Other languages

- ...

- » EC Sales List (recapitulative statement) regarding goods and services

- » How to use our e-service for EC Sales List (recapitulative statement) for VAT

How to use our e-service for EC Sales List (recapitulative statement) for VAT

This is a guide on how to use the e-service EC Sales List for VAT.

You can do the following in the e-service

Log in to the e-service by using your personal eID, Once you have logged in you will find the following options:

- Submit an EC Sales List

- Respond to queries

- View receipts

- Apply for permission to submit EC Sales Lists quarterly

- Register or deregister for EC Sales List sent by post

- Get a digital mailbox

All of the services above, except “Submit a EC Sales List” and “View earlier receipts”, require you to be authorised to use them for the selected business. The Swedish Tax Agency will be aware that you are authorised if:

- the business is your own sole trader business

- you are an authorised signatory, or the CEO, of the business

- the business has registered you as its representative for responding to queries

Log in to the e-service

Use our e-service for EC Sales List for VAT (in Swedish: Periodisk sammanställning för moms).

The opening hours for the e-service are seen in the white box next to the yellow log-in button. If the the e-service is closed you see the text "Stängd" in the white box.

1. How to log in to the e-service

When you have selected the e-service you want to log in to, a login page will open. In the upper part of the view you can change the language to English by clicking the button ”English”. By choosing ”International” you get more alternatives for eIDs you can use to log in to the e-service. Select the login mode that suits you best by clicking it, and then proceed to identify yourself.

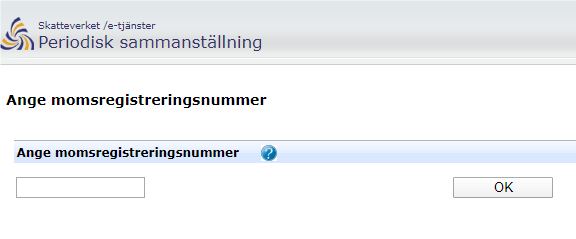

2. Enter VAT number (Ange momsregistreringsnummer)

Once you have logged in, select which business you are going to submit the EC Sales List for by entering their VAT number, then click OK. The VAT registration number must have 12 numerals, of which the last two are 01, e.g. XXXXXXXXXX01.

