Other languages

- ...

- » Paying Taxes – Businesses

- » Preliminary income tax for businesses and associations

- » How to use our e-service Preliminary income tax

How to use our e-service Preliminary income tax

This is a user guide on how to use our e-service Preliminary income tax.

Log in to the e-service

Use our e-service Preliminary income tax (in Swedish: Preliminär inkomstdeklaration).

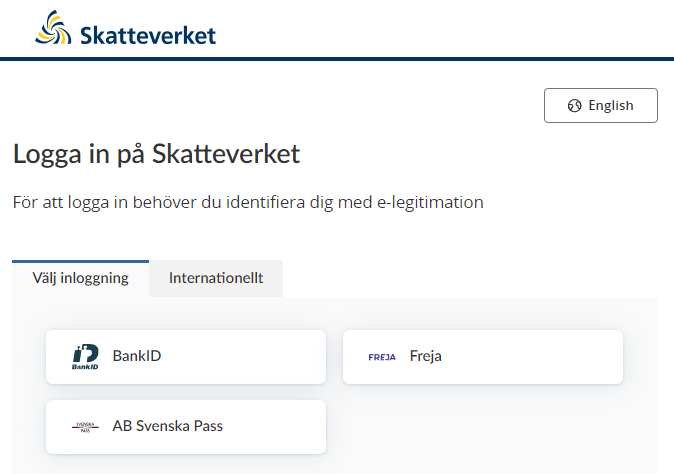

How to log in to the e-service

When you have selected the e-service you want to log in to, a login page will open. In the upper part of the view you can change the language to English by clicking the button ”English”. By choosing "International" you get more alternatives for eIDs you can use to log in to the e-service. Select the login mode that suits you best by clicking it, and then proceed to identify yourself.

“Läs om e-tjänst” (“About the e-service”) (page 1 of the service)

Landing page in the e-service containing general information.

About the e-service

Here you can find out about how to submit a preliminary income tax return. This page is always available for you to return to. Explanatory texts about the information to fill in are displayed if you hover your cursor over the “Help” icon and then click on it . You navigate within the e-service using the arrows/tabs at the top of each page, or the buttons at the bottom of each page.

At the very bottom of the footer are contact details for the Swedish Tax Agency, in case you have questions about how to fill in information, or need technical support.

Select tax return subject

You begin by selecting which tax return subject you want to register information for. If you are only authorised to file tax returns for yourself, you will be preselected as the tax return subject. If you are a tax return representative with authorisation to file tax returns for several different individuals or companies, you must select which one you are filing a tax return for.

The names of the person logged in and tax return subject are always visible at the top of the page.

As soon as you have selected the tax return subject, you can proceed to fill in your preliminary income tax return for the selected financial year. You can also view information about the tax return subject by clicking “Visa uppgifter om deklarationsobjektet” (“Show information about the tax return subject”).

Show information about the tax return subject

This shows you which tax return subject you have selected. If you have submitted preliminary income tax returns using this e-service before, you can view your receipts here. You can also view the most recent decisions on deducted preliminary tax for you. You can save or print receipts and decisions.

Select financial year

You always have to select which financial year you are going to submit a preliminary income tax return for. You can choose between the current, preceding or next financial year. When you have selected the financial year, you can proceed to register information or fetch a draft saved previously.

Register information

This is where you register information on which the calculation of your debited preliminary tax will be based. This page has several different tabs. You can register the information in any order you like. The information you enter is saved automatically while you are logged in to the e-service.

Save draft

You can save your registered information at any time using the “Spara utkast” (“Save draft”) button. The information is not available to the Swedish Tax Agency until you sign and submit your preliminary income tax return. You can save a draft for each financial year (current, preceding and next).

The draft is saved for 30 days, during which time you can fetch it under the tab “Välj beskattningsår” (“Select financial year”) and complete the preliminary income tax return. Once you have submitted the preliminary income tax return, the draft is deleted.

