Other languages

- ...

- » Businesses and employers

- » Starting and running a Swedish business

- » Paying Taxes – Businesses

- » Excise duty on energy

- » Excise duty on fuel

Excise duty on fuel

Excise duty on energy and carbon dioxide must be paid on most fuels used for engine operation or heating. Excise duty on sulphur must also be paid on fuels with a certain sulphur content. Excise duty is normally paid to the Swedish Tax agency by approved business operators.

Information

This webpage is due to be updated. Please visit the corresponding Swedish-language page for the latest information.

Use our e-services

Exemption from excise duty can be granted for certain uses of fuel. This process can vary, depending on who is to be granted an exemption.

Information about excise duty exemptions is available here:

In Sweden’s Energy Taxation Act, fuels are classified according to the Combined Nomenclature (CN), which is the EU’s eight-digit coding system. It is important to find out which code applies to your fuel since the rules vary depending on the fuel type. Established excise duty rates apply to the most common fuel types. You must pay excise duty on these, regardless of what the fuel in question will be used for. The excise duty rates are outlined in the table below. You might need to pay excise duty on fuels to which fixed duty rates do not apply. This is the case for fuel used for heating or as motor fuel.

The CN commodity codes listed in the table below are derived from the EU's 2002 Common Customs Tariff (CCT), in which the CN codes provided in Sweden’s Energy Taxation Act are included. CN codes are updated on a continuous basis, so you will need to search for the applicable code if it is not listed in the table.

You can find a list of newer CN codes in the table on our webpage “Fuels subject to the suspension arrangement”. Here you can check which CN codes in the 2002 Common Customs Tariff the newer codes correspond to.

Fuels to which a fixed excise duty rate applies

When you file an excise duty return for any of the fuels listed in the table below, you must pay excise duty at the specified rate. This rule applies regardless of what the fuel in question will be used for.

In some cases, you may be entitled to claim an excise duty deduction. Information about reduced excise duty rates, and excise duty exemption through deductions, is available on our webpage “Excise duty on energy”.

Rates of excise duty from 1 July 2025

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Petrol that fulfils the environmental protection rating class 1 requirements – motor petrol | SEK 1,52 per litre | SEK 3,27 per litre | SEK 4,79 per litre |

Alkylate petrol | SEK 1,04 per litre | SEK 3,27 per litre | SEK 4,31 per litre |

Petrol that fulfils the environmental protection rating class 2 requirements | SEK 1,56 per litre | SEK 3,27 per litre | SEK 4,83 per litre |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Petrol other than the types referred to under number 1 or number 7. | SEK 2,63 per litre | SEK 3,27 per litre | SEK 5,90 per litre |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Fuel oil, gas oil, kerosene, etc., to which a marker and colouring substance have been added, or unmarked fuels of these types of which less than 85% by volume distils at 350°C | SEK 318 per cubic metre | SEK 3,642 per cubic metre | SEK 3,960 per cubic metre |

Fuel oil, gas oil, kerosene, etc., to which a marker and colouring substance have not been added, of which at least 85% by volume distils at 350°C | SEK 1,150 per cubic metre | SEK 2,811 per cubic metre | SEK 3,961 per cubic metre |

Environmental protection rating class 2 | SEK 1,572 per cubic metre | SEK 2,811 per cubic metre | SEK 4,383 per cubic metre |

Environmental protection rating class 3 or no classification | SEK 1,791 per cubic metre | SEK 2,811 per cubic metre | SEK 4,602 per cubic metre |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Liquefied petroleum gas, liquefied biogas, etc. used for the operation of motor vehicles, vessels or aircraft | SEK 0 per 1,000 kg | SEK 4,544 per 1,000 kg | SEK 4,544 per 1,000 kg |

Liquefied petroleum gas, liquefied biogas, etc. used for other purposes | SEK 1,465 per 1,000 kg | SEK 4,544 per 1,000 kg | SEK 6,009 per 1,000 kg |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Natural gas used for the operation of motor vehicles, vessels or aircraft | SEK 0 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres |

Natural gas used for other purposes. | SEK 1,259 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres | SEK 4,492 per 1,000 cubic metres |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Coal, coke | SEK 868 per 1000 kg | SEK 3,758 per 1000 kg | SEK 4,626 per 1000 kg |

Fule type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Aviation petrol with a maximum lead content of 0,005 grammes per litre | SEK 1,56 per litre | SEK 3,27 per litre | SEK 4,83 per litre |

Fuel tax | Excise duty on energy | Total excise duty |

|---|---|---|

Crude tall oil | SEK 3,960 per cubic metre | SEK 3,960 per cubic metre |

Excise duty on sulphur for solid and gaseous fuels amounts to SEK 30 per kilogramme of sulphur. Excise duty on sulphur for liquid fuels is SEK 27 per cubic metre for every 10% by weight of sulphur.

The sulphur content of fuel (measured as a percentage by weight) must be rounded up to the nearest 10% by weight of sulphur. If the fuel’s sulphur content is more than 0.05% by weight, but no more than 0.2%, you must round up the amount to 0.2% by weight.

You do not need to pay excise duty on sulphur for liquid or gaseous fuels if their sulphur content does not exceed 0.05% by weight.

In Sweden’s Energy Taxation Act, fuels are classified according to the Combined Nomenclature (CN), which is the EU’s eight-digit coding system. It is important to find out which code applies to your fuel since the rules vary depending on the fuel type. Fixed excise duty rates apply to the most common fuel types. You must pay excise duty on these fuels, regardless of what the fuel in question will be used for. The excise duty rates are outlined in the table below. You might need to pay excise duty on fuels to which fixed duty rates do not apply. This is the case for fuel used for heating or as motor fuel.

The CN commodity codes listed in the table below are derived from the EU's 2002 Common Customs Tariff (CCT), in which the CN codes provided in Sweden’s Energy Taxation Act are included. CN codes are updated on a continuous basis, so you will need to search for the applicable code if it is not listed in the table.

You can find a list of newer CN codes in the table on our webpage “Fuels subject to the suspension arrangement”. Here you can check which CN codes in the 2002 Common Customs Tariff the newer codes correspond to.

Fuels to which a fixed excise duty rate applies

When you file an excise duty return for any of the fuels listed in the table below, you must pay excise duty at the specified rate. This rule applies regardless of what the fuel in question will be used for.

In some cases, you may be entitled to claim an excise duty deduction. Information about reduced excise duty rates, and excise duty exemption through deductions, is available on our webpage “Excise duty on energy”.

Rates of excise duty from 1 January to 30 June 2025

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Petrol that fulfils the environmental protection rating class 1 requirements – motor petrol | SEK 1,84 per litre | SEK 3,27 per litre | SEK 5,11 per litre |

Alkylate petrol | SEK 1,22 per litre | SEK 3,27 per litre | SEK 4,49 per litre |

Petrol that fulfils the environmental protection rating class 2 requirements | SEK 1,88 per litre | SEK 3,27 per litre | SEK 5,15 per litre |

Fule type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Petrol other than the types referred to under number 1 or number 7 | SEK 2,95 per litre | SEK 3,27 per litre | SEK 6,22 per litre |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Fuel oil, gas oil, kerosene, etc., to which a marker and colouring substance have been added, or unmarked fuels of these types of which less than 85% by volume distils at 350°C | SEK 318 per cubic metre | SEK 3,962 per cubic metre | SEK 4,280 per cubic metre |

Fuel oil, gas oil, kerosene, etc., to which a marker and colouring substance have not been added, of which at least 85% by volume distils at 350°C | SEK 1,470 per cubic metre | SEK 2,811 per cubic metre | SEK 4,281 per cubic metre |

Environmental protection rating class 2 | SEK 1,892 per cubic metre | SEK 2,811 per cubic metre | SEK 4,703 per cubic metre |

Environmental protection rating class 3 or no classification | SEK 2,111 per cubic metre | SEK 2,811 per cubic metre | SEK 4,922 per cubic metre |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Liquefied petroleum gas, liquefied biogas, etc. used for the operation of motor vehicles, vessels or aircraft | SEK 0 per 1,000 kg | SEK 4,544 per 1,000 kg | SEK 4,544 per 1,000 kg |