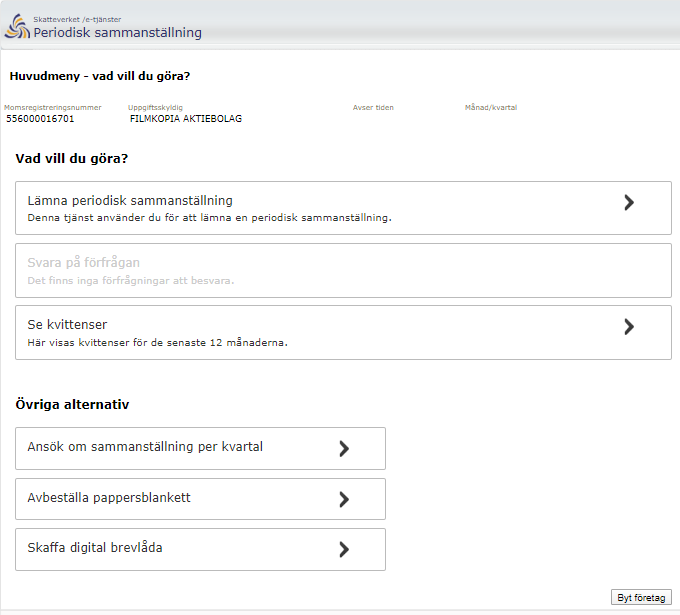

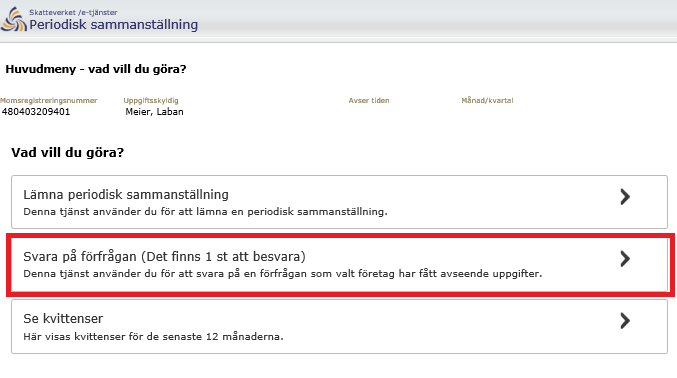

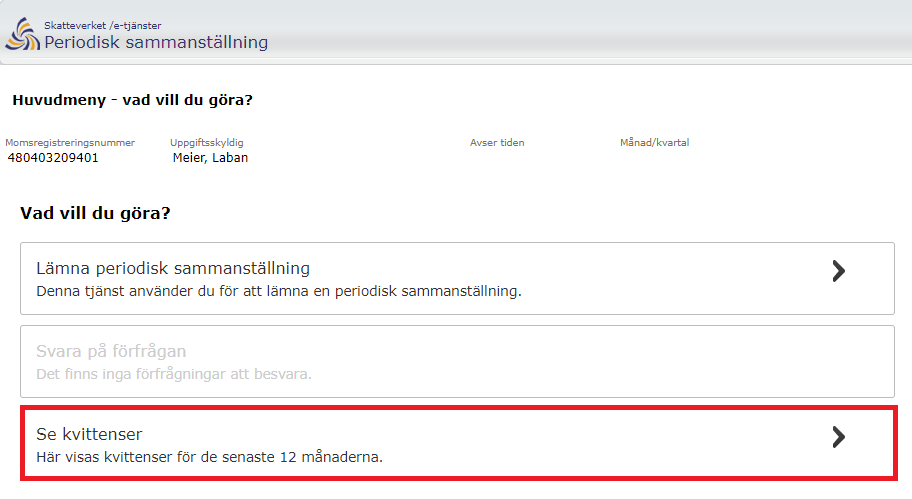

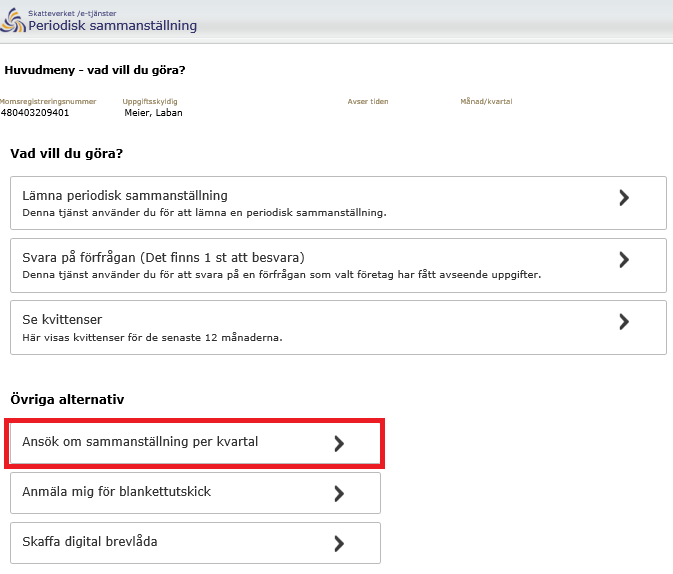

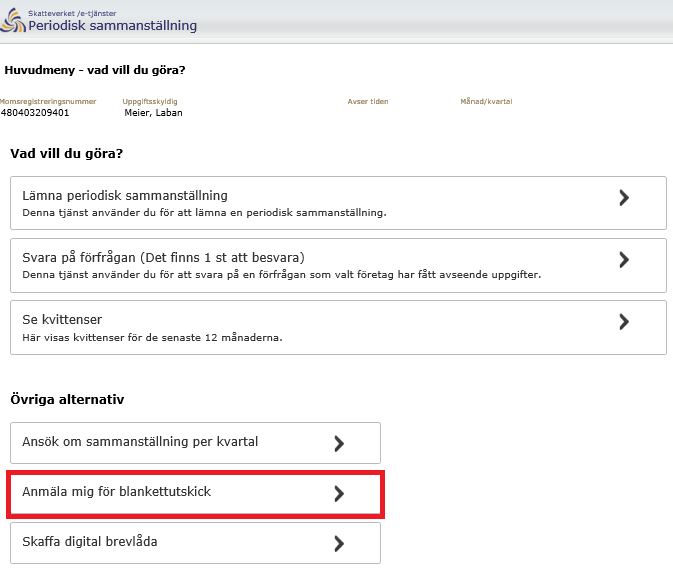

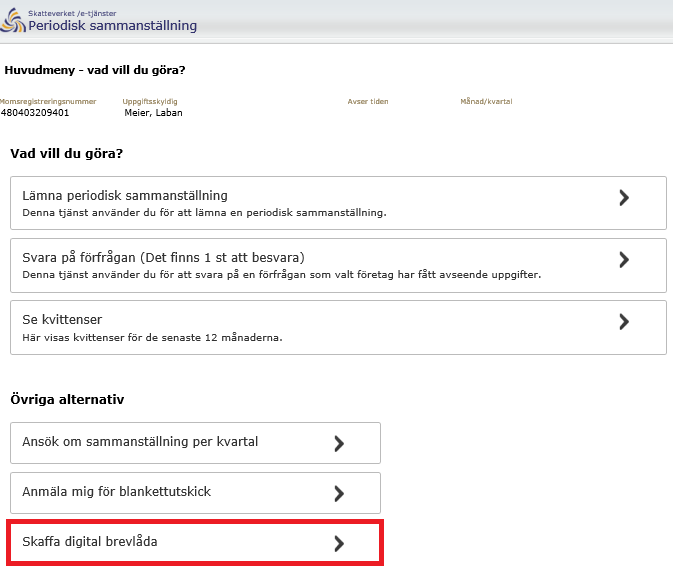

3. Main menu – what would you like to do? (Huvudmeny – vad vill du göra?)

In this step you can choose to:

- Submit an EC Sales List (Lämna periodisk sammanställning)

- Respond to query (Svara på förfrågan)

- View receipts (Se kvittenser)

- Apply for permission to submit EC Sales Lists quarterly (Ansök om sammanställning per kvartal)

- Register or deregister for EC Sales List sent by post (Beställ/Avbeställ pappersblankett)

- Get a digital mailbox (Skaffa digital brevlåda)

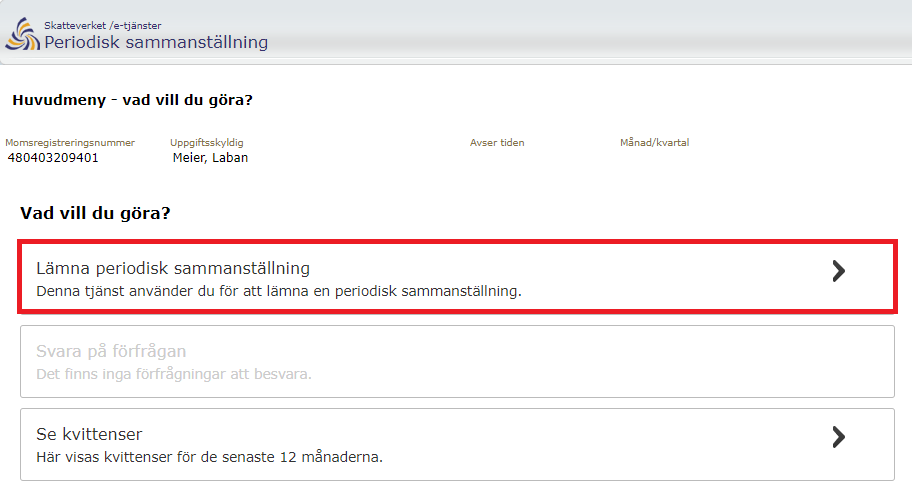

4. Submit an EC Sales List (Lämna periodisk sammanställning)

Select this option to submit an EC Sales List (Lämna periodisk sammanställning).

You can submit an EC Sales List for a business you represent without that business having registered you as its representative with the Swedish Tax Agency.

To submit your EC Sales List you need to select the period and state contact details. After that you need to register rows with supply of goods, triangular trade and services.

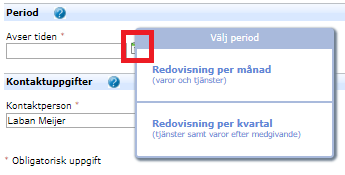

4.1 Period

This is where you select the period. Click the calendar symbol to select either:

- Monthly reporting (Redovisning per månad) or

- Quarterly reporting (Redovisning per kvartal)

After that, select the period by clicking on the year and month/quarter (depending on which period length you selected in the previous step). If you selected the wrong period length in the previous step you can go back by clicking <Select period (<Välj period).

EC Sales Lists normally have to be submitted every calendar month. You can only submit the EC Sales List quarterly if the business is only reporting sales of services, or if the Swedish Tax Agency has reached a decision to allow quarterly reporting. If you select the quarterly reporting option but do not have a decision from the Swedish Tax Agency to that effect, you will only be able to report sales of services. More information about this and about how to apply for quarterly reporting is available on the web page about EC Sales List regarding goods and services.

If you select a quarter and an EC Sales List has already been submitted for a month which is in that quarter, you will get a message that your selection cannot be made. Instead you have to submit monthly EC Sales Lists for the other months in that quarter as well, provided you have anything to report for those periods. The same applies if you have done the reverse, i.e. if you have already submitted a quarterly report, you cannot subsequently submit EC Sales Lists for any of the months within that quarter.

Remember that you only have to submit an EC Sales List if the business has anything to report.

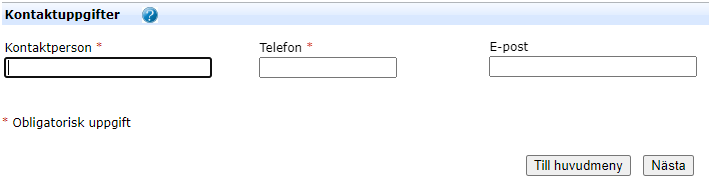

4.2 Contact details

Here you state the name (Kontaktperson), telephone number (Telefon) and email address (E-post) of the person that the Swedish Tax Agency has to contact if we have any queries regarding the information you submit. A contact person and a telephone number are required information (Obligatorisk uppgift). An email address is voluntary.

If you have used the e-service before, the contact details you provided earlier will be prefilled. Don’t forget to fill in new information if your contact details have changed.

After you have stated or updated the contact details click Next (Nästa). You can also go back to the main menu by clicking To main menu (Till huvudmeny).