Review information and calculate tax

Once you have registered all the information, you review it on this page. You can also use the tax calculation tool to see how much preliminary tax you are due to pay based on the information you have provided. When you have reviewed the information, you can submit your preliminary income tax return.

Sign and submit

This page only becomes available once you have reviewed and approved the information. This is where you sign and submit your preliminary income tax return.

Show receipt

When you have signed and submitted your preliminary income tax return, you will receive a receipt for the information provided.

Move on to the next step in the service

Either by clicking “Select tax return subject”

Or by scrolling down the page and clicking the “Next” button.

“Välj deklarationsobjekt” (“Select tax return subject”) (page 2 of the service)

Here you select who you are representing.

Select here the individual/business you are going to file a return for. You have to select a tax return subject in order to move on to the next step of the e-service.

Example of selected tax return subject.

Move on to the next step

Either by clicking “Visa uppgifter om deklarationsobjektet” (“Show information about the tax return subject”).

Or by scrolling down the page and clicking “Nästa” (“Next”).

“Visa uppgifter om deklarationsobjekt” (“Show information about tax return subject”) (page 3 of the service)

Page 3 of the service show information about the tax return subject.

This is where you can view information about the selected tax return subject.

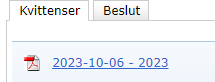

You can also view receipts for preliminary income tax returns you submitted earlier via the e-service. You can download these as pdfs.

To view decisions on debited preliminary tax for you, click the tab “Beslut” (“Decisions”). You can view a maximum of eight decisions (the most recent eight). These you can download to your computer as pdfs.

Move on to the next step

Either by clicking “Välj beskattningsår” (“Select financial year”).

Or by scrolling down the page and clicking the “Nästa” (“Next”) button.

“Välj beskattningsår” (“Select financial year”) (page 4 of the service)

On page 4 of the service, you select financial year.

Select the financial year you are submitting a preliminary income tax return for. If you want to fetch a draft you saved earlier, you can do so after selecting the financial year.

Once six months have passed after the end of the financial year, it is no longer possible to select the preceding financial year, whether you saved a draft or not.

When you fetch a draft, the information you saved earlier will be added to the tabs under “Registrera uppgifter” (“Register information”). If you then save the draft again, it will be kept for a further 30 days, during which time you will be able to fetch it again. Once you submit the preliminary income tax return, the draft is deleted.

Select financial year and move on to the next step

Either by clicking “Registrera uppgifter” (“Register information”).

Or by clicking the “Nästa” (“Next”) button.

“Registrera uppgifter” (“Register information”) (page 5 of the service) – Tab 1 “Näringsverksamhet” (“Business activity”)

On page 5 of the service you register information, tab 1 Business activity.

This is where you fill in information about your business activity. You always have to fill in an estimated profit. If you estimate that the activity will generate a loss, fill in “0”. Regardless of whether you made a profit or a loss, you need to specify certain information about matters which affect your business’ profit or loss.

You can use the calculation tool to work out your profit/loss. If you use the calculation tool, you can choose to transfer information to your preliminary income tax return. The Swedish Tax Agency will not be able to see the information you have entered into the calculation tool until you actually submit it on the page “Granska och skatteberäkna” (“Review and calculate tax”).

When you are finished with this tab, click “Nästa” (“Next”) at the bottom of the page, or the tab you want to open next in the menu above.

Register information, contd. (page 5 of the e-service) – Tab 2 “Anställning” (“Employment”)

On page 5 of the service you register information, tab 2 Employment.

This is where you enter income from employment that you have earned, or will earn, during the year. It is particularly important that you enter income from employment if you also have income from a business activity, so that the tax estimate will be correct and you will not be debited too much or too little. For any income already earned during the year, you also have to fill in the tax that your employer/payer deducted from your compensation.

If you want to claim deductions such as for travel to and from work, or other expenses, you can do so here. If you are a seaman, you also have to fill in the number of days you spent in short-sea shipping and deep-sea shipping.