Liquefied petroleum gas, liquefied biogas, etc. used for other purposes | SEK 1,465 per 1,000 kg | SEK 4,544 per 1,000 kg | SEK 6,009 per 1,000 kg |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Natural gas used for the operation of motor vehicles, vessels or aircraft | SEK 0 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres |

Natural gas used for other purposes | SEK 1,259 per 1,000 cubic metres | SEK 3,233 per 1,000 cubic metres | SEK 4,492 per 1,000 cubic metres |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Coal, coke | SEK 868 per 1,000 kg | SEK 3,758 per 1,000 kg | SEK 4,626 per 1,000 kg |

Fuel type | Excise duty on energy | Excise duty on carbon dioxide | Total excise duty |

|---|---|---|---|

Aviation petrol with a maximum lead content of 0,005 grammes per litre | SEK 1,88 per litre | SEK 3,27 per litre | SEK 5,15 per litre |

Fuel type | Excise duty on energy | Total excise duty |

|---|---|---|

Crude tall oil | SEK 4,280 per cubic metre | SEK 4,280 per cubic metre |

Excise duty on sulphur for solid and gaseous fuels amounts to SEK 30 per kilogramme of sulphur. Excise duty on sulphur for liquid fuels is SEK 27 per cubic metre for every 10% by weight of sulphur.

The sulphur content of fuel (measured as a percentage by weight) must be rounded up to the nearest 10% by weight of sulphur. If the fuel’s sulphur content is more than 0.05% by weight, but no more than 0.2%, you must round up the amount to 0.2% by weight.

You do not need to pay excise duty on sulphur for liquid or gaseous fuels if their sulphur content does not exceed 0.05% by weight.

Fuels are defined in accordance with their designated CN (Combined Nomenclature) numbers. It is crucial that your find out the specific CN number of your fuel to determine the amount of tax you are liable for.

The CN numbers in the table below are based on 2002 tariff numbers. The CN numbers are updated continuously, so if you do not find your CN number in the table, you need to find out its previous corresponding number. You can do this by following the link above. Scroll down to the summary of references in LSE, which corresponds to amended references in the Commission’s implementation decision.

Fuels with a fixed tax rate

Those who submit tax returns are designated one or several of these fuel types as enumerated in the table below, and are subject to taxation in accordance with the tax rate given, regardless of what the fuel is used for.

You may be also be entitled to a tax deduction in some cases. You can find information about reduced tax or complete tax exemption through deductions on the page, Energy tax.

Fuel type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Petrol that meets the requirements of environmental class 1 – Automotive fuel | SEK 2.57 per litre | SEK 3.14 per litre | SEK 5.71 per litre |

Alkylbenzene sulfonate | SEK 1.42 per litre | SEK 3.14 per litre | SEK 4.56 per litre |

Petrol that meets the requirements of environmental class 2 | SEK 2.61 per litre | SEK 3.14 per litre | SEK 5.75 per litre |

Fule type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Other petrol that referred to under items 1 or 7 | SEK 3.61 per litre | SEK 3.14 per litre | SEK 6.75 per litre |

Fuel type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Heating oil, diesel fuel oil, kerosene etc. that have been marked and dyed, or which provide less than 85 volume per cent of distillate at 350ºC. | SEK 305 per m³ | SEK 3,887 per m³ | SEK 4,192 per m³ |

Heating oil, diesel fuel oil, kerosene etc. without marking and dyeing, and which provide at least 85 volume per cent of distillate at 350ºC. | SEK 1,470 per m³ | SEK 2,723 per m³ | SEK 4,193 per m³ |

Environmental class 2 | SEK 1,868 per m³ | SEK 2,723 per m³ | SEK 4,591 per m³ |

Environmental class 3 or no designated environmental class | SEK 2,074 per m³ | SEK 2,723 per m³ | SEK 4,797 per m³ |

Fuel type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

LPG etc. used for the operation of motor vehicles, marine vessels or aircraft. | SEK 0 per 1,000 kg | SEK 4,363 per 1,000 kg | SEK 4,363 per 1,000 kg |

LPG etc. used for other purposes. | SEK 1,407 per 1,000 kg | SEK 4,363 per 1,000 kg | SEK 5,770 per 1,000 kg |

Fuel type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Natural gas used for operation of motor vehicles, marine vessels or aircraft. | SEK 0 per 1,000 m³ | SEK 3,104 per 1,000 m³ | SEK 3,104 per 1,000 m³ |

Natural gas used for other purposes. | SEK 1,209 per 1,000 m³ | SEK 3,104 per 1,000 m³ | SEK 4,313 per 1,000 m³ |

Fuel type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Coal | SEK 833 per 1,000 kg | SEK 3,608 per 1,000 kg | SEK 4,441 per 1,000 kg |

Fule type | Energy tax | Carbon tax | Total tax |

|---|---|---|---|

Aviation fuel with a maximum lead content of 0.005 grams per litre | SEK 2.61 per litre | SEK 3.14 per litre | SEK 5.75 per litre |

Fuel tax | Energy tax | Total tax |

|---|---|---|

Crude tall oil | SEK 4,192 per m³ | SEK 4,192 per m³ |

The sulphur tax for fixed and gaseous fuels is SEK 30 per kg. of sulphur in the fuel. For liquid fuel, the sulphur tax is SEK 27 per m³ for each tenth of a per cent of fuel weight.

You are to round the sulphur content – measured as a percentage of sulphur weight in the liquid fuel – upward to the nearest tenth of a percentage point by weight. However, if the sulphur content exceeds 0.05 per cent by weight but not 0.2 per cent by weight, you are to round the figure to the nearest 0.2 per cent by weight.

You do not need to pay any sulphur tax for liquid or gaseous fuels if the sulphur content does not exceed 0.05 per cent by weight.

Excise duty rates for previous years

Excise duty rates for recent years are outlined in Swedish here:

Fuels to which no specific excise duty rate applies

You may need to pay excise duty on fuel to which no excise duty rate has been applied if you sell, use or intend to use it as:

- heating fuel

- motor fuel

- motor fuel additives

- a substance which increases the volume of motor fuel

In this case, you must pay excise duty on the fuel in question at the rate that applies to an equivalent fuel to which an excise duty rate has been applied.

The taxation of heating fuel can be affected by the presence of hydrocarbons derived from substances other than peat.

- Taxation of hydrogen gas used as fuel in motor vehicles, ships or aircraft (Legal guidance, in Swedish)

- Equivalent fuel (Legal guidance, in Swedish)

- Taxable fuels (Legal guidance, in Swedish)

Excise duty-exempt products

You do not have to pay excise duty on energy and carbon dioxide in connection with the following products:

- wood fuels such as firewood, wood chips and charcoal

- blast furnace gases

- coke oven gases

- gas produced as a result of chemical reduction

- gas produced during electrolytic processes

- fuel in small packages containing a maximum of 1 litre

- fuel which, under special circumstances, has been damaged and rendered

Further information about declaring and paying excise duty on fuel is available here:

- Tax return and tax payment – tax on electricity and fuel (in Swedish)

- Payment to tax account (in Swedish)

- Excise duty form (Legal guidance, in Swedish)

Approved business operators

Some business operators handle fuels that are excise duty exempt – or partially exempt – in certain situations. Some of these business operators handle fuel under a suspension arrangement.

Warehouse keeper

A warehouse keeper is a party approved by the Swedish Tax Agency to handle certain fuels under a duty suspension arrangement. As an authorised warehouse keeper, you are entitled to defer payment of excise duty on energy, carbon dioxide and sulphur (if applicable) when you manufacture, process or store duty-suspended fuels in specially approved locations. The same applies when you move duty-suspended fuels within the EU to specially approved locations or to other special locations registered in advance. Petrol, gas oil and liquefied petroleum gas are examples of duty-suspended fuels.

To be granted authorised warehouse keeper status, you must meet our approval requirements. You must:

- run, or intend to run, a professional business operation and have a storage capacity of 500 cubic metres; or manufacture and process fuels; or store aviation kerosene at an airport

- have a space available to you in Sweden – such as a tank or cistern – that can be approved as an excise warehouse for fuel

- be suitable with regard to your financial situation and other circumstances.