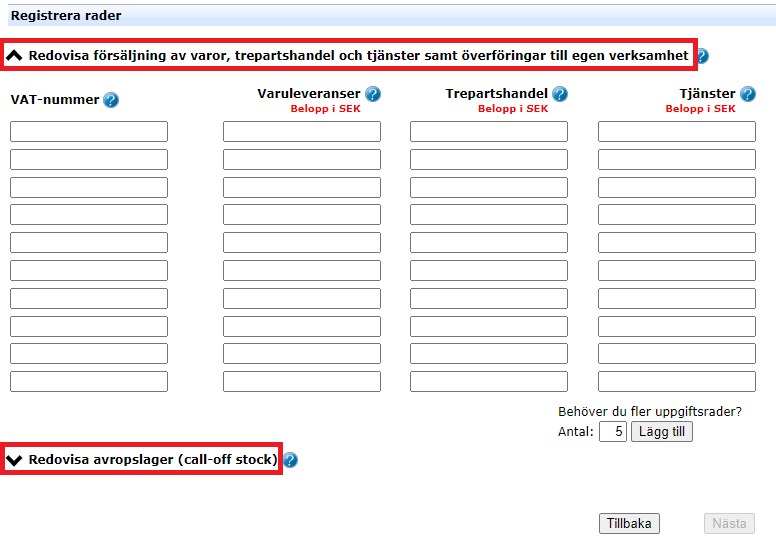

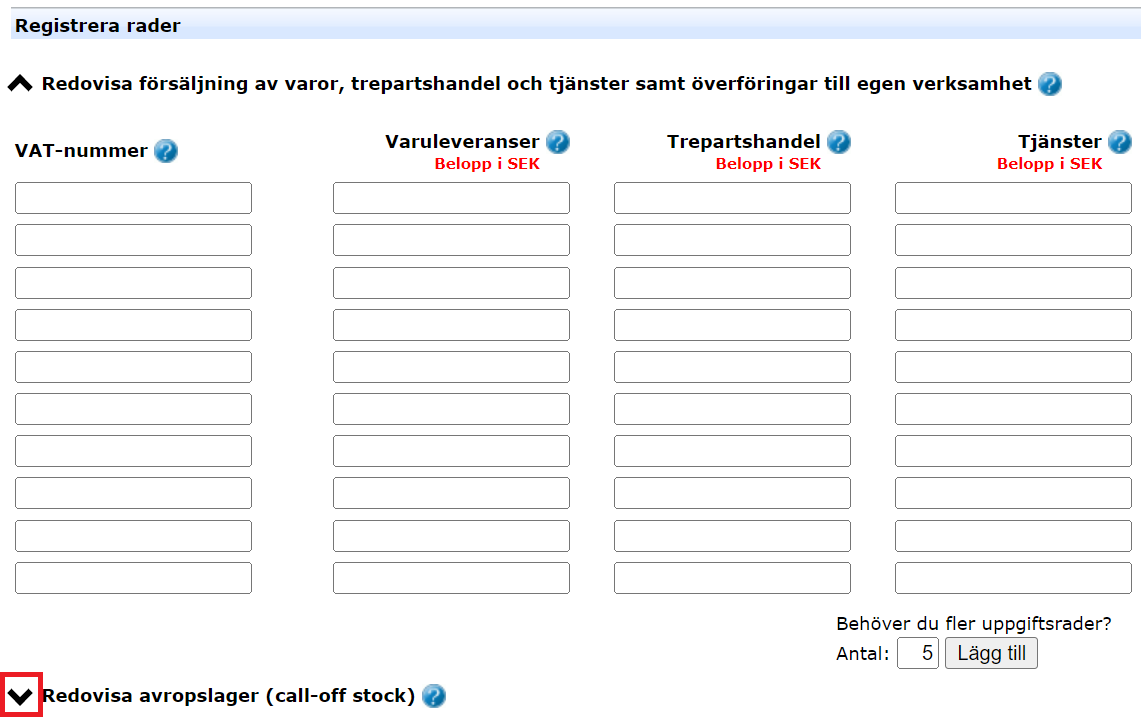

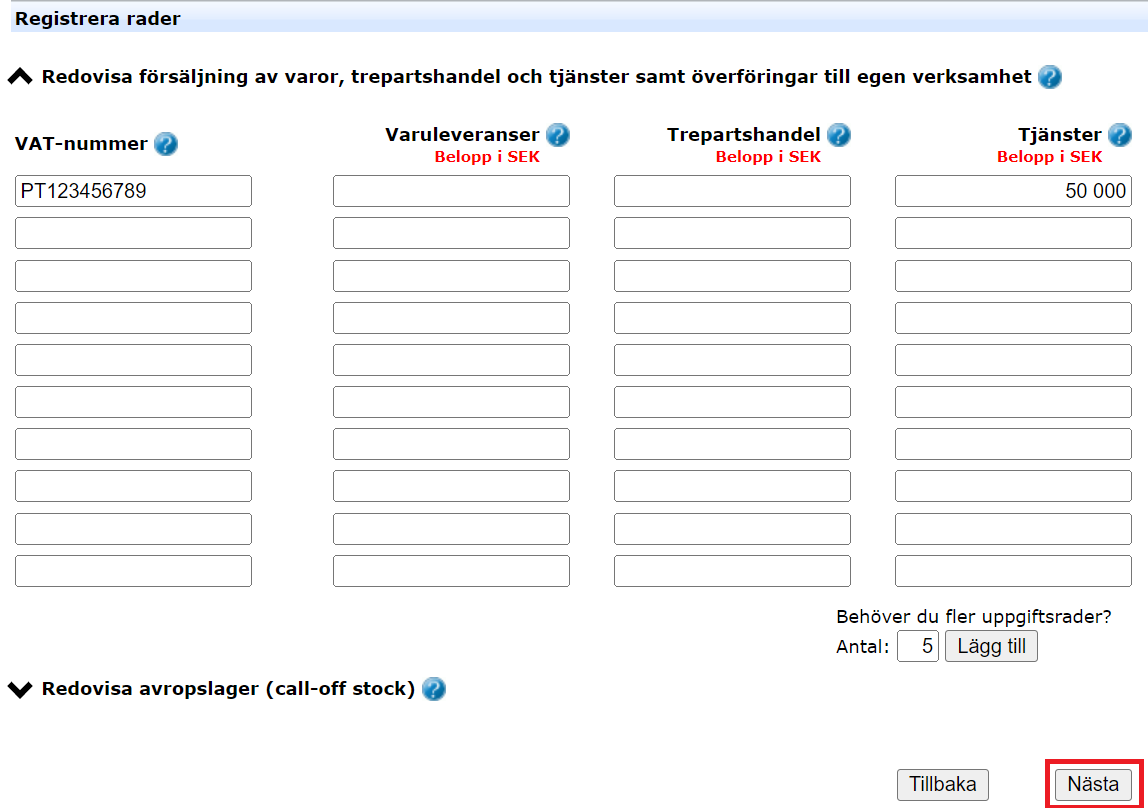

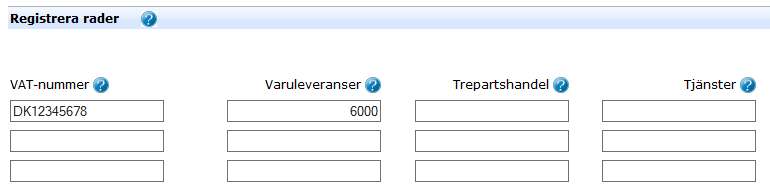

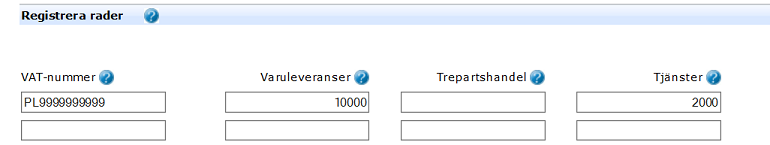

4.3 Register rows (Registrera rader)

Here you fill in information about the business’s sales during the period. There are two sections:

- One for reporting sales of goods, triangular trade and services and transfers to own business (Redovisa försäljning av varor, trepartshandel och tjänster samt överföringar till egen verksamhet)

- One for reporting transfers to call-off stock (Redovisa avropslager (call-off stock))

4.3.1 Register rows for sales of goods, triangular trade and services and transfers to own business (Redovisa försäljning av varor, trepartshandel och tjänster samt överföringar till egen verksamhet)

For reporting sales of goods, triangular trade and services and transfers to own business there are four columns in each row:

- The buyer’s or recipient’s VAT number (VAT-nummer)

- The value of supply of goods per buyer or recipient (Varuleveranser)

- The value of triangular trade per buyer or recipient (Trepartshandel)

- The value of services per buyer or recipient (Tjänster)

4.3.1.1 VAT number (VAT-nummer)

The buyer’s or recipient’s VAT number starts with a country code (two letters) followed by up to 12 characters. Valid characters are the numerals 0–9 and the letters A–Z. Don’t include any hyphens, full stops or spaces. A Swedish VAT number cannot be included in the EC Sales List. In the event of transfers to your own business you have to state your own VAT registration number in the other EU country.