Once you are finished with this tab, click “Nästa” (“Next”) at the bottom of the page, or the tab you want to open next in the menu above.

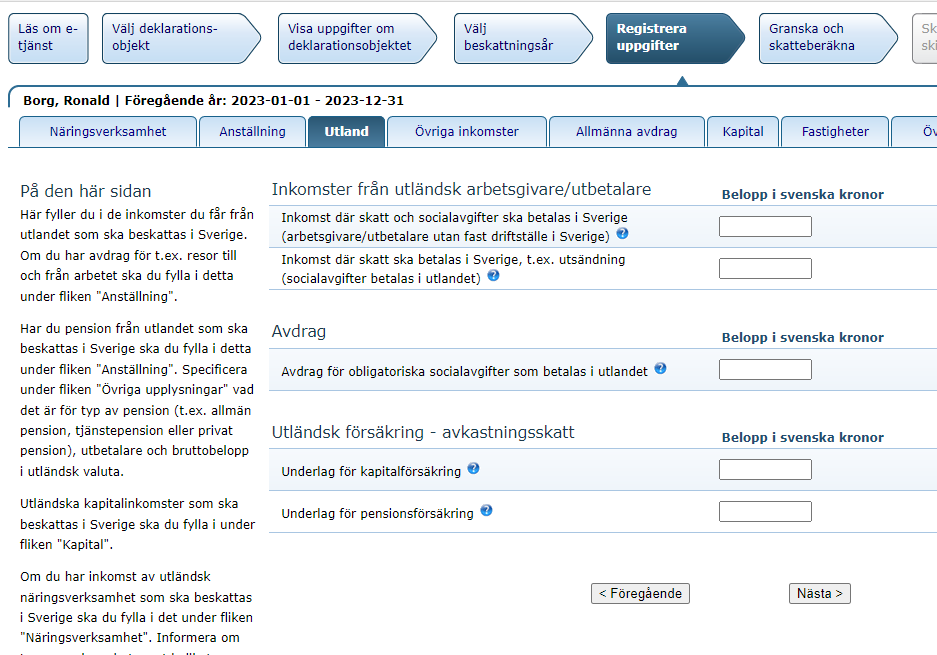

Register information contd. (page 5 of the e-service) – Tab 3 “Utland” (“Foreign countries”)

On page 5 of the service, Register information, tab 3 Foreign countries.

This is where you enter any income from abroad which is taxable in Sweden. If you have deductions, for example for travel to and from work, specify them under the tab “Anställning” (“Employment”).

If you have a pension from abroad which is taxable in Sweden, provide information this under the tab “Anställning” (“Employment”). Specify, under the tab “Övriga upplysningar” (“Other information”), what type of pension it is (e.g. public pension, occupational pension or private pension), the payer, and the gross amount in the foreign currency.

Capital income from abroad which is taxable in Sweden has to be entered under the tab “Kapital” (“Capital”).

If you have income from a foreign business activity which is taxable in Sweden, you have to fill that in under the tab “Näringsverksamhet” (“Business activity”). State what type of activity it is and in which country or countries it is carried out under the tab “Övriga upplysningar” (“Other information”).

If you want to claim a deduction for payment of foreign tax, you have to specify this and the amount under the tab “Övriga upplysningar” (“Other information”).

Once you are finished with this tab, click “Nästa” (“Next”) at the bottom of the page, or the tab you want to open next in the menu above.

Register information contd. (page 5 of the e-service) – Tab 4 “Övriga inkomster” (“Other income”)

On page 5 of the service, Register information, tab 4 Other income.

This is where you enter other income which is taxable as income from employment. State your estimated income for the whole year.

Once you are finished with this tab, click “Nästa” (“Next”) at the bottom of the page, or the tab you want to open next in the menu above.

Register information contd. (page 5 of the e-service) – Tab 5 “Allmänna avdrag” (“General deductions”)

On page 5 of the service, Register information, tab 5 General deductions.