Warehouse keeper (Legal guidance, in Swedish)

How to apply for authorised warehouse keeper status

1. Fill in and submit form SKV 5377, “Application: Warehouse keeper approval – Excise duty on energy”. Our postal address is on the form.

2. Fill in and submit form SKV 5384, “Application: Excise warehouse – excise duty on alcohol goods, tobacco goods, energy”. Our postal address is on the form.

3. We will contact you if we need any additional information, such as details of your business’s financial position.

If you are granted authorised warehouse keeper status, you will be automatically approved as a registered consignor.

Excise warehouse

An excise warehouse is a space that has been approved by the Swedish Tax Agency. As an approved warehouse keeper, you must ensure that excise duty liable fuel is manufactured, processed and stored an excise warehouse of this kind in order to be covered by a duty suspension arrangement. To be granted authorised warehouse keeper status, you must have at least one approved excise warehouse.

As an authorised warehouse keeper, you can apply to the Swedish Tax Agency to have your excise warehouses approved for marking and dyeing of certain petroleum products. To do this, fill in and submit form SKV 5086, “Application: Marking/Dyeing”.

- Application – Marking/Dyeing (SKV 5086, in Swedish)

- The procedure for marking and dyeing of petroleum products (Legal guidance, in Swedish)

Warehouse stock records

As a warehouse keeper, you must keep separate stock records for each excise warehouse. You must update your stock records on a continuous basis, including details of all goods movements relating to excise duty liable fuel. Your stock records must include the following:

- a full description of the fuels received and dispatched from the excise warehouse, including all relevant dates

- details of your own withdrawals of fuel

- details of fuel that has been stolen, destroyed or consumed in the excise warehouse

- details of the sender or recipient of the fuel

- details of the fuels that have been moved between your excise warehouses, and details of the excise warehouses between which the fuels have been moved.

As an authorised warehouse keeper, you have a responsibility to conduct regular stocktaking of fuel kept in your warehouse.

Register a direct delivery location

As an authorised warehouse keeper, you can take delivery of duty-suspended fuel moved under a duty suspension arrangement at a direct delivery destination – such as a depot – in Sweden. You are entitled to do this if you wish to take receipt of fuel at a location other than one of your excise warehouses. You must register this direct delivery location with the Swedish Tax Agency in good time, well before the movement of fuel begins. You register a direct delivery location using form SKV 5369, “Direct delivery location – Excise duty on alcohol goods, tobacco goods, energy”.

As an authorised warehouse keeper, when you take receipt of fuel at a direct-delivery location, you take on responsibility for excise duty on energy, carbon dioxide and sulphur (if applicable). You report and pay these excise duties the same month during which you take receipt of the fuel. It is not possible to store duty-suspended fuel at a direct delivery location. However, as an authorised warehouse keeper, if you move the fuel to an excise warehouse within two days, it will be covered by the duty-suspension arrangement once again. In this case, you do not need to report and pay excise duty on energy, carbon dioxide, and sulphur (if applicable) when you take delivery of the fuel.

Deferring payment of excise duty on fuel

You can defer payment of excise duty on fuel, as long as the fuel is covered by a duty suspension arrangement. This applies to fuels for which you are an authorised warehouse keeper, if you do any of the following:

- store the fuel in an approved excise warehouse, such as a tank or cistern

- move the fuel from an approved excise warehouse to other approved excise warehouses within the EU

- move the fuel from an approved excise warehouse to a registered consignee in another EU country

- move the fuel from an approved excise warehouse to a temporary registered consignee in another EU country

- move the fuel from an approved excise warehouse to a location from which the fuel is exported from the EU

- transfer the fuel to a customs office of exit that is also the customs office of departure for the external transit procedure

- move the fuel from an approved excise warehouse to a direct delivery location.

You are to file a tax return for the reporting period in which the fuel deviates from the duty-suspension arrangement, i.e. when the fuel is handled in a manner other than what is described above. The amount for which you are liable must be paid to the tax account on the final date of submission of the tax return to the Swedish Tax Agency.

Movement of fuel to an embassy, consulate-general or international organisation

You can also defer payment of excise duty on fuel if you move fuel to an embassy, consulate-general or international organisation in an EU country – provided that excise duty exemption also applies in the EU country in question. Only the following places and people are permitted to receive the fuel:

- an embassy or consulate in another EU country

- a member of the diplomatic staff at an embassy or consulate

- an international organisation based in another EU country

- a representative of an EU country within an international organisation

- a person with a position or an assignment within an international organisation.

Moving fuel for receipt by armed forces

You can also defer payment of excise duty on fuel if you move the fuel for receipt by armed forces in another EU country. The following requirements must be fulfilled, provided that excise duty exemption also applies in the EU country to which the fuel will be moved:

- the armed forces belong to a country other than the country to which the fuel will be transferred

- the armed forces are participating in defence operations within the framework of the common security and defence policy, or are forces of the parties to the North Atlantic Treaty

- the fuel will be used by forces personnel, civilian staff accompanying the forces, or the forces’ catering services or retail stores.

You must declare excise duty on fuel for the reporting period during which the fuel is moved out of duty suspension: i.e., when the fuel is handled in a way other than that outlined above. The correct amount of excise duty must be credited to your tax account no later than the deadline date for filing your excise duty return with the Swedish Tax Agency.

If you handle duty-liable goods instead, please click on the following link for further information:

Moving fuel within the EU

As an authorised warehouse keeper, when you move fuel under excise duty suspension from Sweden to another EU country, this movement of goods must be recorded in an electronic administrative document (eAD). You create this eAD using the EU-wide Excise Movement and Control System (EMCS). If fuel is dispatched by a party other than a registered consignor, excise movements within Sweden are not subject to EMCS and the eAD requirement.

Excise numbers and the System for the Exchange of Excise Data (SEED) register

When you are granted authorised warehouse keeper status, the Swedish Tax Agency will give you an excise number.

Before dispatching fuel, an authorised warehouse keeper needs to know the consignee’s excise number in order to check whether the fuel can be moved under duty suspension. An excise number is required to create an eAD in the EMCS, and is also used for identification in the SEED register, which includes details of all approved EU actors.

The SEED register provides authorisation details and other information required by businesses and government agencies to enable movement of excise duty liable fuels under duty suspension. Information from the SEED register is also shared to the EMCS. This enables you, as a consignor, to check the validity of the consignee’s excise number.

Provide an excise duty payment guarantee for storage

In order to handle fuel under duty suspension, you must provide a payment guarantee for excise duty on the fuel in the form of a bank guarantee or pledge account.

If you intend to store duty-suspended fuels, you must provide a payment guarantee equivalent to at least 10% of excise duty on energy, carbon dioxide and sulphur (if applicable) for the fuel that you plan to store.

When calculating the payment guarantee amount, you must include all the fuels that will be stored in your warehouse, regardless of whether or not you own the fuel. The payment guarantee that you provide must cover the excise duty on the fuel you have in the warehouse.

Calculate the excise duty payment guarantee for storage

The excise duty on the fuel you plan to keep in your warehouse on 1 May amounts to a total of SEK 2,000,000.

Here’s how to calculate the payment guarantee:

10% of SEK 2,000,000 is 0.1 × SEK 2,000,000 = SEK 200,000

You must provide an excise duty payment guarantee amounting to SEK 200,000 by 1 May at the latest.

Lower the payment guarantee amount if your stock is reduced

If your fuel stocks are reduced, you can also lower your payment guarantee amount by providing a new payment guarantee. The new payment guarantee amount must be at least 75% of the highest amount calculated in accordance with the general rule during the past three months. If you do not pay the excise duty on time, the Swedish Tax Agency can claim the payment guarantee you have provided.

Lower your payment guarantee amount: here’s how to make the calculation

You have previously provided a payment guarantee of SEK 500,000. Now you want to lower the payment guarantee amount since your fuel stock has been reduced.

On 1 December, the excise duty on the fuel amounts to SEK 1,000,000. According to the general rule, the payment guarantee must therefore amount to SEK 100,000.

During the three previous calendar months (September to November), the excise duty on the fuels has amounted to a maximum of SEK 3,000,000. Under the complementary rule, you must calculate the minimum amount at which the payment guarantee can be set.