The VAT number must contain a valid country code for another EU country. If the country code is invalid or does not apply to any of the other EU countries you will get a message that the country code is invalid (“Du har angivit felaktig landskod”). You have to correct the country code before you can go to the next step. Check valid country codes (the first two letters in the VAT registration number) in the table containing VAT registration numbers (VAT numbers) in EU member states.

Note that there may be requirements for you to show that the buyer was registered for VAT in the other EU country. You should therefore have checked beforehand that the buyer is registered for VAT in their home country. You can check the number on the European Commission’s website. If the VAT registration number is not valid when the sale occurs, you should contact the buyer.

State the total value for each buyer or recipient. A VAT number can only feature once in each EC Sales Listt. Add up the amounts and report the total on the same row for the VAT number concerned. If the same VAT number is specified on more than one row you will get a message that you stated the same VAT number in more than one row (“Du har angivit samma VAT-nummer på flera rader”). You have to correct the duplicated rows before you can go to the next step.

4.3.1.2 Supply of goods (Varuleveranser)

For every buyer or goods recipient in another EU country, state the total value of:

- The sale of goods (invoiced amounts), including all amounts that were required by the customer. The amounts must not include any advance payments for these goods

- Corresponding credit invoices issued during the period covered by the EC Sales List

- The value of goods transferred from your business activity in Sweden to your own business activity in another EU country.

It is important that you state the total value of the supply of goods for each buyer. Each VAT number may therefore only occur once in the EC Sales List.

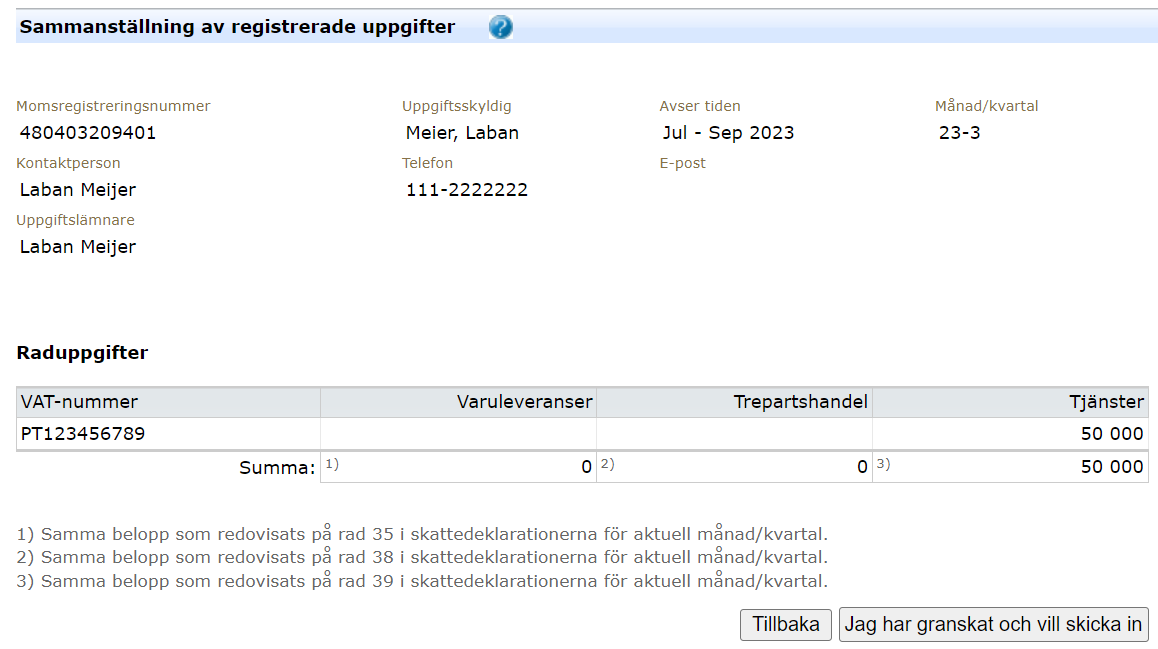

The total value of the supply of goods should normally match the amount you report as “Sales of goods to another EU country” in box 35 of your VAT return for the same period.

The value must be stated in SEK (without öre: hundredths of 1 SEK). Specify amounts less than SEK 0 with a clear minus sign (-) before the amount. This situation may occur if you have issued credit invoices to a specific buyer for a higher amount than that of your original sale to the buyer.

4.3.1.2.1 Exceptions for certain transfers of goods

You do not have to provide information about transfers of goods for the following kinds in an EC Sales List:

- When goods are intended to be sold on board a ship, aircraft or train during its journey from one EU country to another.

- When work is to be carried out on transferred goods in another EU country, after which the goods will be returned to the business in Sweden that first transferred them (the customer needs to account for VAT in Sweden for the service carried out)

- When goods are to be used temporarily in the other EU country in connection with the sale of a service, or for a maximum of two years.

- When goods are transferred for sale in another EU country and are regarded there as VAT exempt sales to another EU country, or exports. In order for this condition to be met, the buyer must be known at the time of the transfer.

- When goods are transported to another EU country and the Swedish seller has to pay VAT in that EU country under the rules on distance sales. In this case, the Swedish seller must register for VAT in the other EU country.

- When goods are delivered in another EU country for assembly or installation.

- When gas, electricity, heating or cooling is transferred via a distribution network to a fixed establishment in another EU country.

4.3.1.3 Triangular trade (Trepartshandel)

State here the amount you invoiced your buyer as an intermediary in triangular trade. You have to state the total value per buyer.

The total value of triangular trade has to match what you report as “Sale of goods by middleman in triangular trade” in box 38 of the VAT return for the same period.

The value must be stated in SEK (without öre: hundredths of 1 SEK). Specify amounts less than SEK 0 with a clear minus sign (-) before the amount. This situation may occur if you have issued credit invoices to a specific buyer for a higher amount than that of your original sale to the buyer.

4.3.1.4 Services (Tjänster)

This is where you report the value of services for which the buyer has stated their VAT number and for which, under the main rule, they have to pay VAT. For each buyer in another EU country, state the total value of:

- The sale of services (invoiced amounts), including all amounts that were required by the customer. Include in the amounts any advance payments for these services

- Corresponding credit invoices issued during the period covered by the recapitulative statement

The total value of the services should normally match the amount you report as “Sales of services to a trader in another EU country under the main rule” in box 39 of your VAT return for the same period.

The value must be stated in SEK (without öre: hundredths of 1 SEK). Specify amounts less than SEK 0 with a clear minus sign (-) before the amount. This situation may occur if you have issued credit invoices to a specific buyer for a higher amount than that of your original sale to the buyer.

Note that if you have sold services to companies in Northern Ireland, you cannot report this in the EC Sales List. Northern Ireland is a part of the United Kingdom, and thus outside the EU as a result of Brexit. There is an agreement between the EU and the United Kingdom to the effect that the rules of intra-Union sales be applied for sales of goods – this does not, however, apply for the sale of services.

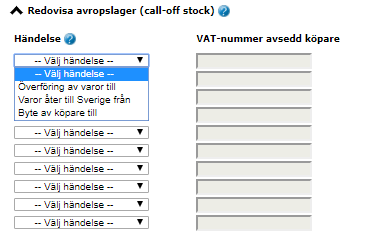

4.3.2 Reporting call-off stock (Redovisa avropslager (call-off stock))

Under rules in force since 1 January 2020, can business’s that make transfers of goods to what is known as call-off stock for identified buyers choose to apply a simplified reporting method. If you choose to apply the new rules you have to report your transfers, as well as certain changes, in this section.

You access the section for reporting call-off stock by clicking the arrow to the left of the heading “Redovisa avropslager (call-off stock)”.

Under this section you provide information regarding different events (Händelse) and VAT number for intended buyer (VAT-nummer avsedd köpare).

4.3.2.1 Events linked to call-off stocks

In the column headed "Händelse" (Event), on the far left, you have to select which type of event you are going to report. When you click the arrow on the right a drop-down menu is shown with the various options.