This is where you fill in the social security contributions paid during the year under the EU regulation, etc. If you have filled in the deduction under “Utland” (“Foreign countries”), you cannot claim the same deduction here.

More information about the information you need to fill in is available by hovering your cursor over the question mark, and then click on it.

Register information contd. (page 5 of the e-service) – Tab 6 “Kapital” (“Capital”)

Page 5 of the service, Register information, tab 6 Capital.

This is where you declare income and deductions in the income category Capital. This includes positive and negative interest adjustments that you have reported in your business activity.

If you have interest income or interest expenses related to your business activity, they are not reported here.

Register information contd. (page 5 of the e-service) – Tab 7 “Fastigheter” (“Properties”)

On page 5 of the service, Register information, tab 7 Properties.

Property tax or property charges are calculated as a percentage of a base amount. The type of property in question determines how high the tax or charge is.

The base amount for property tax/charge shown is taken from the Real Property Register and is the assessed value on 31 December of the previous year for properties that you owned on 1 January. The base amount for residential houses can sometimes be limited to a maximum amount.

If you own several properties in the same category, all those properties are included in the base amount shown. If you think the base amount is incorrect, fill in the correct amount in the box by each property type.

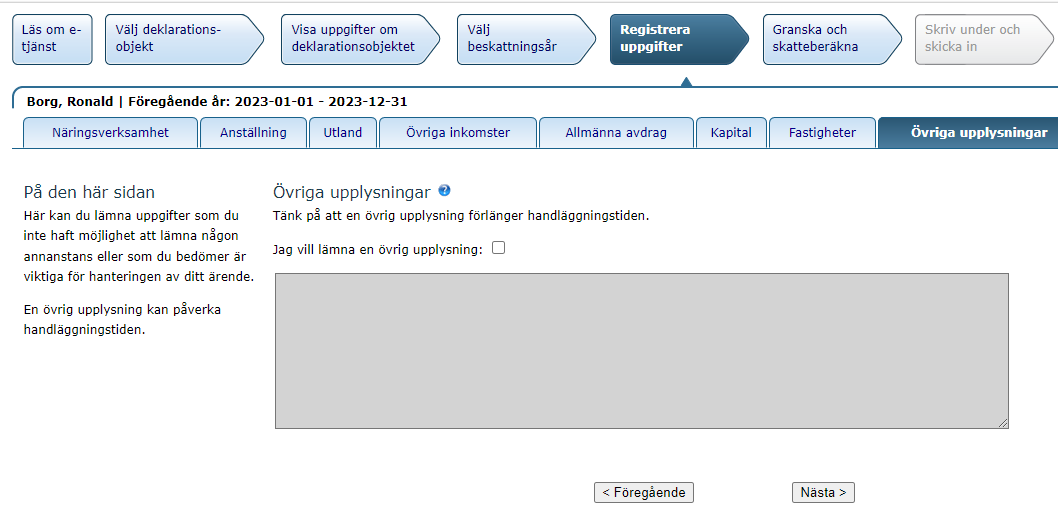

Register information contd. (page 5 of the e-service) – Tab 8 “Övriga upplysningar” (“Other information”)

On page 5 of the service, Register information, tab 8 Other information.

This is where you can provide information that you have not been able to provide anywhere else, or that you think is important for the processing of your matter.

The provision of other information may affect the time it takes to process your matter.