Calculate 10% of SEK 3,000,000 (= SEK 300.000).

Calculate 75% of SEK 300,000 (= SEK 225.000): the payment security provided to the Swedish Tax Agency on 1 December.

The Swedish Tax Agency may reach the decision that you can adjust the payment security amount (either by reducing it or by removing it completely) – if there are grounds for this, taking into account your financial situation or other special circumstances.

If you want to request an adjustment, you must state clearly the reasons for this. Apply for an adjustment by filling in and submitting form SKV 5427, “Request: Adjustment of payment guarantee – Excise duty on energy”. Our postal address is on the form.

Providing a movement guarantee

If you move fuel under excise duty suspension, you must provide a guarantee corresponding to the total amount of excise duty applicable to the fuel in the form of a bank guarantee or pledge account.

The movement guarantee is valid in all EU countries. Your guarantee must be registered with the Swedish Tax Agency prior to dispatch.

The Swedish Tax Agency can claim the movement guarantee amount if you become liable to pay excise duty in connection with a consignment, or if you do not pay the excise duty on time. Since the guarantee is valid in all countries, the Swedish Tax Agency can use it for the payment of excise duty if you become liable to pay excise duty in another EU country on fuel that you have dispatched from Sweden under duty suspension.

How do I calculate the movement guarantee amount?

In order to calculate the right amount of guarantee cover, you must work out a daily average for excise duty on fuel consignments that you move under duty suspension. Include only the days during which you move fuel over a one-year period.

You must include administrative excise movements between a place of import and an excise warehouse located within the same storage space. An administrative excise movement takes place through an update to the stock records. The goods themselves are not moved physically.

Movement guarantee calculation: examples

Example 1:

You move fuel consignments under duty suspension on five different occasions during a year.

Movement | Number of days on which goods are moved | Excise duty amount per movement | Excise duty amount × number of days |

|---|---|---|---|

1 | 2 | SEK 21,580 | SEK 43,160 |

2 | 1 | SEK 83,000 | SEK 83,000 |

3 | 3 | SEK 20,056 | SEK 60,168 |

4 | 1 | SEK 56,000 | SEK 56,000 |

5 | 4 | SEK 95,268 | SEK 381,072 |

Amount | 11 | SEK 623,400 |

Here’s how to calculate the movement guarantee amount:

SEK 623,400 divided by 11 days = SEK 56,673

Example 2:

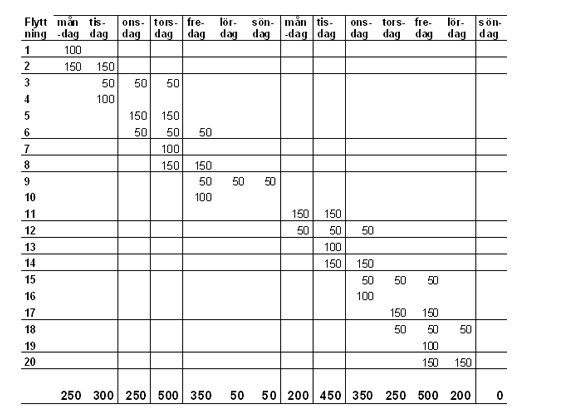

You move fuel consignments under duty suspension on 20 different occasions over a two-week period. You start to move two consignments a day on each business day (Monday to Friday). Ongoing movements continue during weekends, but no new movements are started. Each movement takes one to three days to complete and is subject to excise duty amounting to SEK 50,00, SEK 100,000 or SEK 150,000. No movement is undertaken on the last Sunday of the period in question. Movements therefore take place on 13 days during a two-week period.

You can see the total excise duty amounts for each day’s ongoing excise movements at the bottom of the table in Example 2 above. The total of these amounts is SEK 3,700,000. The average daily excise duty amount for movement under duty suspension is therefore SEK 284,615 (SEK 3,700,000 divided by 13 days).

The Swedish Tax Agency may decide that you do not have to provide a movement guarantee for sea freight deliveries on Swedish territory. This is known as an excise duty adjustment.

Apply for an excise duty adjustment by filling in and submitting form SKV 5427 (“Begäran Jämkning av säkerhet – Skatt på energi”), which is in Swedish. Our postal address is on the form. State clearly your reasons for applying for an excise duty adjustment.

Different ways to provide a movement guarantee

You can choose to provide the movement guarantee in the form of a pledged account, or a demand guarantee. Here are some examples of movement guarantees:

- Example: pledging a frozen account as an authorised warehouse keeper’s movement guarantee for excise duty on fuel

- Example: bank guarantee as an authorised warehouse keeper’s movement guarantee cover for excise duty on fuel (in Swedish)

- Example: using a pledge account as an authorised warehouse keeper's payment guarantee for excise duty on fuel (in Swedish)

- Example: bank guarantee as an authorised warehouse keeper’s guarantee for payment excise duty on fuel

Withdrawal of authorised warehouse keeper status

Your approval can be withdrawn for any of the following reasons:

- If you completely or partially cease to carry out your business activities involving duty-suspended fuel, you must request the withdrawal of your approval as an authorised warehouse keeper. To do this, fill in and submit the excise duty deregistration form SKV 5335 (“Avregistrering – punktskatt”) to the Swedish Tax Agency. Our postal address is on the form. An authorised signatory must sign the form.

- The Swedish Tax Agency can withdraw your approval as an authorised warehouse keeper if you do not fulfil your responsibilities with regard to excise duty returns, excise duty payments, or business accounting records, in the event of economic crime, or if you have not reported changes in your business activities on an ongoing basis. The business’s signatories, accountant or board of directors might have changed, for example. The payment guarantee that you have provided might also be insufficient.

If your approval is withdrawn, you are not entitled to dispatch fuel under a duty-suspension arrangement. This means that your excise warehouse approval and registered consignor approval will also be withdrawn. You must report excise duty on all duty-suspended fuels being kept in a warehouse when your approval is withdrawn.

Various excise duty returns for authorised warehouse keepers

As an authorised warehouse keeper, you may need to file three different types of excise duty returns, depending on the fuels for which you have been granted approval:

- Excise duty return 712: Use this excise duty return to report excise duty on energy and carbon dioxide for fuels such as gas oil, liquefied gas oil, liquefied biogas, aviation kerosene, heavy fuel oil and vegetable and animal oils.

- Excise duty return 714: Use this excise duty return to report excise duty on energy and carbon dioxide, primarily for petrol, alkylate petrol and E85.

- Excise duty return 718: Use this excise duty return to report excise duty on sulphur, primarily for heavy fuel oil.

As an authorised warehouse keeper, you must pay excise duty on energy, carbon dioxide and sulphur (if applicable) for:

- Fuel dispatched from your excise warehouse without being under a duty suspension arrangement. As long as the fuel remains in the excise warehouse, you do not need to pay excise duty on it. You only need to pay the excise duty when the fuel actually leaves the excise warehouse, or when someone (you or another person) has used the fuel inside your excise warehouse. Examples of use include fuel consumption in industrial operations, or for heating a storage cistern.

- Fuel you receive at a pre-registered direct delivery location, if the fuel is not transferred directly to an excise warehouse in Sweden.

- Fuel you receive at a location closely connected with your excise warehouse, if the fuel is not brought directly into the excise warehouse that the consignor has registered in an electronic administrative document (eAD). One example is when you receive fuel at a loading dock. You must also have accepted receipt of the fuel by creating an electronic Report of Receipt document in the EU-wide Excise Movement and Control System (EMCS).

- Missing inventory owing to theft or waste, for example. As a warehouse keeper, you cannot be granted an exemption from excise duty on fuel that has left the excise warehouse due to criminal activities.

- Fuel being stored, if approval of your excise warehouse is withdrawn.

In certain circumstances, you can claim a deduction in your excise duty return. Information about the business operations and areas of use to which this applies, is available on our webpage “Excise duty on energy”.

If you have delivered fuel in Sweden for US armed forces, you can claim a deduction if you have a certificate which states that the goods will be used by or for the armed force in question. The invoice must also state that you have delivered the fuel on a duty-exempt basis. You can also claim a deduction for fuel consumed in supplying other goods and services to US armed forces.