You can select:

- Transfer of goods to (Överföring av varor till)

- Goods returned to Sweden from (Varor åter till Sverige från)

- Change of buyer to (Byte av köpare till)

4.3.2.1.1 Transfer of goods to (Överföring av varor till)

Select this event to report transfers of goods to call-off stock in other EU countries for previously identified buyers. Under "VAT-nummer avsedd köpare" (VAT number of intended buyer), you state the VAT number of the buyer with whom you have an agreement about purchasing the goods.

4.3.2.1.2 Goods returned to Sweden from (Varor åter till Sverige från)

If goods which you reported in a previous EC Sales List as transferred to call-off stock are returned to Sweden, you have to report this by selecting the event “Varor tillbaka till Sverige från” (Goods returned to Sweden from). Under "VAT-nummer avsedd köpare" (VAT number of intended buyer) you state the VAT number of the buyer you previously reported as the intended buyer of the goods.

Note that you have to report when only a part of the goods is returned as well as when all of them are.

4.3.2.1.3 Change of buyer to (Byte av köpare till)

If a change occurs to the effect that a buyer you previously reported as the intended buyer of goods from your call-off stock is replaced with another buyer, you have to report this by selecting the event "Byte av köpare till" (Change of buyer to). When you select this option a new column headed "VAT-nummer tidigare köpare" (VAT number of previous buyer) is shown. State the VAT number of the previous buyer in this column, and the VAT number of the new buyer in the column "VAT-nummer avsedd köpare" (VAT number of intended buyer).

Note that you have to report when the change concerns only a part of the goods as well as when it concerns all of them.

4.4 Go to the next step or go back

When you have filled in the information you need in the EC Sales List, click on the button “Nästa” (Next) to get to the next step. If you want to go back to the previous step where you choose period and state contact details, click “Tillbaka” (Back).

4.5 Summary (Sammanställning av registrerade uppgifter)

A summary of the information you intend to submit to the Swedish Tax Agency is shown here.

4.5.1 The information is formally correct

If the information in the EC Sales List that you submit is formally correct, it will be sent to whichever EU country or countries it concerns. The receiving country will then check that the specified VAT numbers are registered and active. The receiving country will report back to the Swedish Tax Agency if there are any errors. If there are errors, the Swedish Tax Agency will send you a query about incorrectly reported information. The query includes a request that you correct the incorrect VAT number or show in some other way that conditions were in place for a VAT-exempt delivery. Such queries, which may be one or several, will be sent after some time has passed, and may be sent on several different occasions.

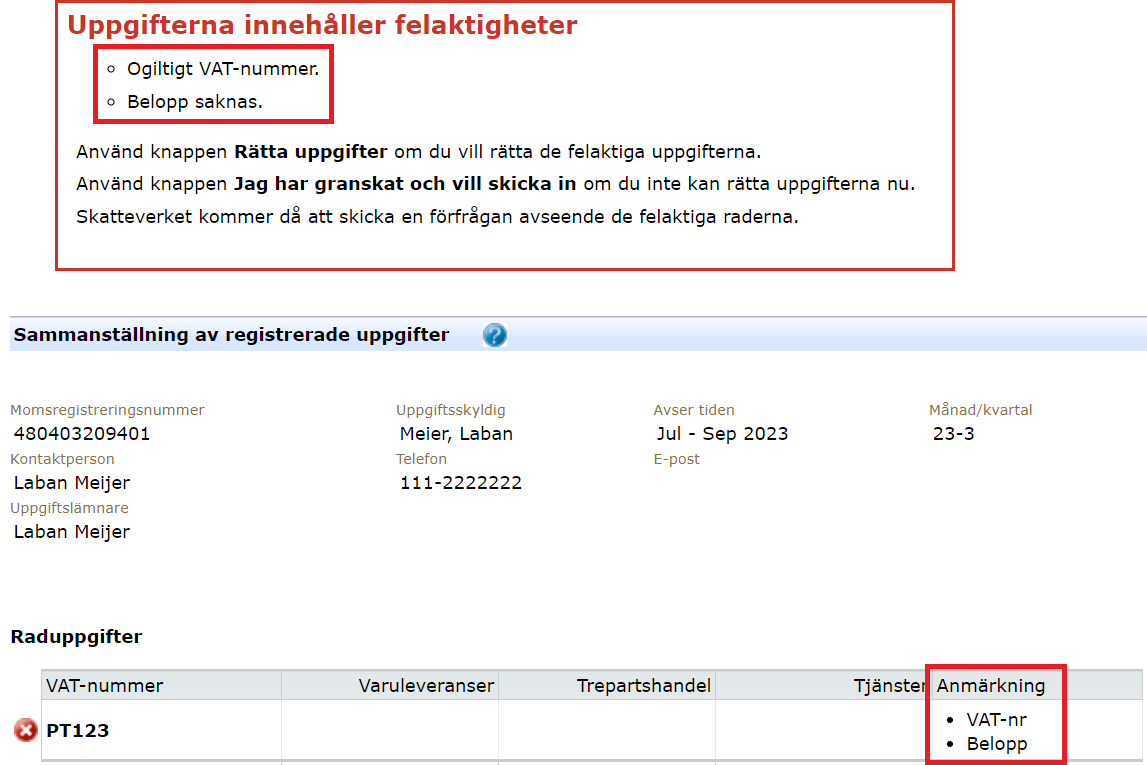

4.5.2 The information contains errors

If the information contains errors, these will be highlighted in the column “Anmärkningar” (Notes).

The following notes may be shown:

- VAT-nr (VAT number): Ogiltigt VAT-nummer (Invalid VAT number) – the wrong number of characters, or the wrong control digits aside from the country code. Check what a valid VAT number looks like in the table containing VAT registration numbers (VAT numbers) in EU member states. If you correct a VAT number you can check that the corrected number is valid on the European Commission’s website.

Table containing VAT registration numbers (VAT numbers) in EU member states (in Swedish)

Check VAT registration number (European Commission’s website) External link.

External link. - Belopp (Amount): Belopp saknas (Amount missing) – information about the amount is missing in all three columns. Fill in the amount for total value per buyer or recipient in the column for goods deliveries, triangular trade or services. The value must be in SEK (without öre: hundredths of SEK 1). Specify amounts less than SEK 0 with a clear minus sign (-) before the amount.

Rows containing errors should be corrected before being submitted to the Swedish Tax Agency. Rows containing invalid VAT numbers and with amounts missing can be submitted anyway. Click the button “Jag har granskat och vill skicka in” (I have reviewed the information and want to submit it). The Swedish Tax Agency will then send a query to the business with a request to check and correct the errors.

4.6 Receipt

You will receive a receipt for the submitted information in the e-service. The receipt will show the following information:

- Date and time when the information was submitted (Datum)

- What type of e-service was used (E-tjänst – Periodisk sammanställning)

- The VAT registration number and name of the business responsible for providing information in EC Sales Lists (Momsregistreringsnummer and Uppgiftsskyldig)

- The name of the person the Swedish Tax Agency can contact in the event of queries and that person’s telephone number and email address (Kontaktperson, Telefon and E-post)

- The name of the person who logged in and submitted the information (Uppgiftslämnare)

- Receipt number (Kvittensnummer)

- Information about how many rows were submitted and how many of these rows contain errors

You can save the receipt on your own computer by clicking the button “Spara kvittens” (Save receipt). If you want to print out the receipt, click the button “Skriv ut” (Print). Below the receipt are links to view a detailed receipt (Detaljerad kvittens), change business (Byt företag, and go back to the main menu (Till huvudmeny). If you click the link “Detaljerad kvittens” (Detailed receipt) you will also be shown all the rows you reported.