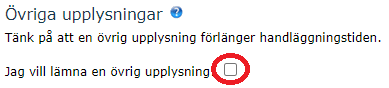

To enter information, click the box circled in the image below: “Jag vill lämna en övrig upplysning” (“I want to provide other information”)

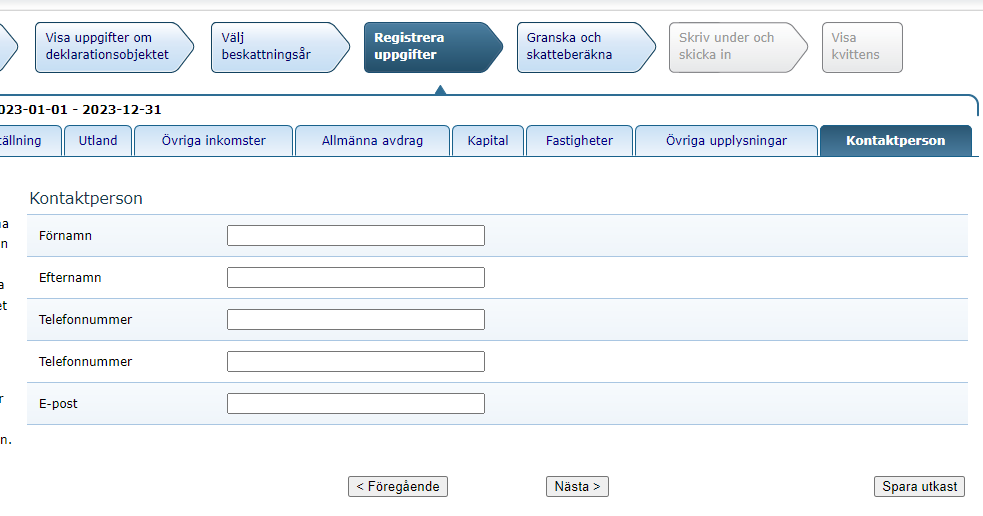

Register information contd. (page 5 of the e-service) – Tab 9 “Kontaktperson” (“Contact person”)

On page 5 of the service, Register information, tab 9 Contact person.

To make it easier for the Swedish Tax Agency to contact you in the event of any questions, you can provide current contact details here. If you instead want us to contact someone else by phone, you can also provide their name and phone number here.

Questions in writing from the Swedish Tax Agency are always sent to your address in the Population Register or to your special tax address if you have one. If you have a digital mailbox, we will send our questions there instead.

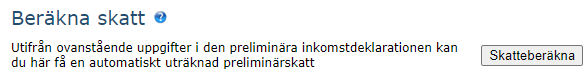

“Granska och skatteberäkna” (“Review, calculate tax, sign and submit”) (page 6 of the e-service)

On page 6 of the service, Review, calculate tax, sign and submit.

This tab shows you a compilation of all the information you have provided in the e-service. If you want to see all the fields in the service, click “Visa allt” (“Show all”). If you want to go back and change or add anything, click “Ändra” (“Change”) in the row in question.

The button “Skatteberäkna” (“Calculate tax”) will bring up an automatic calculation of your preliminary tax based on the information you have provided.

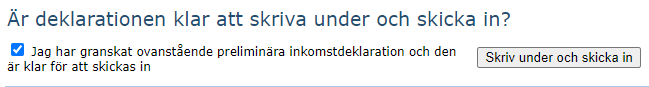

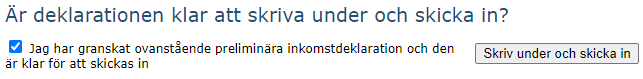

Once you have checked the information, tick the box to confirm that you have reviewed the preliminary income tax return and that you are ready to submit it. You then click the button “Skriv under och skicka in” (“Sign and submit”).

“Visa kvittens” (“Show receipt”) (page 7 of the e-service)

On page 7 of the service, Show receipt.

Your preliminary income tax return has now been submitted to the Swedish Tax Agency. The receipt is a confirmation that the Swedish Tax Agency has received the preliminary income tax return with the information you provided.

The submitted information and your estimate of profit or loss, if you have uploaded one, are now available under “Visa uppgifter om deklarationsobjektet” (“Show information about the tax return subject”). When the Swedish Tax Agency has made a decision on changing your debited preliminary tax, this decision will also be shown on the same page.

Leave a review (Your Europe)

Leave a review (Your Europe)