Other languages

- ...

- » Starting and running a Swedish business

- » Paying Taxes – Businesses

- » Tax on air travel

- » English translation of the tax return form

English translation of the tax return form

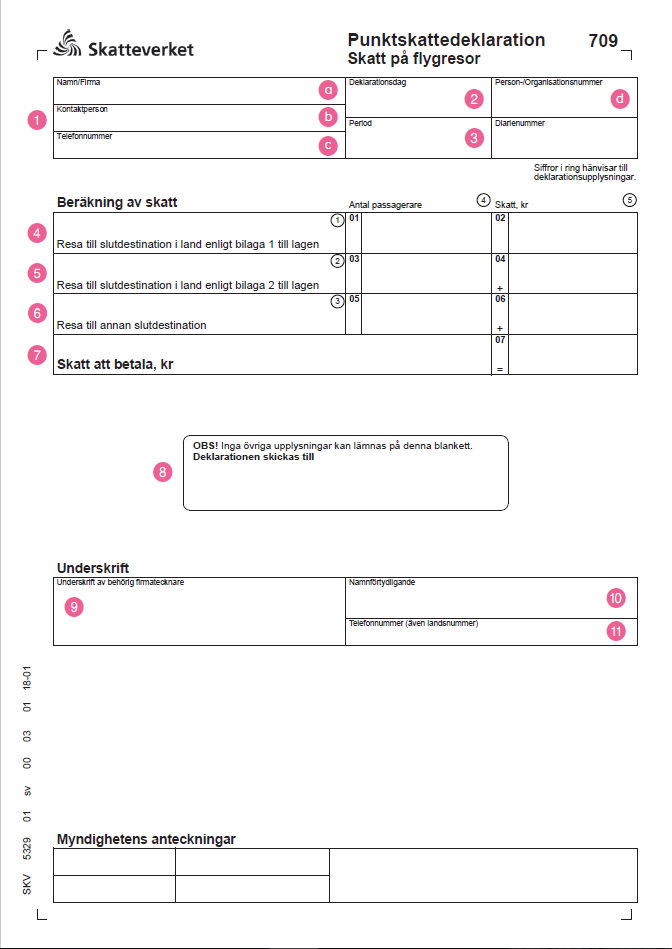

On this page you find an English translation of the tax return form for tax on air travel in Sweden, and instructions on how to fill in the form.

Information

This webpage is due to be updated. Please visit the corresponding Swedish-language page for the latest information.

The instructions is found below this image.

- At the top of the declaration form there are printed identification information which you may not alter. The information is

a) the company’s name,

b) your contact person,

c) the contact person’s telephone number and

d) the company’s Swedish corporate identity number.

Contact the Swedish Tax Agency if the information is incorrect. - The deadline for submitting the declaration to the Swedish Tax Agency is specified here.

- The accounting period to which the declaration refers is specified here.

- For this row, fill in the number of passengers with final destinations in the countries listed in appendix 1 to the act and the tax for these passengers. Fill in the number of passengers in field 01 and the tax in field 02.

- For this row, fill in the number of passengers with final destinations in the countries listed in appendix 2 to the act and the tax for these passengers. Fill in the number of passengers in field 03 and the tax in field 04.

- For this row, fill in the number of passengers with final destinations in countries which are found in neither appendix 1 nor 2, along with the associated tax. Fill in the number of passengers in field 05 and the tax in field 06.

- For this row, in the field “Skatt att betala” (tax to pay), fill in how much tax you should pay in total for the period. You should therefore sum up the amounts in fields 02, 04 and 06 and enter the result in field 07.

- The address you need to send the declaration to is specified here. It is also stated that you may not provide any additional information on the form.

- An authorised signatory must sign the declaration here.

- An authorised signatory must clearly write their full name here.

- The telephone number of the authorised signatory who has signed the declaration is entered here.

Additional information

Who is to pay tax on air travel?

You are to pay tax on air travel if you are an air carrier providing flights from Swedish airports on aircraft approved for more than ten passengers. An air carrier is a private individual or legal entity with a valid operating licence or similar

permit to offer commercial air service. The organisation that is responsible

for the government airlines is also regarded as an air carrier. The tax on air travel is on both domestic and international flights.

You pay the tax per passenger. The tax rate is based on the final destination.

Exemptions from tax on air travel

You do not pay tax on air travel for the following categories of passengers:

- children younger than 2

- those who fail to reach their final destination due to technical difficulties, weather conditions or other unforeseen events such that they must depart a second time

- flight crew who fly the aircraft, perform technical surveillance, maintenance or repair, provide services or take charge of passenger safety

- those who land at a Swedish airport and continue on the same aircraft as stipulated by travel documents

- those who land at a Swedish airport and connect to another aircraft that departs within 24 hours as stipulated by travel documents

What if you don’t owe any tax for the period?

File a return even if you don’t owe any tax for the period. Enter a zero on Line 07 (tax due).

Payment

Your payment must be registered in Swedish Tax Agency bank giro account no. 5050-1055 by the deadline for the return. In other words, depositing or transferring funds on the due date will result in late payment. If you pay online, you will need to have an OCR number, which is available at skatteverket.se. You may order a payment slip by calling 0771-567 567 or going to

Beställ blanketter (in Swedish)

Filing or paying late

You may be charged a penalty if you file, or interest if you pay, after the due date. Go to skatteverket.se for additional information.