Registered consignor

A registered consignor is a party authorised by the Swedish Tax Agency to dispatch certain fuels from a place of import under a duty-suspension arrangement. As a registered consignor, you are entitled to defer payment of excise duty on energy, carbon dioxide and sulphur (if applicable) when you dispatch fuels under a duty-suspension arrangement from a place of import. Petrol, gas oil and liquefied petroleum gas are examples of fuels subject to duty-suspension arrangements.

To be granted registered consignor status, you must meet our approval requirements with regard to your financial situation and other circumstances.

How to apply for registered consignor status

Fill and submit form (SKV 5334). Our address is on the form.

We will contact you if we need any additional information, such as details of your business’s financial position.

You can defer payment of excise duty

As a registered consignor, you are liable for the excise duty on fuel until it reaches a specific destination. Your liability is then deferred, and transferred to the consignee, when you move the fuel from a place of import to:

- a registered consignee in another EU country

- a temporarily registered consignee in another EU country

- a preregistered direct delivery location in Sweden or another EU country

- a place of export: i.e., a place from which goods leave the EU

- an excise warehouse in Sweden or another EU country

- a customs office of exit that is also the customs office of departure for the external transit procedure.

If fuel is due to be exported directly after import, as a registered consignor you are liable for the excise duty on the fuel until it has actually left the EU.

Transit movement of fuel to an embassy, consulate-general or international organisation

You can also defer payment of excise duty on fuel if you move fuel to an embassy, consulate-general or international organisation in an EU country – provided that excise duty exemption also applies in the EU country in question.

Only the following places and people are permitted to receive the fuel:

- an embassy or consulate in another EU country

- a member of the diplomatic staff at an embassy or consulate

- an international organisation based in another EU country

- a representative of an EU country within an international organisation

- a person with a position or an assignment within an international organisation.

Moving fuel for receipt by armed forces

You can also defer payment of excise duty on fuel if you move the fuel for receipt by armed forces in another EU country.

The following requirements must be fulfilled, provided that excise duty exemption also applies in the EU country to which the fuel will be moved:

- The armed forces belong to a country other than the country to which the fuel will be moved.

- The armed forces are participating in defence operations within the framework of the common security and defence policy, or belong to the parties to the North Atlantic Treaty.

- The fuel will be used by forces personnel, civilian staff accompanying the forces, or the forces’ catering services or retail stores.

Moving fuel within the EU

As a registered consignor, when you move fuel under excise duty suspension from a place of import, this transit movement of goods must be recorded in an electronic administrative document (eAD). You create this eAD using the EU-wide Excise Movement and Control System (EMCS).

Excise numbers and the System for the Exchange of Excise Data (SEED) register

When you are granted registered consignor status, the Swedish Tax Agency will give you an excise number. Before dispatching fuel, a registered consignor needs to know the consignee’s excise number in order to check whether the fuel can be moved under duty suspension. An excise number is required to create an eAD in the EMCS, and is also used for identification in the SEED register, which includes details of all approved EU actors.

The SEED register provides authorisation details and other information required by businesses and government agencies to enable movement of excise duty liable fuels under duty suspension. Information from the SEED register is also shared to the EMCS. This enables you, as a consignor, to check the validity of the consignee’s excise number.

Providing a movement guarantee

If you move fuel under excise duty suspension, you must provide a movement guarantee corresponding to the total amount of excise duty applicable to the fuel. The Swedish Tax Agency can claim the movement guarantee amount if you become liable to pay excise duty in connection with a consignment, or if you do not pay the excise duty on time.

The movement guarantee is valid in all EU countries. This means that the Swedish Tax Agency can use it for the payment of excise duty if you become liable to pay excise duty in another EU country on fuel that you have dispatched from Sweden under duty suspension. Your movement guarantee must be registered with the Swedish Tax Agency prior to dispatch.

How do I calculate the movement guarantee amount?

In order to calculate the right amount of guarantee cover, you must work out a daily average for excise duty on fuel consignments that you move under duty suspension. Include only the days during which you move fuel over a one-year period.

You must include administrative excise movements between a place of import and an excise warehouse located within the same storage space. An administrative excise movement takes place through an update to the stock records. The goods themselves are not moved physically.

Movement guarantee calculation: examples

Example 1

Movement | Number of days on which goods were moved | Excise duty amount per movement | Excise duty amount × number of days |

|---|---|---|---|

1 | 2 | SEK 21,580 | SEK 43,160 |

2 | 1 | SEK 83,000 | SEK 83,000 |

3 | 3 | SEK 20,056 | SEK 60,168 |

4 | 1 | SEK 56,000 | SEK 56,000 |

5 | 4 | SEK 95,268 | SEK 381,072 |

Total | 11 | SEK 623,400 |

Here’s how to calculate the movement guarantee amount:

SEK 623,400 divided by 11 days = SEK 56,673

Example 2

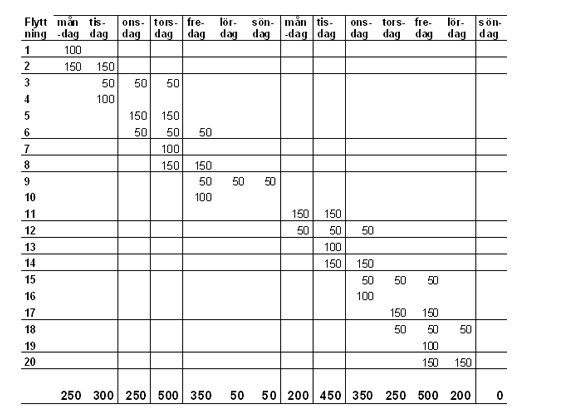

You move fuel consignments under duty suspension on 20 different occasions over a two-week period. You start to move two consignments a day on each business day (Monday to Friday). Ongoing movements continue during weekends, but no new movements are started.

Each movement takes one to three days to complete and is subject to excise duty amounting to SEK 50,00, SEK 100,000 or SEK 150,000. No movement is undertaken on the last Sunday of the period in question. Movements therefore take place on 13 days during a two-week period.

You can see the total excise duty amounts for each day’s ongoing excise movements at the bottom of the table in Example 2 above. The total of these amounts is SEK 3,700,000.

The average daily excise duty amount for movement under duty suspension is therefore SEK 284,615 (SEK 3,700,000 divided by 13 days).

The Swedish Tax Agency may decide that you do not have to provide a movement guarantee for sea freight deliveries on Swedish territory. This is known as an excise duty adjustment.

Apply for an excise duty adjustment by filling in and submitting Form SKV 5427 (“Begäran Jämkning av säkerhet – Skatt på energi”), which is in Swedish. Our postal address is on the form. State clearly your reasons for applying for an excise duty adjustment.

Different ways to provide a movement guarantee

You can choose to provide the movement guarantee in the form of a pledged account or a demand guarantee. You must enter into an agreement with your bank if you wish to provide a demand guarantee.

Here are some examples of movement guarantees:

- Example: pledging a frozen account as a registered consignor’s movement guarantee for excise duty on fuel (in Swedish)

- Example: a demand guarantee provided as a registered consignor’s movement guarantee for excise duty on fuel (in Swedish)

Withdrawal of registered consignor approval

Your approval can be withdrawn for any of the following reasons:

- If you completely or partially cease to carry out your business activities involving duty-suspended fuel, you must request the withdrawal of your approval as a registered consignor. To do this, fill in and submit the excise duty deregistration form SKV 5335 (“Avregistrering – punktskatt”) to the Swedish Tax Agency. Our postal address is on the form. An authorised signatory must sign the form.

- The Swedish Tax Agency can withdraw your registered consignor approval if you do not fulfil your responsibilities with regard to excise duty returns, excise duty payments or business accounting records; in the event of economic crime; or if you have not reported changes in your business activities on an ongoing basis. The business’s signatories, accountant or board of directors might have changed, for example. The payment guarantee that you have provided might also be insufficient.

If your approval is withdrawn, you are not entitled to dispatch fuel under a duty-suspension arrangement.