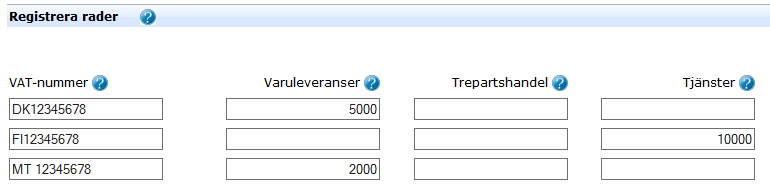

4.7 Make changes to an already submitted EC Sales List

To make changes to an already submitted EC Sales List, submit a new one. Examples of changes include:

- Changing an amount

- Changing a buyer (VAT number)

- Adding another sale

- Removing a reported sale

- Correcting incorrect information before you have received a query from the Swedish Tax Agency

When you make a change to an already submitted EC Sales List, you submit a new EC Sales List but only fill in the information that you are changing. For example, you first submit an EC Sales List and report supply of goods to a Danish business of SEK 5 000, supply of services to a Finnish business of SEK 10 000 and supply of goods to a Maltese business of SEK 2 000.

You then discover that the value of the sale to the Danish business was not SEK 5,000 but SEK 6,000. You then have to submit a correction, by leaving a new EC Sales List for the same period, where you change the former amount reported for supply of goods to the Danish business to SEK 6 000.

If you have received a query from the Swedish Tax Agency and want to submit corrected information via the e-service, you instead select the option “Svara på förfrågan” (Respond to a query) in the main menu.

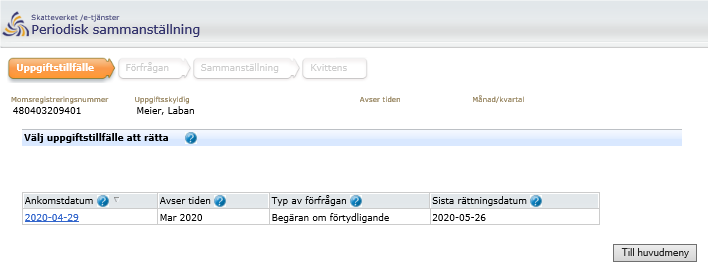

5. Respond to a query (Svara på förfrågan)

When an EC Sales List is received, the Swedish Tax Agency checks that the reported information meets certain formal requirements, e.g. that the foreign VAT registration numbers reported are formally correct. If the EC Sales List contains any formal errors you will be sent a query with a clarification request. A formal error might be that the same buyer is reported several times, that amounts are missing, or that a VAT number is not entered in the correct format.

If the information in the EC Sales List is formally correct it is forwarded to the relevant EU country. The receiving country will check that the included VAT numbers are registered and active, and will report back to the Swedish Tax Agency if anything is incorrect. If it is, the Swedish Tax Agency will send you a query regarding incorrectly reported information. The query will contain a request that you correct the incorrect VAT number or show in some other way that conditions were in place for a VAT-exempt delivery. Such queries, which may be one or several, will only be sent after some time has passed, and may be sent on several different occasions.

If you have received a query, you have to use the menu option Respond to a query (Svara på förfrågan) to submit corrected information.

This menu option can only be selected if there is at least one query to respond to and you are authorised to use the service. You can use the service if you selected any of the following:

- Your own sole trader business

- A company for which you are an authorised signatory or the CEO

- A company that has registered you as its representative for responding to queries

If the service indicates that you lack authorisation, this is because the Swedish Tax Agency has no information about your authorisation to represent the business. To appoint a representative to respond to queries, use the e-service “Representatives and authorisation” (Ombud och behörigheter), or the form SKV 4774. If there are several authorised signatories who sign jointly for the business, you must appoint a representative to respond to queries.

Under the menu option Respond to a query (Svara på förfrågan) you will find a list of all EC Sales Lists that the business has received a query about from the Swedish Tax Agency. There may be several queries for the same period. The list will show you the date on which the queried EC Sales List was received by the Swedish Tax Agency (Ankomstdatum), the period that the EC Sales List covers (Avser tiden), what type of query the business received (Typ av förfrågan) – Begäran om förtydligande (Clarification request) or “Felrapporterade uppgifter” (Incorrectly reported information) and the deadline for the correction (Sista rättningsdatum).

Once the deadline for the correction has passed, the query will no longer be shown here. Instead, you will have to submit a response using the form posted to the business’s address. If you have not received a form, contact our tax information service (“Skatteupplysningen”) on 0771 567 567 (calling from Sweden) or +46 8 564 851 60 (calling from outside Sweden).

If you want to make changes to an EC Sales List but have not received a query from the Swedish Tax Agency, select the menu option “Submit an EC Sales List” (Lämna periodisk sammanställning).

5.1 Deadline for corrections

You will find information about the deadline for submitting corrections (Sista rättningsdatum) in the e-service. You will normally have around four weeks in which to respond. If you need longer than that, contact our tax information service (“Skatteupplysningen”) on 0771 567 567 (calling from Sweden) or +46 8 564 851 60 (calling from outside Sweden). Once the deadline for corrections has passed, the query will no longer be shown here. Instead you have to provide your response on the query form sent to the business by post. If the query was sent to a digital mailbox, you have to request a copy of the query in order to provide your response on paper. Note that if you choose to provide your response on paper instead of using the e-service, your response has to be received by the Swedish Tax Agency about seven days earlier than the e-service deadline.

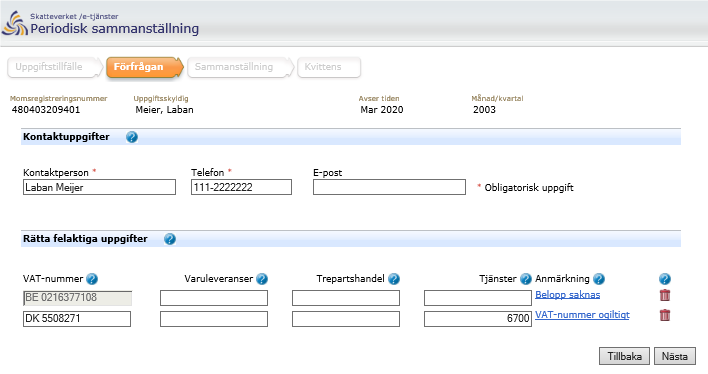

5.2 Rows to correct and contact details

By clicking on an arrival date (Ankomstdatum) in the list you can correct that particular item of information. If there are several queries for the same period, address each query separately. Then you will see the errors in the EC Sales List that you are expected to correct (Rätta felaktiga uppgifter). You can also change contact details (Kontaktuppgifter).

5.2.1 Contact details (Kontaktuppgifter)

State here the contact details of the person that the Swedish Tax Agency should contact in the event of any questions. A contact person and a telephone number are required information. An email address is voluntary.

Contact details that were provided in connection with submitting the EC Sales List in the e-service are shown here (if the EC Sales List was submitted by some other means, the text fields will be empty). The contact details can be changed by clicking the appropriate field and typing directly into it:

- Kontaktperson (Contact person)

- Telefon (Telephone)

- E-post (E-mail address)

5.2.2 Rows to correct

Here you will see the rows in the EC Sales List that contain errors. You will see the VAT number that was reported in the EC Sales List and the amounts reported for the VAT number on the same row:

- Supply of goods (Varuleveranser)

- Triangular trade (Trepartshandel)

- Services (Tjänster)

You can correct one or several rows. You will only have fully responded to the query once all rows with errors are corrected.

5.2.2.1 Note (Anmärkning)

This specifies the errors in the row in question. A “Clarification request” (Begäran om förtydligande) can include the following notes:

- Invalid country code (Landskod ogiltig) – the country code is invalid or does not apply to any of the other EU countries

- Invalid VAT number (VAT-nummer ogiltigt) – the wrong number of characters, or the wrong control digits aside from the country code

- Amount missing (Belopp saknas) – information about the amount is missing in all three columns

- Duplication (Dubblett) – the same VAT number is specified on more than one row

- Services amount (Tjänstebelopp) – sales of services to businesses in Northern Ireland

A query regarding “Incorrectly reported information” (Felrapporterade uppgifter) can include the following notes:

- Unknown VAT number (VAT-nummer finns ej) – No business is registered under the VAT number provided

- Invalid VAT number (VAT-nummer ogiltigt) – the VAT number is formally invalid

- Inactive VAT number (VAT-nummer ej aktivt) – the VAT number concerns a business that was not registered for VAT during the period that the information covers

Below is a description of how to correct the information each note refers to, and what you should bear in mind.

