement form can be submitted electronically in the XML file’s form section, which then becomes a separate form that can be corrected or removed in the same way as an income statement. You can also make additions to that form.

6.8.1 Identifiers of common income statement forms

The following criteria helps separate a common income statement form for Swedish withholding tax, from another common income statement form:

KU type | The name of the common income statement form is KupongS. |

FK201 | The information provider's personal ID or corporate ID number |

FK203 | Income year |

FK572 or FK890 | ISIN/OrgnrUtdelandeBolag |

FK851 | Merchant number |

These five fields are mandatory and must be specified in all forms. They are also important for corrections and removal.

6.8.2 Correction of common income statement forms

A common income statement form can be corrected either through replacement or addition.

Correction through replacement. If you choose correction through replacement, you must send a new account with complete information about the dividend date and with the same identificators as the original account.

Correction through addition. If you choose correction through addition, you must enter a new merchant number. Since the addition has the same record date (FK853) as the original account, it is evident that it relates to a addition and not a new dividend. An addition can also contain negative values in the fields FK860–FK879.

7. Corrections and removals

7.1 Correction of income statements and withholding tax information

The income statements must be submitted to the Swedish Tax Agency no later than January 31st of the year following the income year. Corrected income statements must be submitted as soon as possible. It is important that corrections are supplied continuously, without delay, as soon as they are produced. The reason is that the information is updated continuously in the electronic income tax return.

A modification made to a previously submitted income statement is considered to be a correction. An additional income statement, on the other hand, is considered as a completely new income statement. Note: Income statements that are reported correctly in the original report, should not be re-submitted.

A correction-income statement should be complete. In addition to the corrected information all information that has not been corrected must be included in the correction-income statement.

When correcting a previously submitted income statement, all the following identifiers should be specified:

KU type | The form that should be used for the income statements in question |

FK201 | The information provider's personal ID or corporate ID number |

FK203 | Income year |

FK215, FK222 or FK224 | Whoever the income statement relates to. Personal ID, coordination number, or corporate ID number (FK215). Should none of these numbers exist, specify date of birth for an individual (F222) or another ID number for a legal entity (FK224). |

FK570 | Specification number (same as on the original income statement) |

Information on Swedish withholding tax on dividends is corrected in the same way as common income statements, but the submission of withholding tax accounts must be completed no later than four (4) months after the dividend.

7.2 Correction of income statement submitted for the wrong person

If an income statement has been submitted for the wrong person, two income statements must be submitted to correct the error. The incorrect income statement is removed, and a correct income statement is submitted, including the correct personal ID or coordination number or date of birth, and other relevant information.

7.3 Removal of submitted income statements

Upon removal of a previously submitted income statement, removal marking (FK205) and all identifiers should be specified:

KU type | The form that should be used for the income statements in question |

FK201 | The information provider's personal ID or corporate ID number |

FK203 | Income year |

FK215, FK222 or FK224 | Whoever the income statement relates to. Personal ID, coordination number, or corporate ID number (FK215). Should none of these numbers exist, specify date of birth for an individual (F222) or another ID number for a legal entity (FK224). |

FK570 | Specification number (same as on the original income statement) |

No additional information may be included.

7.4 Removal of entire income statements file

If something goes wrong and several, or even all, income statements in the file are found to contain incorrect information, the best action may be to remove the entire income statements file submitted. You do this by creating a removal file.

A removal file includes all income statements from the original file, but all income statements have only identifiers and Removal marking (FK205) completed. No other information may be completed for a removal.

When the removal file is submitted, all income statements from the previously submitted file are removed. You can then submit your new income statement file with the correct income statements. The latest income statements become current and valid.

8. The format of the XML file

8.1 File format

The following conditions apply for the file:

- The file format is XML (eXtensible Markup Language), which is a markup language that defines a set of rules for encoding documents.

- The character encoding for the file is UTF-8 (eight-bit Unicode transformation format).

- The file name is optional.

- The maximum number of characters in the file name is 256.