Various excise duty returns for registered consignors

As a registered consignor, you may need to file three different types of excise duty returns, depending on the fuels for which you have been granted approval:

- Excise duty return 712: Use this excise duty return to report excise duty on energy and carbon dioxide for fuels such as gas oil, liquefied gas oil, liquefied biogas, aviation kerosene, heavy fuel oil and vegetable and animal oils.

- Excise duty return 714: Use this excise duty return to report excise duty on energy and carbon dioxide, primarily for petrol, alkylate petrol and E85.

- Excise duty return 718: Use this excise duty return to report excise duty on sulphur, primarily for heavy fuel oil.

Registered consignee

A registered consignee is a party authorised by the Swedish Tax Agency to take delivery on a professional basis of fuel moved from another EU country under duty suspension. If you have been granted registered consignee status, you are entitled to defer payment of excise duty on energy, carbon dioxide and sulphur (if applicable) on duty-suspended fuel until you have taken delivery of it in Sweden. Petrol, gas oil and liquefied petroleum gas are examples of duty-suspended fuels.

To be granted registered consignee status, you must meet our approval requirements with regard to your financial situation and other circumstances.

How to apply to become a registered consignee

Fill in and submit form SKV 5347. Our address is on the form.

We will contact you if you need to supplement your application, such as with information about your company’s financial position.

Normal delivery address and direct-delivery locations

As a registered consignee, you must specify an address in Sweden at which you will take delivery of fuel moved under duty suspension from another EU country. This address is known as your normal delivery address.

You can only specify one normal delivery address. If you want to change your normal delivery address, you can fill in and submit form SKV 5430.

If you want to take delivery of fuel under duty suspension in other places, you must register these places as direct-delivery locations. You do this by filling in and submitting form SKV 5369.

Excise number, SEED register and EMCS

When you are granted registered consignee status, the Swedish Tax Agency will give you an excise number. The excise number is used for identification in the SEED register, which includes details of all approved EU actors. The SEED register provides authorisation details and other information required by businesses and government agencies to enable movement of fuels under duty suspension. Data from the SEED register is also supplied to the Excise Movement and Control System (EMCS).

The sender creates an electronic administrative document (eAD) in EMCS before the fuel is dispatched to you. When you have taken delivery of the fuel at your normal delivery address or a direct-delivery location, you must create a Report of Receipt in EMCS within five days.

Providing a payment guarantee

If you have been granted registered consignee status, you must provide an excise duty payment guarantee for fuel that you receive from other EU countries under a duty suspension arrangement. The Swedish Tax Agency can claim this guarantee amount if you do not pay the excise duty for which you are liable on time.

You must send the original payment guarantee document to the Swedish Tax Agency at this address:

Skatteverket

771 83 Ludvika

If the payment guarantee amount that you have provided is insufficient, the Swedish Tax Agency can withdraw your registered consignee approval.

Here's how to calculate the average excise duty amount

Calculate the total amount of excise duty for your latest reporting periods (up to a maximum of 12), as outlined above. Then divide this amount by the number of reporting periods for which you have paid excise duty.

Example 1

Reporting period | Excise duty payable |

|---|---|

April - Year 1 | SEK 30,000 |

May - Year 1 | SEK 25,000 |

June - Year 1 | SEK 0 |

July - Year 1 | SEK 20,000 |

August - Year 1 | SEK 25,000 |

September - Year 1 | SEK 30,000 |

October - Year 1 | SEK 0 |

November - Year 1 | SEK 45,000 |

December - Year 1 | SEK 25,000 |

January - Year 2 | SEK 0 |

February - Year 2 | SEK 15,000 |

March - Year 2 | SEK 20,000 |

Total excise duty payable | SEK 235,000 |

Here's how you calculate the payment guarantee amount:

SEK 235,000 ÷ 9 (the number of reporting periods for which you have paid excise duty) = SEK 26,111.

You must therefore provide a minimum payment guarantee of SEK 26,111.

Example 2

You were granted registered consignee status in May

Reporting period | Excise duty payable |

|---|---|

May | SEK 15 000 |

June | SEK 0 |

July | SEK 20,000 |

August | SEK 15,000 |

September | SEK 25,000 |

October | SEK 0 |

November | SEK 30,000 |

Total excise duty payable | SEK 105,000 |

You calculate the payment guarantee amount as follows:

SEK 105,000 ÷ 5 (the number of reporting periods for which you have paid excise duty) = SEK 21,000.

You must therefore provide a minimum payment guarantee of SEK 21,000.

If the payment guarantee amount you have calculated is SEK 0, you must provide a payment guarantee equivalent to the full amount of excise duty on the fuels being moved for you to receive (see example 3 below).

Example 3

The Swedish Tax Agency has determined that you are liable to pay SEK 0 in excise duty for the past 12 months. On 15 August, fuel is dispatched to you from another EU country under duty suspension. The excise duty on this fuel amounts to SEK 30,000. You must therefore provide a payment guarantee of at least SEK 30,000, which must be registered by the Swedish Tax Agency on 15 August at the latest.

Adjustment of collateral amount

The Swedish Tax Agency may decide to grant you a payment guarantee adjustment (either by reducing it or by removing the requirement completely) if there are grounds for this, taking into account your financial situation or other special circumstances. If you request a payment guarantee adjustment, you must state clearly the reasons for this. You apply for a payment guarantee adjustment by filling in and submitting form SKV 5427 below. Our address is on the form.

Various ways to provide a payment guarantee

You can choose to provide the payment guarantee in the form of a pledged account, or a demand guarantee. If you wish to provide a demand guarantee, you must enter into an agreement with your bank. Here are some examples of payment guarantees:

- Providing a registered consignee’s excise duty payment guarantee in the form of a pledged account (in Swedish)

- Providing a registered consignee’s excise duty payment guarantee in the form of a demand guarantee (in Swedish)

Withdrawal of registered consignee approval

Your registered consignee approval can be withdrawn for any of the following reasons:

- If you completely or partially cease to carry out your business activities involving duty-suspended fuel, you must request the withdrawal of your approval as a registered consignee. To do this, fill in and submit the excise duty deregistration form SKV 5335 (“Avregistrering – punktskatt”) to the Swedish Tax Agency. Our postal address is on the form. An authorised signatory must sign the form.

- The Swedish Tax Agency can withdraw your registered consignee approval if, for example, you do not fulfil your responsibilities with regard to excise duty returns, excise duty payments or business accounting records; in the event of economic crime; or if you have not reported changes in your business activities on an ongoing basis. The business’s signatories, accountant or board of directors might change, for example. The payment guarantee amount that you have provided might also be insufficient. If your approval is withdrawn, you will not be entitled to receive fuel under duty suspension.

Various excise duty returns for registered consignees

As a registered consignee, you may need to file three different types of excise duty returns, depending on the fuels for which you have been granted approval:

- Excise duty return 712: Use this excise duty return to report excise duty on energy and carbon dioxide for fuels such as gas oil, liquefied gas oil, liquefied biogas, aviation kerosene, heavy fuel oil and vegetable and animal oils.

- Excise duty return 714: Use this excise duty return to report excise duty on energy and carbon dioxide, primarily for petrol, alkylate petrol and E85.

- Excise duty return 718: Use this excise duty return to report excise duty on sulphur, primarily for heavy fuel oil.

As a registered consignee, you must pay excise duty on all duty-liable fuels under duty suspension that you receive in Sweden. When you take receipt of the fuel, you must pay excise duty on it.

Under certain circumstances, you can claim a deduction in your excise duty return. Information about the business operations and areas of use to which this applies, is available on our webpage “Excise duty on energy”.

Temporarily registered consignee

A temporarily registered consignee is a party authorised by the Swedish Tax Agency to professionally receive a fuel consignment that is being relocated from another EU country, and which is under a duty-suspension arrangement, at a one-time occasion pertaining to a specific delivery. If you are approved as a temporarily registered consignor, you may defer the payment of energy tax, carbon tax and any sulphur tax until such time that you receive the inventory fuel in Sweden. Petrol, diesel fuel oil and liquefied petroleum gas are examples of inventory fuel.