5.2.2.2 Invalid country code (Landskod ogiltig)

The country code does not refer to any of the EU member states, or is incorrect. You correct it by replacing the incorrect country code with the correct one.

If you want to remove the entire row, click on the wastebasket icon on the far right. You can undo the removal by clicking on the arrow that appears after you have clicked the wastebasket icon.

Valid country codes are listed in the table VAT registration numbers in EU countries.

Note that Swedish VAT registration numbers (SE) should not be included in the EC Sales List, and that Norway and Switzerland are not EU member states.

The United Kingdom is no longer an EU member state either. Starting from the period January 2021/first quarter of 2021, sales to companies in the United Kingdom (with VAT numbers beginning with the letters GB) should not therefore be reported in EC Sales List. Supply of goods to businesses in Northern Ireland, however, must be reported in EC Sales Lists. Businesses in Northern Ireland have been assigned new VAT numbers beginning with the letters XI.

5.2.2.3 Invalid VAT number (VAT-nummer ogiltigt) in a ”Clarification request” (Begäran om förtydligande))

The VAT number reported is formally incorrect and must be corrected. You correct it by replacing the incorrect VAT number with the correct one.

The VAT number must refer to one of the EU member states (except SE), and it also has to contain the right number of characters and be correctly composed.

VAT numbers begin with a country code (two letters), followed by up to 12 characters. Valid characters are the numerals 0–9 and the letters A–Z. Do not include any hyphens, full stops or spaces.

You can check what a valid VAT number should look like in the table VAT registration numbers in EU countries.

Swedish VAT registration numbers are not to be reported in the EC Sales List. Note that Norway, Switzerland and the United Kingdom are not EU member states.

You can check if the VAT number is valid on the European Commission’s website.

5.2.2.4 Amount missing (Belopp saknas)

The note “Amount missing” means that an amount is missing from the supply of goods, triangular trade and services rows, or that it is impossible to read the reported amounts. Correct them by filling in the amount on the relevant row.

Remember to report the total value of supply of goods, triangular trade and services for each buyer on the relevant row. A VAT number may only occur once in the EC Sales List.

The value must be stated in SEK (without öre: hundredths of 1 SEK). Specify amounts less than SEK 0 with a minus sign (-) before the amount. This situation may occur if you have issued credit invoices to a specific buyer for a higher amount than that of your original sale to the buyer.

Keep in mind that the amounts have to match the amounts reported by the business in its VAT return for the same period.

5.2.2.5 Duplication (Dubblett)

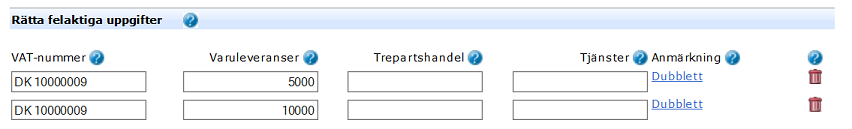

The same VAT number was reported several times in the EC Sales List. Each VAT number may only occur once in the EC Sales List.

Correct this by adding up the amounts and filling in the total value on one of the rows. Write “0” on the other rows with same VAT number, or delete those rows by clicking the wastebasket icon.

5.2.2.6 Services amount (Tjänstebelopp)

In the event of sales to businesses in Northern Ireland, supply of goods have to be reported in an EC Sales List, but not sales of services. If the reported row needs to be removed from the EC Sales List, the easiest way to do so is to click on the wastebasket icon to the right of the row.

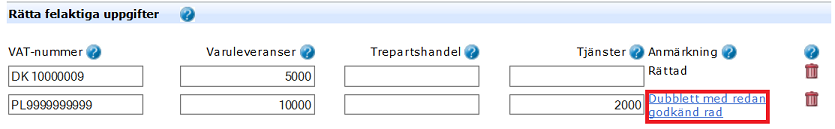

5.2.2.7 Duplication of a previously approved row (Dubblett med redan godkänd rad)

If you change a VAT number to another one which has already been registered and approved, a new error occurs and this note is shown. This error will remain until you correct it.

If you want to change an incorrect VAT number to one which has already been reported and approved, do the following:

- Remove the incorrect VAT number by clicking the wastebasket icon, and then “Nästa” (Next). Make any other corrections necessary before clicking “Next”.

- Submit a new EC Sales List and report the VAT number and the correct amount.

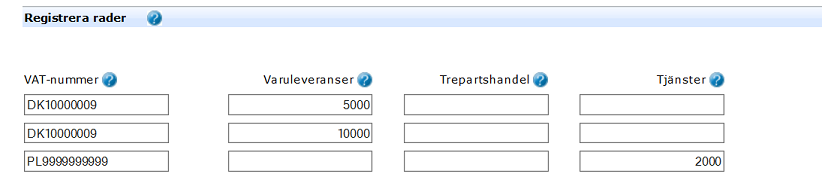

For example, you submit an EC Sales List and report supply of goods to the same Danish business divided in two rows, one with the amount of SEK 5 000 and the other one SEK 10 000. You also report supply of services to a Polish business of SEK 2 000.

After submitting the EC Sales List the Swedish tax agency sends you a query with the note “Duplication” (Dubblett) for the two rows that you submitted for the same Danish business.

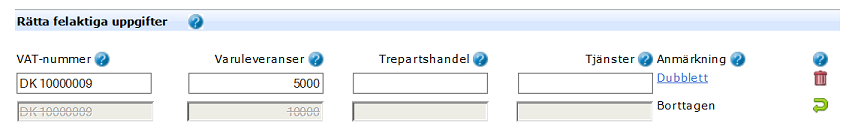

When you are going to correct the error with the note ”Duplication” (Dubblett) you discover that the reported supply of goods to the Danish buyer of the amount SEK 10 000 instead concerned the Polish buyer (which has already been registered and approved when submitting the EC Sales List). You correct this by clicking the wastebasket icon by the row with the incorrect information. This will delete the row and the note is changed to “Removed” (Borttagen). If you want to undo the removal, just click on the green arrow to the right of the row.

After you have deleted the row you need to submit a new EC Sales List for the same period where you report the VAT number of the Polish business and the amount of SEK 10 000 in the column for supply of goods.

5.2.2.8 Correction not approved (Ej godkänd rättning)

If the note “Ej godkänd rättning” (Correction not approved) appears your correction could not be accepted. This could be because your correction has left the original error in place. Check your corrected information to see if it needs to be changed. If you maintain that your corrected information is correct, you will be asked instead to make the correction on the query form sent to your home address, as the e-service is unable to handle your correction.

5.2.2.9 Unknown VAT number (VAT-nummer finns ej)

There is no business registered with the reported VAT number. You correct this by deleting the incorrect VAT number and then filling in the correct number on the same row.

If the VAT number is correct and you therefore should not change it to another number, you will be asked to contact the Tax Information Service for help on 0771 567 567 (calling from Sweden) or +46 8 564 851 60 (calling from outside Sweden).

5.2.2.10 Invalid VAT number (VAT-nummer ogiltigt) in a “Incorrectly reported information” (Felrapporterade uppgifter))

The reported VAT number is not formally correct. Usually this kind of error is discovered as soon as you submit the EC Sales List, and you receive a clarification request (Begäran om förtydligande). Sometimes, the error is only discovered once the information has been forwarded to the other EU country, and you receive a different query – “Incorrectly reported information”. You correct this in the same way as when you are shown a note in a clarification request. The only difference is that the amounts cannot be changed in such cases.