8.2 Forbidden characters

The following characters are replaced with HTML code in the XML file, and therefore cannot be used as field values:

- < is replaced with <

- > is replaced with >

- & is replaced with &

- ' is replaced with '

- " is replaced with "

9. XML structure

9.1 General structure

The XML file is divided into the following sections:

- One section containing sender information

- One section containing common form information

- One or several sections containing income statement information

For hierarchies and structure for XML, see Appendix 2.

10. Further questions

Questions regarding the technical description and the e-service as well as other questions can be submitted via the contact form below. You can also call Skatteupplysningen: 0771-567 567 or +46 8 564 851 60 if you are calling from outside of Sweden.

Appendices and schema files

Income year 2024 (schema version 10.0)

Income year 2023 (schema version 9.0)

Income year 2022 (schema version 8.0)

Income year 2021 (schema version 7.0)

Income year 2020 (schema version 6.0)

Income year 2019 (schema version 5.0)

Income year 2018 (schema version 4.0)

Description of appendices

Brochure SKV 260

Historically the technical specification was published in a brochure (SKV 260) which was updated once a year. This has been discontinued after schema version 6.0.

Appendix 1 – Field types

The appendix contains a description of the field types that are listed in appendix 2.

Appendix 2 – XML structure

The appendix describes the XML structure for e-filing of income statements.

Appendix 2b – List of fields, controls etc. in Excel format (only in Swedish, Bilaga 2b)

The appendix shows a list of all field codes for different types of income statements. It also contains controls.

Appendix 3 – Contents in fields

The appendix contains information about in which income statements certain field codes appear.

Appendix 4 – Sample XML files

The appendix contains examples of XML files with different types of income statements. This appendix has been replaced after schema version 6.0 with a ZIP file containing editable XML files.

All sample files

The appendix contains examples of XML files with different types of income statements.

News letter

The Swedish Tax Agency has a news letter aimed toward software companies and information providers with their own systems for generating income statement files.

News letters

This is a list of published news letters. Each news letter contains an English translation.

- Nyhetsbrev kontrolluppgifter maj 2023

Pdf, 580.7 kB.

Pdf, 580.7 kB. - Nyhetsbrev kontrolluppgifter juni 2022

Pdf, 550.2 kB.

Pdf, 550.2 kB. - Nyhetsbrev kontrolluppgifter maj 2022

Pdf, 166.4 kB.

Pdf, 166.4 kB. - Nyhetsbrev kontrolluppgifter april 2021

Pdf, 550.6 kB.

Pdf, 550.6 kB. - Nyhetsbrev kontrolluppgifter oktober 2020

Pdf, 586.7 kB.

Pdf, 586.7 kB. - Nyhetsbrev kontrolluppgifter juli 2020

Pdf, 568.2 kB.

Pdf, 568.2 kB. - Nyhetsbrev kontrolluppgifter april 2020

Pdf, 576.2 kB.

Pdf, 576.2 kB. - Nyhetsbrev kontrolluppgifter december 2019

Pdf, 696.6 kB.

Pdf, 696.6 kB. - Nyhetsbrev kontrolluppgifter oktober 2019

Pdf, 568.6 kB.

Pdf, 568.6 kB. - Nyhetsbrev kontrolluppgifter augusti 2019

Pdf, 580.9 kB.

Pdf, 580.9 kB. - Nyhetsbrev kontrolluppgifter april 2019

Pdf, 334.6 kB, opens in new window.

Pdf, 334.6 kB, opens in new window. - Nyhetsbrev kontrolluppgifter januari 2019

Pdf, 454.4 kB.

Pdf, 454.4 kB.

Kontakta oss

Aktuellt

-

Det gäller för julbord och julklappar

Julen närmar sig och många företag firar den tillsammans med sina anställda geno...

-

Truster och stiftelser gömmer obeskattade tillgångar

Med hjälp av utländskt informationsutbyte har Skatteverket gjort riktade kontrol...

-

Nya förutsättningar att kontrollera taxiföretag

De senaste åren har Skatteverket fått bättre möjligheter att kontrollera taxibra...