- Fuels encompassed by duty-suspension arrangements (in Swedish)

- Temporarily registered consignee (Legal guidance, in Swedish)

How to apply for registration as temporary consignee

1. Fill in and submit the form, Application/Report – Temporarily registered consignee – Alcohol tax, Tobacco tax, Energy tax (SKV 5371). Use the address on the form.

2. To qualify for handling fuel under tax deferment, you must pledge collateral to cover the tax for which you may be liable.

You pledge collateral through an advance payment to the Swedish Tax Agency’s bank giro account: 5583-8411. The collateral amount shall correspond to the tax on the fuel that you will be receiving. State your name and corporate registration number when paying, so that we can link the collateral to your application. Contact the Swedish Tax Agency if you prefer instead to pledge collateral in the form of a demand guarantee or locked bank account.

We will contact you if you need to supplement your application.

3. You are assigned a temporary excise-duty number when the Swedish Tax Agency approves your application to be a temporarily registered consignee.

Excise duty number, SEED registry and EMCS

In conjunction with your authorisation as a temporarily registered consignee, you are assigned an excise-duty number by the Swedish Tax Agency. The excise-duty number is used for identification in the SEED registry, which comprises all of the EU’s approved parties. The purpose of the register is to provide the company and government agencies with information about authorisation etc. requisite to the relocation of inventory fuels under a duty-suspension arrangement. The SEED registry also provides a data feed to the Excise Movement and Control System (EMCS).

The consignor creates an electronic administrative document (e-AD) in the EMCS when the fuel is consigned to you. Upon receiving the fuel at your goods-receipt address, you must register its receipt in the EMCS within five days.

To file a special tax return, do the following:

Upon receiving the fuel, you are to file its taxable amount using the special tax return that you receive from the Swedish Tax Agency when registering your application and you pledged collateral. You may not use our e-Service for this tax return. To file the tax return, do the following:

- There is some prefilled identification information at the top of the tax return. In the form box, Period, you are to state the date on which you received the fuel. If any of the information is incorrect, you are to contact the Swedish Tax Agency immediately.

- Fill in and send the tax return within five days of your receiving the fuel in Sweden. Your tax return must be signed by an authorised signatory.

The Swedish Tax Agency’s address is provided in the tax return or the tax return flyleaf.

Under certain conditions, you are entitled to file for tax deductions in your tax return. The page, Energy taxes, offers information about the operations and scope of application for these deductions.

Payment of energy tax

On receiving your special tax return, the Swedish Tax Agency transfers the prepaid tax (your pledged collateral) to your tax account.

Stockist

A stockist is a party approved by the Swedish Tax Agency, who is thus authorised to handle certain as-yet-untaxed fuels – such as crude tall oil, biogas, natural gas, coal, coke and peat. Only the owner of the fuel is authorised to handle it while it is untaxed.

To be an authorised stockist, you must undertake some of the following activities:

- recycle fuel

- manufacture fuel

- process fuel

- store large volumes of fuel

- resell large volumes of gaseous hydrocarbons

- personally use large volumes of gaseous hydrocarbons

It suffices that you conduct or intend to conduct operations pursuant to one of the above activities in order to be an authorised stockist. Once you are approved, you are also authorised to handle untaxed fuel in accordance with the other activities.

You can find out about the definitions of large volumes here.

When do I pay the tax?

You are liable for tax when you have used or delivered fuel to:

- a party who is not a stockist

- a proprietary sales location that is not a depot.

You are not required to pay tax upon delivery of the fuel to other approved stockists – the same applies when you relocate fuel between your proprietary storage facilities in Sweden. For each delivery, you are to verify that the purchaser is an authorised stockist. Your accounts are to comprise information about the deliveries of untaxed fuel.

When relocating fuel to another EU country or exporting it to a country beyond the EU, you can file for a deduction for the fuel tax in your tax return.

You are exempt from Swedish Customs duties if you import fuel that you own from a country beyond the EU. You are to report the tax in your excise-duty form when, for example, selling fuel to a party who is not a stockist. On the other hand, if you do not own the fuel, you are liable for duties to Swedish Customs.

How to apply to become an authorised Stockist

Approval as a stockist is requisite on, among other factors, your suitability with respect to your financial and general circumstances.

1. Fill in and submit the form, Stockist application – Energy tax (SKV5075). Use the address on the form.

2. We will contact you if you need to supplement your application, such as with information about your company’s financial position.

Revocation of Stockist authorisation

Your authorisation may be revoked on the following grounds:

- In the event that you, in whole or in part, discontinue with operations pertaining to fuel, you are to personally request a revocation of your authorisation. You can do this by filling in and sending the form, Deregistration – excise duty (SKV 5335), to the Swedish Tax Agency using the address provided on the form. Your request must be signed by an authorised signatory.

- The Swedish Tax Agency may revoke authorisation if, for example, tax returns, tax payments or financial accounting are mismanaged, or in the event of economic crime or your failure to continuously report changes to your operations. These may refer to, for example, changes of the company’s signatories, auditor or board of directors.

If your authorisation should be revoked, you are no longer to receive, consign or store untaxed fuel. This further entails that you must report tax on your inventory of untaxed fuel.

Various tax forms for approved Stockists

As an authorised Stockist, you may be required to submit three different tax forms, depending on the types of fuel that you are authorised to handle:

- Tax form 713: Use this form to account for energy and carbon taxes, primarily for petrol, biogas, coal, coke, petroleum coke, dimethyl ether, methane and waste oils.

- Tax form 718: Use this form to account for sulphur tax, primarily peat, coal and coke.

- Tax form 736: Use this form to report energy tax on crude tall oil.

Under certain conditions, you are entitled to file for tax deductions in your tax return. The page, Energy taxes, offers information about the operations and scope of application for these deductions.

If you have supplied fuel for United States armed forces in Sweden, you can claim deductions for it if you have documentation showing that the fuel is designated for use by or for the armed force in question. Your invoice must also state that you have delivered the fuel on a duty-free basis. You can also claim deductions for excise duty on fuel that you have consumed in order to supply other goods and services to armed forces.

A tax-exempt fuel user is a party approved by the Swedish Tax Agency and thereby entitled to receive certain untaxed fuels from warehouse keepers or stockists in Sweden. As a tax-exempt fuel user, you are authorised to receive and use solely untaxed fuel for the purposes for which you are authorised – you may not sell the fuel onward.

You can be approved as a tax-exempt user for the consumption of fuel

- in ships not used for private purposes

- in certain boats not used for private purposes

- in aircraft not used for private purposes

- in aircraft engines on testbeds or similar facilities

- in trains or other track-bound transportation

- for other purposes than as motor fuel or as heating fuel

- in one and the same process if the fuel is used for heating and purposes other than as a motor fuel or heating fuel

- in metallurgical processes

- i certain processes for the production of mineral substances other than metals

- in soda recovery boilers or lye boilers.

You can read more about each category here

- Fuel for certain boats and ships (marine vessels) for non-private purposes

- Aircraft and aircraft engines on testbeds or similar facilities

- Trains or other track-bound transportation

- Fuel consumption not for engines or heating or combined applications

- Metallurgical processes

- Mineralogical processes

- Use in soda recovery boilers or lye boilers

- Tax exempt fuel consumption (Legal guide, in Swedish)

How to apply for approval as a tax-exempt fuel user

If you wish to be approved as a tax-exempt fuel user, you are to apply for this with the Swedish Tax Agency. Approval as a tax-exempt fuel user is requisite on, among other factors, your suitability with respect to your financial and general circumstances. Do the following:

1) You apply using the form, Tax-exempt consumption – fuel (SKV 5079) which is available from the Swedish Tax Agency’s website. The address to the Swedish Tax Agency is provided in the form.

2) Attach the requested information and documentation to the application form, such as a description of your operations, annual report and the CN numbers of the fuels that you wish to be approved for handling. CN numbers are used to classify fuel and other goods pursuant to the EU-wide customs tariffs. Contact your fuel supplier if you are uncertain about the CN number of the fuel that you intend to use.

3) Upon submission of your application, the Swedish Tax Agency performs a suitability appraisal of the legal entities and natural persons the application concerns. The Swedish Tax Agency verifies the information with, for example, the Swedish Police Authority, Swedish Enforcement Authority, Swedish Companies Registration Office and the Swedish Tax Agency’s proprietary registers (such as your tax account). You will be notified of the decision by letter.