5.2.2.11 Inactive VAT number (VAT-nummer ej aktivt)

The reported VAT number concerns a business that was not registered for VAT during the period that the information covers. Correct this by replacing the incorrect VAT number with the correct one.

If the reported number is correct and you therefore should not change it to another number, you will be asked to contact the Tax Information Service for help on 0771 567 567 (calling from Sweden) or +46 8 564 851 60 (calling from outside Sweden).

5.2.2.12 Wastebasket icon

If you want to remove a row you can do so by clicking the wastebasket icon. The row will then be greyed out and have the note “Removed” (Borttagen). You can undo the removal by clicking the green arrow that appears in place of the wastebasket icon when you have removed a row.

5.2.3 Summary

This shows a summary of the information you have filled in and are going to submit to the Swedish Tax Agency.

If you want to change anything, click the “Tillbaka” (Back) button. If everything is correct, you submit the information by clicking “Jag har granskat och vill skicka in” (I have reviewed the information and want to submit it).

5.2.4 Receipt

You will be sent a receipt for the submitted information. The receipt will show the following information:

- Date and time when the information was submitted (Datum)

- What type of e-service was used (E-tjänst – Periodisk sammanställning)

- The VAT registration number and name of the business responsible for providing information in EC Sales Lists (Momsregistreringsnummer and Uppgiftsskyldig)

- The name of the person the Swedish Tax Agency can contact in the event of queries and that person’s telephone number and email address (Kontaktperson, Telefon and E-post)

- The name of the person who logged in and submitted the information (Uppgiftslämnare)

- Receipt number (Kvittensnummer)

- Information about how many rows were submitted and how many of these rows, if any, remain to be corrected

Below the receipt are links to view a detailed receipt (Detaljerad kvittens), change business (Byt företag), and go back to the main menu (Till huvudmeny).

If you click the link “Detaljerad kvittens” (Detailed receipt) you will also be shown all the rows you have corrected.

6. View receipts (Se kvittenser)

In the e-service select the option "Se kvittenser" (View receipts) to see receipts for earlier submitted EC Sales Lists and responded queries (depending on your authorization).

If you selected a business for which the Swedish Tax Agency has information that you are authorised to represent, you will see the following:

- Receipts for all EC Sales Lists submitted over the past 12 months

- Receipts for all queries responded to via the e-service over the past 12 months. If partial corrections have been made, these will be shown separately

Once you have opened a receipt you can select to see all the information that was reported in the EC Sales List/response to the query by clicking "Detaljerad kvittens" (Detailed receipt) at the bottom left.

If you selected a business for which the Swedish Tax Agency does not have information that you are an authorised representative, you will see the following:

- Receipts for all EC Sales Lists recapitulative statements you have submitted using your eID over the past 12 months

In this case “Detailed receipt” (Detaljerad kvittens) cannot be selected, which means that you cannot see what row-by-row information was reported in the EC Sales List.

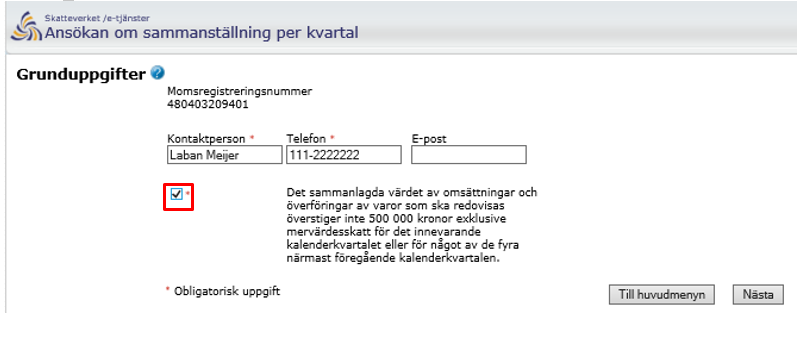

7. Application for EC Sales List quarterly (Ansök om sammanställning per kvartal)

There are two different reporting intervals for EC Sales Lists:

- Monthly – applies if you are reporting sales and/or transfers of goods

- Quarterly – applies if you are reporting sales of services

If you are reporting both sales/transfers of goods and service sales you have to submit a monthly EC Sales List.

If you are reporting sales/transfers of goods and therefore have to report on a monthly basis, you can apply for quarterly reporting instead. In order for you to be allowed to report on a quarterly basis, the sales and transfers to report in an EC Sales List must not exceed SEK 500,000, excluding VAT, during the current quarter as well as in the preceding four quarters.

In the e-service select the option "Ansök om sammanställning per kvartal" (Apply for EC Sales List quarterly) to make your application.

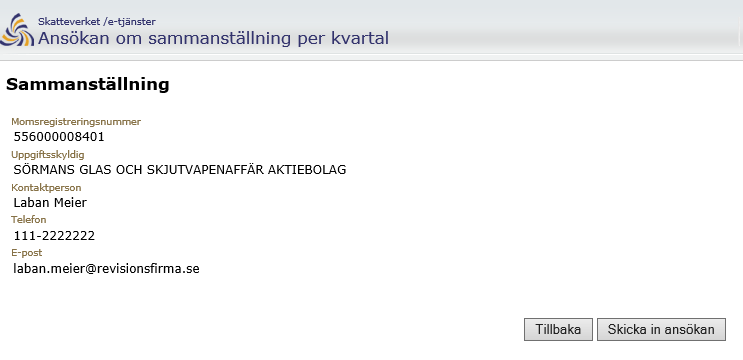

You will be taken to a page where you have to specify contact details and indicate whether the business fulfils the requirement for being granted quarterly reporting and then click “Nästa” (Next).

In the following step a summary of the information you intend to submit to the Swedish Tax Agency is shown. To submit your application click “Skicka in ansökan” (Submit application).

Read more about reporting on a monthly or quarterly basis on the web page about EC Sales List regarding goods and services.

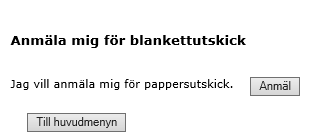

8. Register to receive paper forms, or opt out of receiving them (Anmäl mig för blankettutskick, or Avbeställa pappersblankett)

By selecting the option “Anmäl mig för blankettutskick” (Register to receive paper forms) you can register that you want the form EC Sales List (SKV 5740) sent to you by post prior to each reporting period.

When you click the “Anmäl” (Register) button, the Swedish Tax Agency will register that you want the paper form sent to you by post.

Since you only have to submit the form if you have anything to report, we will only send it to you prior to those periods we assume you will be submitting it for. We will send you the form if you have submitted an EC Sales List for VAT in any of the six previous months.

Please note that even if you receive the form, you only have to submit it if you have anything to report.

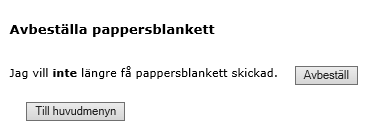

When you no longer wish to receive the paper form by post, you use the same option to deregister from receiving paper forms by clicking the “Avbeställ” (Deregister) button.

Note also that the forms sent by post do not include the form for reporting call-off stock: SKV 5739. This can be downloaded here.

9. Get a digital mailbox (Skaffa digital brevlåda)

If you have a digital mailbox, you will receive mail from the Swedish Tax Agency and other government agencies digitally instead of on paper. With a digital mailbox you always have access to your mail, and you receive it quickly, safely and in a more environmentally friendly way.

By selecting the option “Skaffa digital brevlåda” (Get a digital mailbox) in the e-service to be taken to a web page where you can read more about digital mail and register to get a digital mailbox.

Kontakta oss

Aktuellt

-

Nytt uppdrag att utreda AI-verkstad för offentlig sektor

Skatteverket och Försäkringskassan har fått ett nytt uppdrag från regeringen att...

-

Fel och brister inom skogs- och slaktnäringarna

Skatteverket har kontrollerat verksamheter inom skog och slakt. I omkring sex av...

-

Skatteverket leder nytt regeringsuppdrag

Skatteverket får ansvar för att samordna utvecklingen av digitala lösningar och ...