If you are approved as a registered fuel user

When the Swedish Tax Agency approves an application, the decision document comprises information about:

- the start and end dates of that the authorisation’s validity – which, although is normally valid until further notice, could be for a fixed period, in which case the decision document will state the authorisation’s period of validity.

- the specific tax-exempt purpose(s) the authorisation concerns, and whether there are any special terms and conditions for your approval.

If you are approved, you must

- continuously report significant changes to Swedish Tax Agency regarding the ownership structure and changes of signatories, auditors or the board of directors

- report other changes, if any, to your submitted information.

Your approval is not transferable to another party. In the event that your operations are transferred to another legal entity or natural person, the entity or person must apply for their own approval as a tax-exempt fuel user. Your approval may be revoked on the initiative of the Swedish Tax Agency if you should personally request for such a transfer. In the event that you change or sell your operations, you must immediately notify us by letter to the address: The Swedish Tax Agency, SE-771 83 Ludvika, Sweden, or by e-mail. An authorisation may also be revoked if the company is acquired by or merged with another company.

Tax exempt fuel user, Legal guide

As a tax-exempt fuel consumer, you are to keep special stock accounts through which you continuously record purchases and consumption of fuel that you purchased tax-free. The stock accounts must contain such information as the volume and type of fuel procured, the source from which it was purchased and the date you received the fuel. It should also state how much fuel you have used and for what purpose. You must also regularly take inventory of your stocks of fuel that was purchased tax-free.

As a tax-exempt fuel user, you are also to maintain documentation to indicate that the fuel was used for the purpose(s) for which you are/were approved. For example, if you are approved as a tax-free fuel user, for marine vessels or aircraft, you are to maintain a logbook, operating journal or similar to be able to prove that the fuel was used for the tax-free purpose(s).

- Swedish Tax Agency’s regulations on stock taking and stock inventory for tax-free fuel users (Legal guidance, in Swedish)

- Swedish Tax Agency’s information about stock taking and stock inventory for tax-free fuel users (in Swedish)

Revocation of tax-exempt fuel user authorisation

The Swedish Tax Agency may revoke authorisation if, for example, tax returns, tax payments, financial accounting or stock accounting are mismanaged, or in the event of economic crime or your failure to continuously report changes to your operations. These may refer to, for example, changes of the company’s signatories, auditor or board of directors.

In the event that you, in whole or in part, discontinue with operations pertaining to your authorisation, you are to personally request a revocation of your authorisation. You can do this by filling in and sending the form, Deregistration – excise duty (SKV 5335), to the Swedish Tax Agency using the address provided on the form. Your request must be signed by an authorised signatory.

Some business operators must pay excise duty when they have sold excise duty liable fuel to private individuals and public authorities among others in Sweden. This applies to fuel transported to Sweden from another EU country.

Distance sales

You can apply to be registered with the Swedish Tax Agency as a distance seller if you regularly sell certain fuels to a customer in Sweden who does not conduct any independent business operations, if the fuel is transported directly from another EU country to the customer and if such transportation is arranged by you or someone acting on your behalf. As a distance seller, you may only handle inventory fuels and only fuels that have already been taxed abroad. Petrol, diesel fuel oil and liquefied petroleum gas are examples of inventory fuel.

- Fuels encompassed by duty-suspension arrangements

- Distance sales to Sweden (Legal guidance, in Swedish)

- Distance selling of excise goods (European Commission)

How to apply to become a registered seller

1. Fill in and submit your application to be registered as a distance seller. You must also appoint a representative for distance sales in Sweden. (This could be a private individual or company established in Sweden.) Use the address on the form.

2. Attach:

- a certified copy of valid registration certificate

- a detailed description of how distance sales will be conducted

- information about the country or countries from which the fuel will be transported

- documentation of your calculation on the amount of fuel-relocation collateral:

When you are registered with the Swedish Tax Agency, you may not transfer the registration to another party.

Collateral for fuel relocation

Fuel-relocation collateral must be pledged before the Swedish Tax Agency can approve your representative. The collateral amount shall correspond to 10 per cent of the calculated annual tax on the fuel that you move to Sweden from other EU countries. Pledge the collateral in Swedish crowns (SEK). It may consist of, for example, a demand guarantee issued by a bank, or an amount deposited in a locked pledge account. The collateral must be available a minimum of six months after its removal by you or the bank.

You are responsible for keeping your collateral up to date. If the collateral should become insufficient, you are to pledge additional collateral.

If you do not pledge the collateral with Swedish Tax Agency, your customer who receives the fuel would instead be liable for energy tax, carbon tax and any sulphur tax.

Handling taxed fuels

Whoever your customer may be, it should be clear that the fuel is imported to Sweden. As a distance seller, you may only sell fuel that has already been taxed in the EU country from which it is transported. You are not permitted to import untaxed fuel to Sweden. To avoid double taxation on the fuel, you can apply for a refund from the consignor country for any energy tax, carbon tax and any sulphur tax that you have paid in the consignor country.

No interim storage of the fuel is permissible in Sweden prior to its onward transportation to your customer. On the other hand, the fuel may be reloaded in Sweden if necessitated by transportation technology.

Fuel transportation

The fuel must be transported by you or by a haulage contractor or a company that procures transports. If there is an existing framework agreement between you and the haulage contractor, your customers may directly interact with the contractor to order and pay for transportation. It would thus pertain to a matter of distance sales.

Information about the representative

Your representative is authorised to act as your proxy in Sweden. This means that the representative is responsible for submitting your excise-duty forms and also to otherwise represent you on issues pertaining to payment of energy tax, carbon tax and sulphur tax. The representative must also have the documentation related to your excise-duty forms. However, as the distance seller, you are the party liable for tax.

The Swedish Tax Agency may revoke the authority of a representative if the conditions for authorisation no longer exist or per the request of the representative.

Various tax forms for distance sellers

As a distance seller, you may be required to submit three different tax forms, depending on the types of fuel that you are authorised to handle:

- Tax form 712: Use this form to report energy and carbon tax on fuels such as diesel fuel oil, liquefied petroleum gas, jet fuel, heavy fuel oil and vegetable and animal oils.

- Tax form 714: Use this form to account for energy and carbon taxes, primarily for petrol, alkylbenzene sulfonate and E85 fuels.

- Tax form 718: Use this form to account for sulphur tax, primarily heavy fuel oil.

The tax return must either be signed by an authorised signatory for the distance seller or by an authorised representative. The tax return must be signed by the representative and not by any other proxy.

Deregistration:

If you should discontinue fuel sales to Sweden, you are to deregister yourself through a written request. The request must be signed by you, as the authorised signatory, or by your representative.

Temporary registration of distance seller

You can apply with the Swedish Tax Agency to be temporarily registered as a distance seller if you, on the odd occasion, sell certain fuels to private individuals in Sweden, and the said fuels are transported directly from another EU country to the buyer and such transportation is arranged by you or other party on your behalf. As a temporarily registered distance seller, you may only handle inventory fuels and only fuels that have already been taxed abroad. Petrol, diesel fuel oil and liquefied petroleum gas are examples of inventory fuel.

- Fuels encompassed by duty-suspension arrangements

- Distance sales – nonrecurring (Legal guidance, in Swedish)

How to apply for temporary registration as a distance seller

1. Fill in and submit the form, Application – Temporary registration as distance seller – Alcohol tax, Tobacco tax, Energy tax (SKV 5372). Your application must be delivered to us before the fuel may be consigned from other EU country. (As a temporarily registered distance seller, you are not entitled to register a proxy to represent you.)

2. Pledge the fuel-relocation collateral before consignment of the fuel from the other EU country.

Collateral for fuel relocation

Fuel-relocation collateral must be pledged before the Swedish Tax Agency can approve your application. You pledge collateral through an advance payment to the Swedish Tax Agency’s bank giro account: 5583-8411. The collateral amount shall correspond to the tax on the fuel pertaining to your application. State your name and corporate registration number when paying, so that we can link the collateral to your application. Contact the Swedish Tax Agency if you prefer instead to pledge collateral in the form of a demand guarantee or locked bank account.